Necessary factors

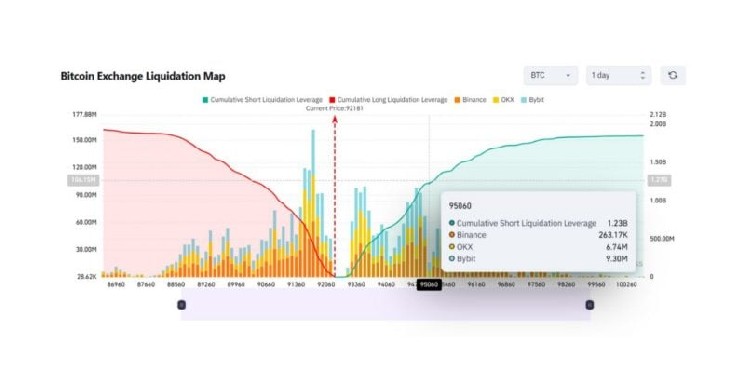

- If Bitcoin reaches $95,076, $1.2 billion of leveraged quick positions might be liquidated.

- Pressured purchases because of short-term liquidations may push Bitcoin costs even larger.

In line with Coinglass’ liquidation map, $1.2 billion of leveraged quick positions are prone to liquidation if Bitcoin rises to $95,076.

The potential liquidation highlights the quantity of bearish bets presently being made towards the most important digital asset by market capitalization. A brief place entails a dealer promoting Bitcoin as a way to borrow Bitcoin, betting that the worth will fall, then shopping for again Bitcoin at a cheaper price and making the most of the distinction.

Liquidation happens when a dealer’s place is routinely closed by the change because of inadequate collateral to maintain the leveraged wager. An increase to $95,076 may set off compelled shopping for as these quick positions are liquidated, accelerating the upward momentum of the worth.

In line with CoinGecko, Bitcoin is at $91,895 on the time of writing, retreating from a transfer above $94,000 earlier than the FOMC choice.