Ethereum value is falling once more. Ethereum It has fallen about 3.2% up to now 24 hours, extending the pullback from January highs round $3,390. On the floor, this appears to be like like a traditional cooldown inside a broader uptrend. Nevertheless, if you happen to take a look at the construction of the chart, you’ll be able to see that tensions are constructing inside.

Threat will not be apparent at first look, nevertheless it will increase when a number of alerts are considered collectively.

Ethereum’s bullish construction stays robust, however its momentum is quietly weakening

Ethereum continues to be in an ascending channel, with the decrease trendline holding since mid-November. This construction retains the present development technically bullish. Nevertheless, the value failed to interrupt out of the higher restrict on December tenth and rose above the $3,390 degree once more on January 14th earlier than reversing.

This warning stems from momentum motion, the preliminary bearish pressure. The Relative Power Index (RSI) is a momentum indicator that compares latest beneficial properties to latest declines and signifies whether or not shopping for or promoting strain is growing.

From December tenth to January 14th, the Ethereum value made new lows and the RSI made new highs. This mixture displays hidden bearish strain. This means that momentum has improved however value has did not react and infrequently seems close to the development exhaustion zone.

Then, from January sixth to January 14th. Ethereum Costs rose barely once more, however the RSI fashioned decrease highs. This second transfer added an ordinary bearish divergence on the every day time-frame.

Bearish Indicators: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Each of those two RSI alerts level to the identical conclusion. Each the broader swings and the latest rally, or moderately the January peak, are dropping momentum. Whereas this doesn’t affirm a collapse, it does improve the chance that January’s highs can be sustained except consumers shortly regain management.

If momentum continues to weaken, Ethereum turns into weak to extra severe help assessments. This shifts the eye to the motion on the chain.

