Wealth managers could must rethink their method to digital property, with a latest US survey exhibiting greater than a 3rd of younger, prosperous buyers stated they’d switched from advisors that didn’t provide crypto publicity.

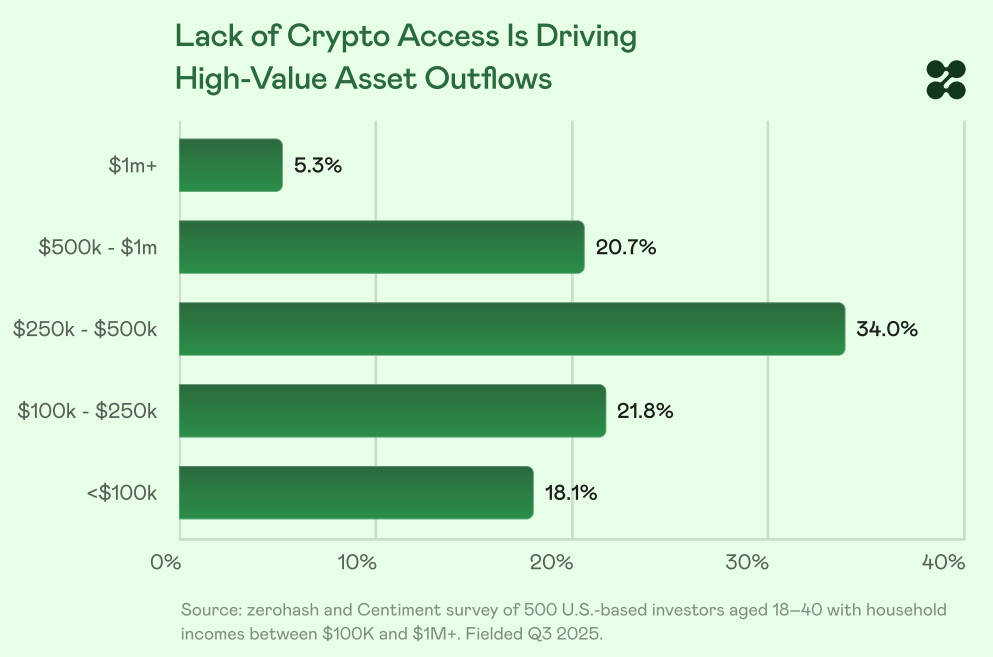

A survey of 500 U.S. buyers between the ages of 18 and 40 launched on Wednesday by crypto funds supplier Zerohash discovered that 35% have transferred funds from advisors that don’t present entry to cryptocurrencies.

These surveyed had incomes between $100,000 and $1 million, and greater than half of those that moved cash as a result of their advisor didn’t provide crypto stated they moved between $250,000 and $1 million.

Greater than half of buyers who transferred property from advisors round cryptocurrencies have been within the $250,000 to $1 million vary. sauce: zero hash

Cryptocurrencies have solely not too long ago loved a really pleasant coverage surroundings within the U.S., however some wealth advisers are nonetheless taking part in catch-up as youthful buyers are much less risk-averse than previous generations.

In keeping with Zerohash, greater than four-fifths of these surveyed stated their belief in cryptocurrencies has elevated after main monetary establishments comparable to BlackRock, Constancy, and Morgan Stanley adopted them.

Holding of crypto property is widespread and is anticipated to proceed increasing

Zerohash discovered that respondents with incomes of $500,000 or extra have been “main the exodus,” with half of them leaving advisors due to entry to cryptocurrencies.

The survey additionally discovered that 84% of all respondents plan to extend their crypto holdings within the subsequent 12 months, with practically half saying they may “considerably enhance their allocation.”

Advisors “threat being left behind”

Zerohash stated the findings present that cryptocurrencies have “turn out to be an integral a part of trendy portfolio methods” and that many rich buyers are “not ready for personal wealth managers to catch up.”

“Advisors who adapt early can strengthen buyer loyalty and seize new progress, whereas those that delay threat falling behind,” they stated.

