Digital asset funding merchandise shed $360 million final week after Federal Reserve Chairman Jerome Powell signaled hesitation about future rate of interest cuts.

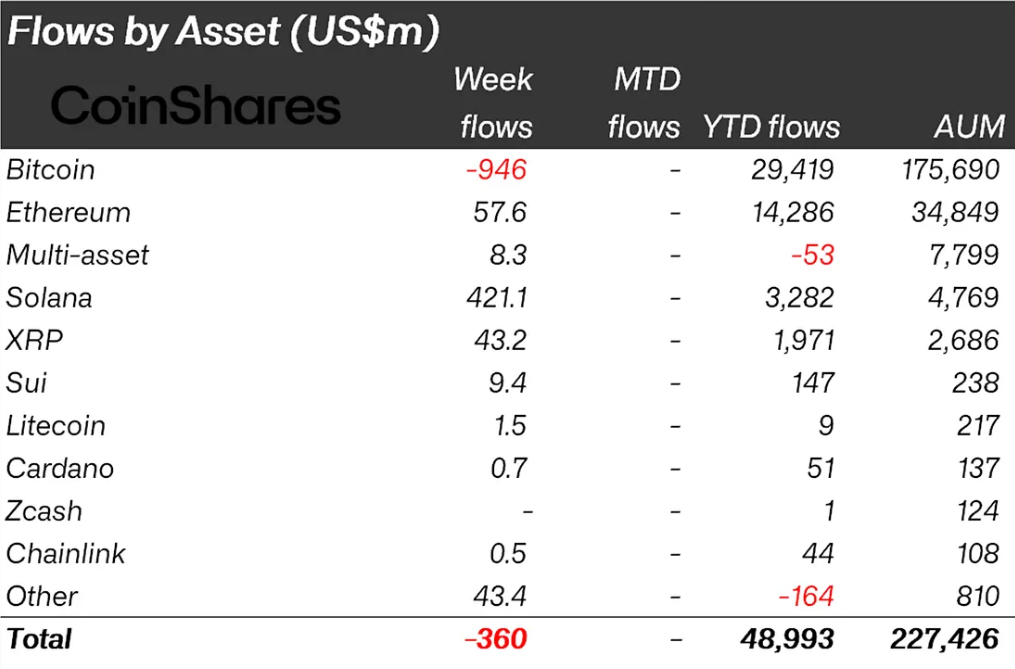

Bitcoin ETFs had been the toughest hit, with losses of $946 million, whereas Solana noticed file inflows of $421 million.

Chairman Powell’s hawkish stance shakes the market

The outflow of funds occurred in response to Chairman Powell’s feedback that additional rate of interest cuts in December weren’t sure. He warned that easing coverage too quickly might threaten the rise in inflation, whereas motion too late might weigh on financial progress.

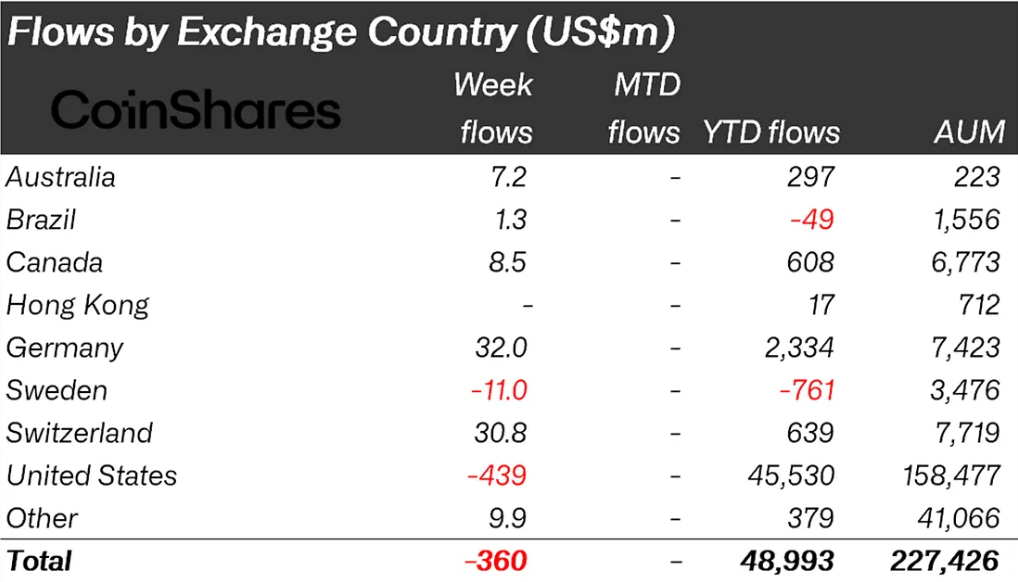

Buyers seen his feedback as hawkish and undermining hopes for swift financial easing. These alerts led to a withdrawal from digital asset merchandise, significantly in the US. US traders led the outflow, pulling $439 million from crypto merchandise.

Digital foreign money outflow by nation. Supply: CoinShares Report

Whereas US traders exited, Germany and Switzerland recorded modest inflows of $32 million and $30.8 million, indicating continued confidence within the area. Moreover, the shortage of launch of key US financial knowledge added to market uncertainty all through the week.

Bitcoin merchandise recorded the largest decline, with losses of $946 million in a single week. This has made Bitcoin the asset most vulnerable to modifications in financial coverage.

The timing coincided with a broader risk-off interval as market contributors reconsidered their expectations for aggressive charge cuts.

Solana bucks pattern with file institutional demand

Whereas retreating elsewhere, Solana stood out. Inflows into the blockchain platform totaled $421 million, making it the second-highest weekly complete for a similar asset.

Crypto outflows by asset. Supply: CoinShares

This improve was primarily as a result of launch of the newly launched US Solana ETF, which incorporates Bitwise’s BSOL, which noticed file inflows in its first buying and selling week.

SoSoValue reported that the Solana ETF recorded internet inflows totaling $200 million for the fourth consecutive day since its launch.

In accordance with the SoSoValue ETF dashboard, because the launch of the Bitwise Solana Staking ETF ($BSOL) and Grayscale Solana ETF ($GSOL) on October twenty eighth and twenty ninth, the $SOL ETF has had 4 consecutive days of internet inflows, totaling $200 million. $BTC and $ETH Spot ETF recorded internet funds on the identical time… pic.twitter.com/CrKgogePA5

— SoSoValue (@SoSoValueCrypto) November 3, 2025

On the identical time, we noticed outflows from Bitcoin and Ethereum spot ETFs, reinforcing Solana’s contrarian momentum. This implies that institutional traders view Solana as a beautiful and differentiated asset.

The launch of Solana ETFs, praised for its buying and selling velocity and low charges, marks a major second for entry to the institutional investor community.

Grayscale’s GSOL, which launched on NYSE Arca on October 29, gives direct SOL publicity with potential staking rewards, consistent with Solana’s proof-of-stake method. These options set the Solana ETF aside from conventional Bitcoin merchandise and make it interesting to traders on the lookout for yield.

Yr-to-date, Solana has seen $3.3 billion in inflows, confirming its standing as one of many fastest-growing digital property amongst monetary establishments.

Regardless of persevering with market-wide headwinds, sustained demand demonstrates confidence within the platform’s technological capabilities and ecosystem growth.

The put up Crypto Fund Leaks $360 Million After Powell Speech — Excludes Solana appeared first on BeInCrypto.