Revenue incentives exist, however spot sellers stay calm

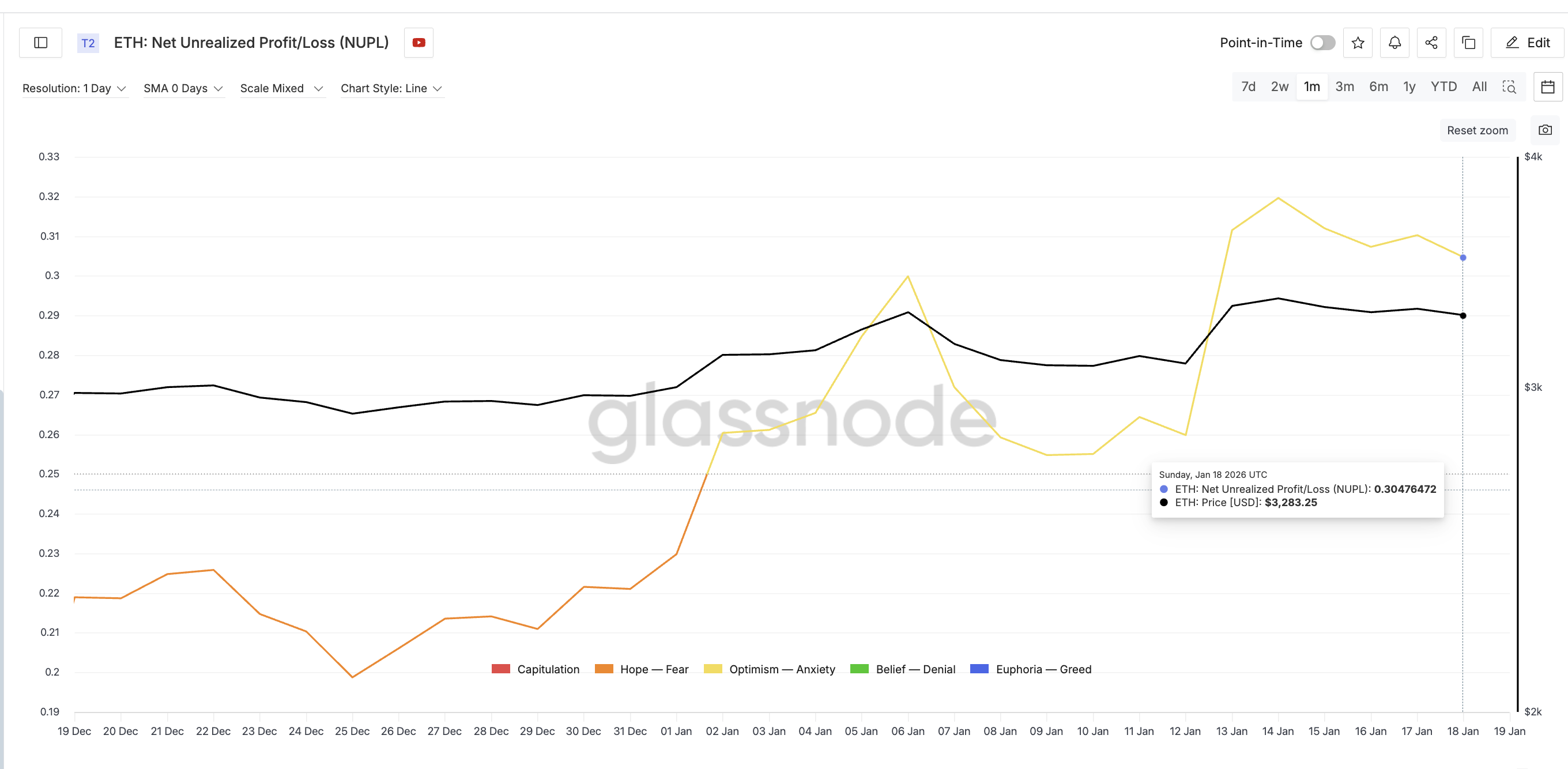

On-chain information reveals that Ethereum holders are saddled with important unrealized beneficial properties. Web Unrealized Achieve/Loss (NUPL) measures whether or not holders are making a revenue or dropping cash by evaluating the present value to the common acquisition value of the coin.

Ethereum’s complete NUPL, which covers each short-term and long-term holders, is hovering close to its highest month-to-month degree. Even after falling greater than 6% not too long ago from its peak in January, NUPL has solely fallen from about 0.31 to 0.30. That is solely a 3% decline in comparison with the value change.

Revenue reservation incentives stay: Glassnode

That is essential as a result of excessive NUPL creates an incentive to take income, particularly when technical alerts weaken. In idea, Ethereum is weak to revenue taking. That’s the second energy.

Nevertheless, that threat doesn’t prolong to the spot market.

Spent coin age band information, which tracks the variety of cash truly shifting on the chain, reveals the other conduct. Since January 14th, spent coin exercise throughout the cohort has decreased from roughly 318,000. Ethereum As much as about 84,300 Ethereum (Month-to-month minimal). This can be a lower of just about 74%.

Coin exercise stays low: Santiment

Merely put, there are fewer holders to maneuver their cash as the value goes down. This means panic promoting and never speeding to appreciate income. The spot holder is affected person and seems to be absorbing the dip moderately than accelerating it.

So the place does the draw back threat come from if spot exercise is subdued?

Derivatives positioning makes $3,050 a make-or-break value degree for Ethereum

When a spinoff is added to the picture, the strain adjustments.

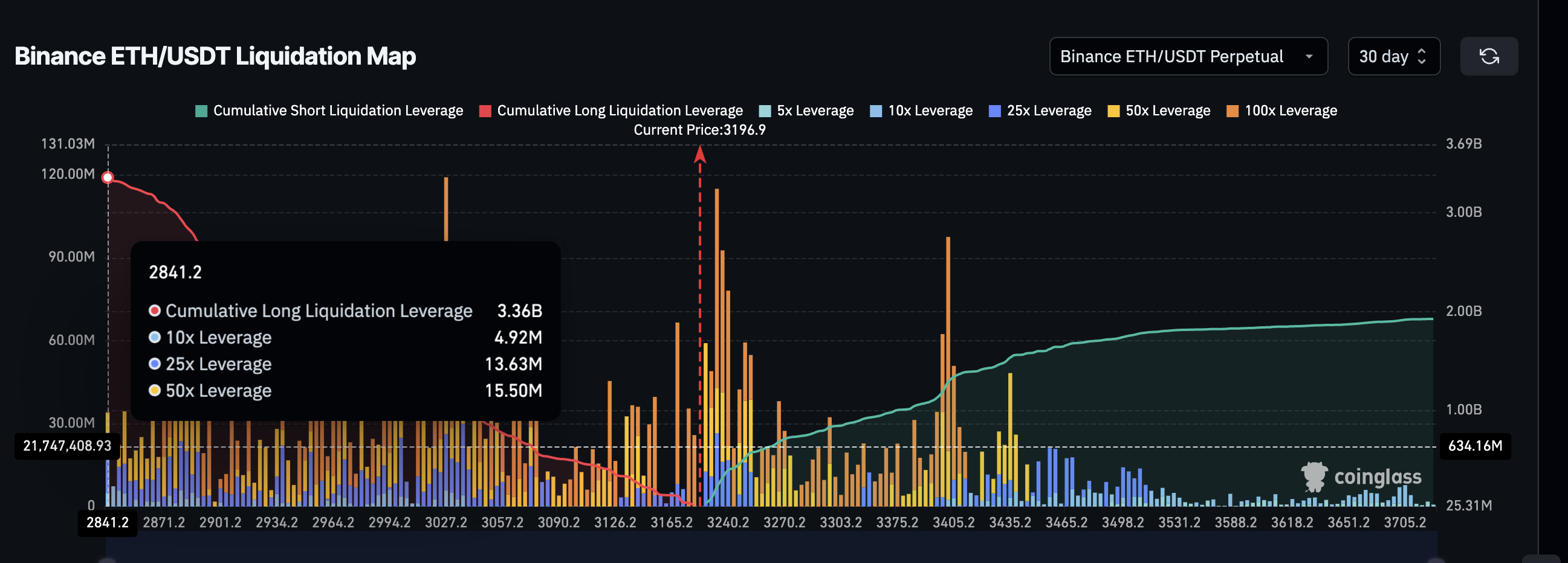

About Binance Ethereum-USDT perpetual market, positions for the subsequent 30 days are closely biased in direction of lengthy. Cumulative lengthy leverage has reached almost $3.36 billion, whereas brief publicity has reached almost $1.93 billion. This creates a powerful lengthy bias, with roughly 80-90% of the directional publicity leaning in a single route.

Lengthy bias seen: Coinglass

This imbalance turns into harmful when approaching key value ranges.

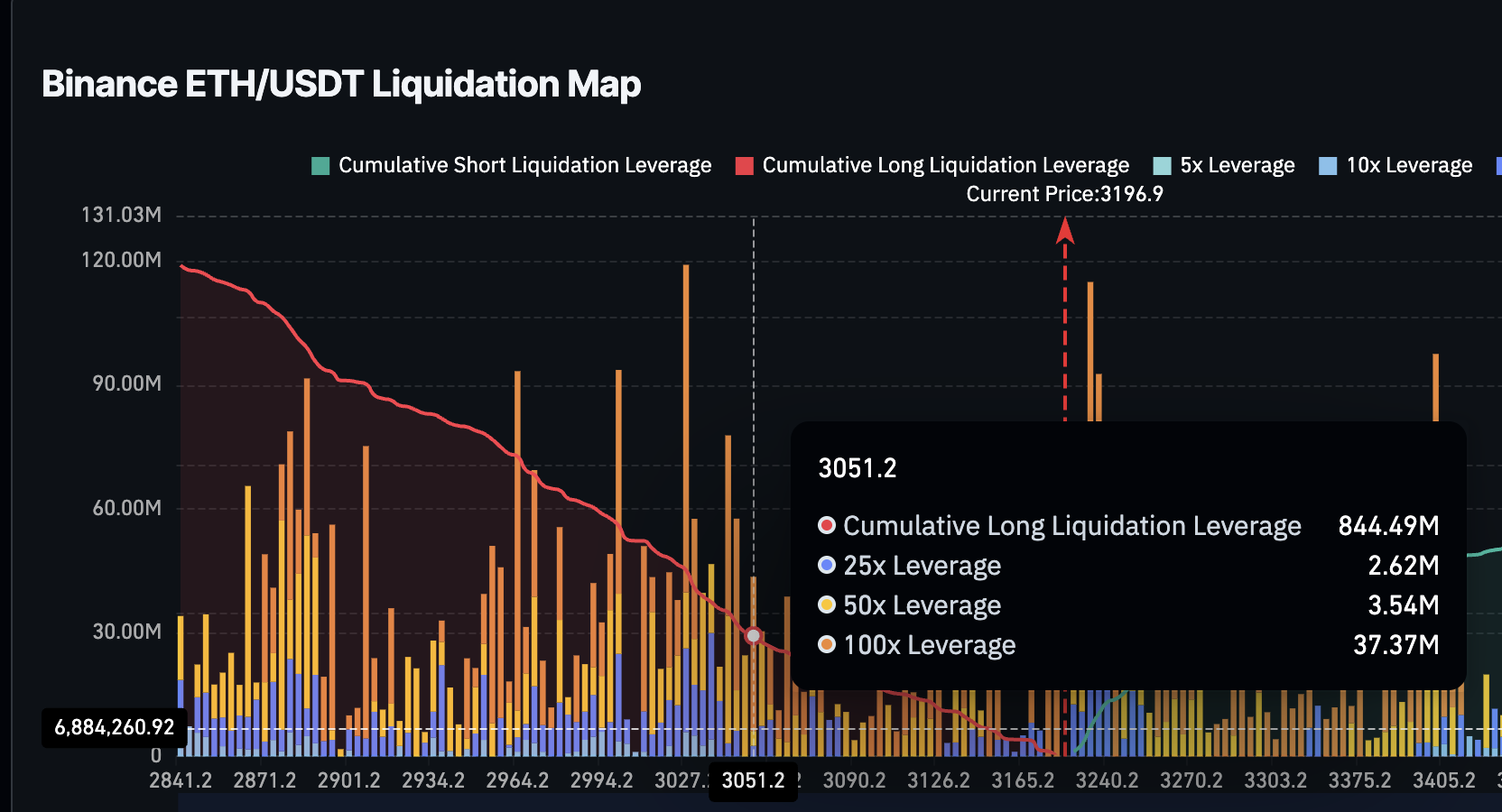

The liquidation map reveals that long-term liquidations are concentrated beneath $3,050. Above that degree, liquidation strain is comparatively restricted. Beneath that, a a lot bigger portion of the $3.3 billion in lengthy leverage turns into weak. It seems as a 3rd pressure.

ETH liquidation map”>

ETH liquidation map”>

Ethereum Liquidation Map: Coin Glass

It matches immediately with the chart.

The $3,050 space is Ethereum If this falls beneath this degree day-after-day, not solely will large-scale liquidations turn out to be energetic over an extended time frame, however we will even come near destroying the channel construction that has supported us up till now. Ethereum Since November. On this state of affairs, draw back momentum may quickly speed up and $2,760 may emerge as the subsequent main help.

On the upside, Ethereum must regain the every day shut of $3,390 to invalidate the bearish momentum sign. A rally above $3,480 will improve the probabilities of a restoration. A whole breakout of the development will doubtless require a push above $3,650, after which the door opens to $4,260.

Ethereum Worth Evaluation: TradingView

For now, the message is evident. The momentum is weakening. Revenue incentives exist. The spot holder is calm. Derivatives are crowded. Ethereum shouldn’t be damaged but. But when $3,050 fails, the chance is now not theoretical.

The publish “Three Forces Put Ethereum’s January Peak at Threat, Placing $3,050 in Disaster” appeared first on BeInCrypto.