Associated: US authorities reopening might launch floodgates for crypto ETFs: Analyst

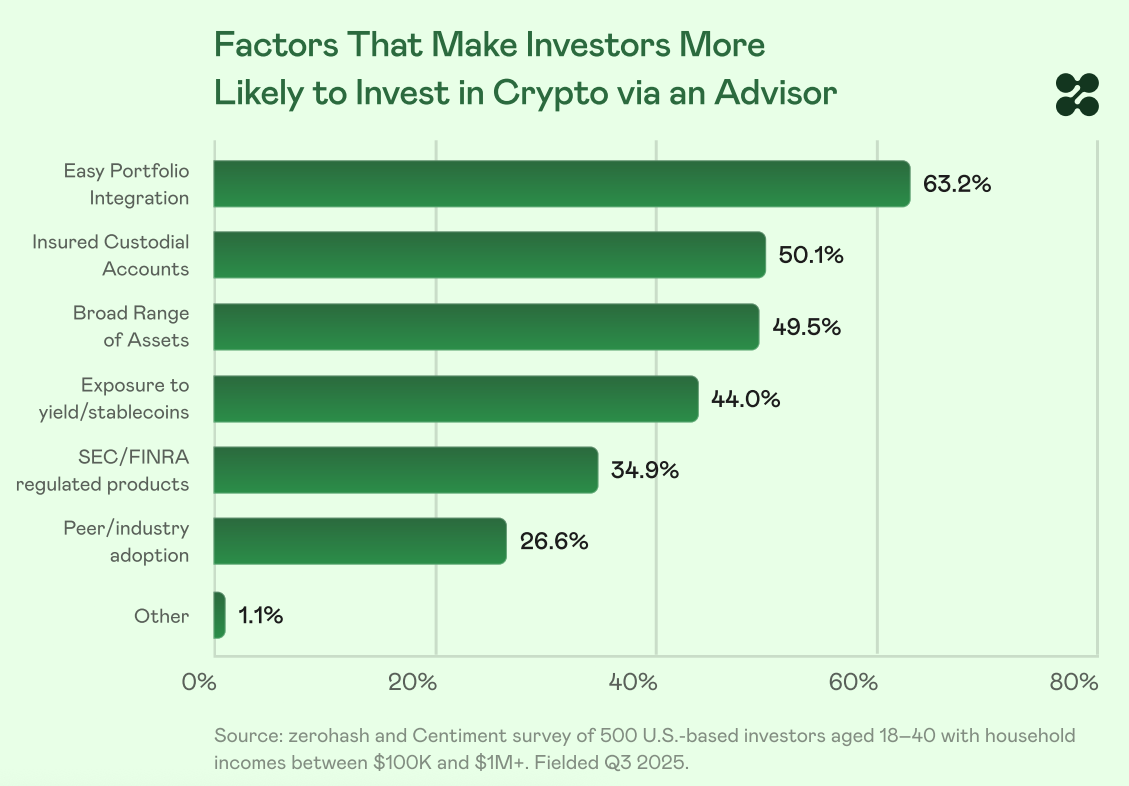

They added that buyers clearly perceive their expectations and wish “insured and compliant crypto entry.”

Primarily based on its analysis, Zerohash stated its technique for advisors to win over buyers is to supply cryptocurrencies “on the identical dashboard as conventional property” with assured custody.

“Traders expect greater than Bitcoin and Ethereum,” he added. “92% say entry to a broader vary of digital property is essential to them.”

A majority of buyers stated they need their advisors to make suggestions to facilitate portfolio integration of cryptocurrencies. sauce: zero hash

In the meantime, asset managers have begun providing exchange-traded merchandise with publicity to a variety of cryptocurrencies, together with merchandise associated to altcoins comparable to Solana (SOL), XRP (XRP), and Dogecoin (DOGE).

Moreover, the brand new product features a staking characteristic that rewards customers who lock up their tokens to safe the blockchain. Main issuer BlackRock additionally seems to offer staking publicity, submitting for a staking ether (ETH) exchange-traded fund in Delaware on Wednesday.

journal: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom