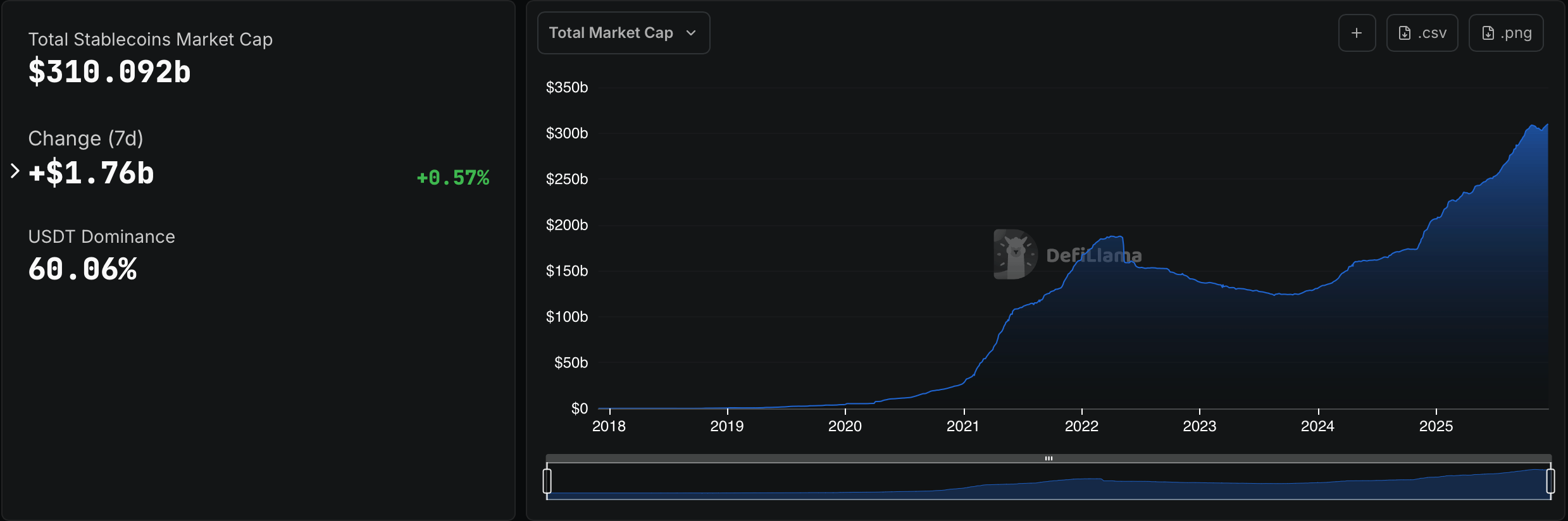

Stablecoins are on the rise once more, with the fiat-pegged token financial system topping the $310 billion mark within the second week of December, setting one other all-time excessive.

Stablecoin market reaches new peak, surpassing $310 billion

In mid-November, stablecoins rose to an all-time excessive of $309 billion earlier than recording a modest pullback. From there, the stablecoin financial system fell to a low of $302.88 billion based mostly on knowledge compiled by defillama.com. Since then, the fiat-pegged token sector has crossed the $310 billion threshold this week, reaching $310.092 billion as of Saturday, December 13, 2025.

The week-on-week improve was roughly 0.57%, with roughly $1.79 billion flowing into the stablecoin sector over the previous seven days. Tether’s USDT stays within the lead with a 60.06% share, and the market capitalization of the main stablecoin at the moment stands at $186.256 billion. USDT recorded weekly will increase, growing its market capitalization by $536.21 million. In the meantime, Circle’s USDC added $613 million over the identical interval, growing its complete to $78.414 billion.

Supply: Defillama.com, December 13, 2025.

Among the many prime 10 stablecoins by market capitalization, Circle’s USYC posted the biggest 7-day achieve, rising 4.02%. On the identical time, BlackRock’s BUIDL has retreated considerably, falling 13.24% over the previous week, leaving its market cap at $1.321 billion. Zooming out, BUIDL recorded a month-to-month contraction of 42.05%, with over $958 million flowing out of the token over time.

learn extra: Choices and Futures: Why the crypto choices market has 97% room to develop

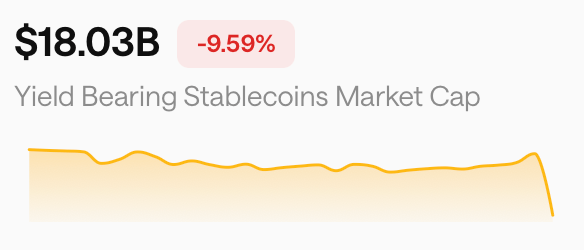

Different shares outdoors the highest 10 by way of 7-day positive factors had been Tron’s USDD, which surged 23.46%, and crvUSD, which rose 28.92%. Ethena’s stablecoin additionally continues to be dragged down this week as USDe fell by 2.98% and venture USDtb suffered an enormous drawdown of 18.99%. It is a pattern that has occurred for many stablecoins with yields after the October cryptocurrency market crash, when foundation/yield economics turned much less engaging.

Over the previous 30 days, the mixed market capitalization of all yield-bearing stablecoins has fallen by greater than 9% to only over $18 billion, in accordance with an evaluation by Stablewatch.io. On this nook of the market, redemptions are outpacing new points as a widespread risk-off temper makes traders cautious. This pullback is demand-driven, with alUSD down 73%, smsUSD down 67%, and sBOLD down 14% within the final week.

Supply: Stablewatch.io evaluation on December 13, 2025.

Because of this this week’s progress and all-time highs have been pushed virtually completely by non-yielding stablecoins, often known as fee stablecoins. This cut up factors to a transparent pattern towards fluidity and simplification as the tip of the 12 months approaches. Whether or not these dynamics will proceed into 2026 is an open query, and for now traders appear content material to maintain issues easy, easy, liquid and able to transfer. Time will inform whether or not this desire finally adjustments.

Steadily requested questions 🧠

- What’s the present measurement of the worldwide stablecoin market? The market capitalization of stablecoins not too long ago exceeded $310 billion, a brand new all-time excessive.

- Which stablecoins are driving current progress? Many of the current growth has been pushed by non-yielding fee stablecoins reminiscent of USDT and USDC.

- Why are high-yield stablecoins lowering? Redemptions exceed new issuance as traders are inclined to prioritize liquidity in a risk-off setting.

- How have high-yield stablecoins carried out not too long ago? The market capitalization of each corporations has fallen greater than 9% over the previous 30 days, to only over $18 billion.