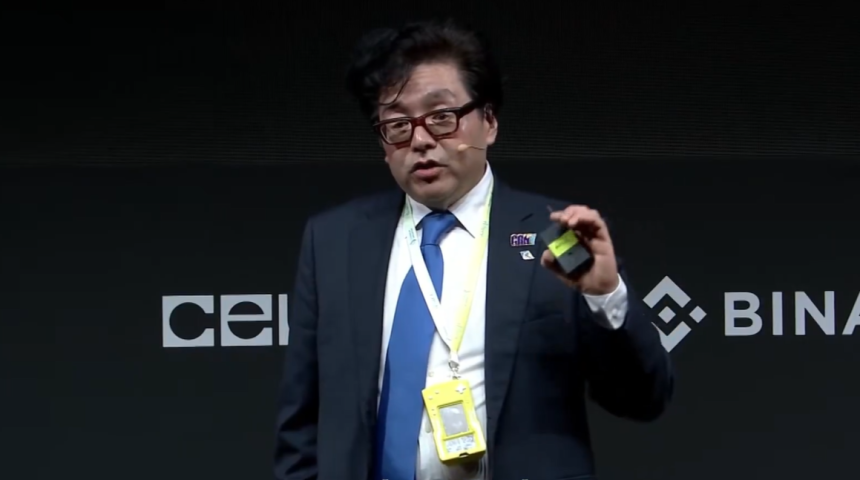

Tom Lee reiterated some of the aggressive Ethereum targets available on the market, telling attendees at Binance Blockchain Week on December 4 that ETH may finally commerce for $62,000 because it turns into the core infrastructure for tokenized finance.

“Okay, now that we’ve talked about cryptocurrencies, let me clarify why Ethereum is the way forward for finance.” Lee stated from the stage. He characterised 2025 as Ethereum’s “1971 second,” drawing a direct analogy to when the U.S. greenback left the gold customary and sparked a wave of economic innovation.

Lee’s paper on Ethereum

“In 1971, the greenback got here off the gold customary. And in 1971, it galvanized Wall Road to create monetary merchandise that will enable the greenback to turn into a reserve forex,” Lee argued. “By 2025, every little thing can be tokenized. So it’s not simply {dollars} that can be tokenized, it’s shares, bonds and actual property.”

In his view, this variation positions ETH as the first settlement and execution layer for tokenized belongings. “Wall Road will as soon as once more leverage this to construct merchandise on sensible contract platforms, and Ethereum is the place they’re constructing this,” he stated. “The overwhelming majority, the overwhelming majority of this, is being constructed on Ethereum,” Lee stated, pointing to present real-world asset experiments as early proof, including, “Ethereum has received the sensible contract struggle.”

Lee additionally emphasised that ETH’s market habits doesn’t but replicate its structural function. “As you realize, ETH has been rangebound for 5 years, as I’ve proven right here, however it’s beginning to escape,” he informed the viewers. “The rationale we transformed Bitmine into an ETH treasury firm and have become deeply concerned in Ethereum is as a result of we noticed this breakout coming,” he defined to the viewers.

The crux of his valuation case is expressed by way of the ETH/BTC ratio. Lee expects Bitcoin to rise sharply within the close to time period. “I believe Bitcoin will attain $250,000 in a couple of months.” From there, he derives two important ETH situations:

First, we imagine there’s important upside potential if the ETH/BTC value relationship returns to historic averages. “If the ETH value ratio to Bitcoin returns to its eight-year common, the value of Ethereum can be $12,000,” he stated. Second, a extra aggressive case the place ETH rises to 1 / 4 of the value of Bitcoin would hit his long-held goal of $62,000. “In comparison with Bitcoin, if it hits 0.25, it’s price $62,000.”

🔥 TOM LEE ASKS $62,000 $ETH

“I believe Ethereum goes to be the way forward for finance, the cost methodology of the long run, and in comparison with Bitcoin, at 0.25 it’s $62,000. Ethereum at $3,000 is considerably undervalued.” pic.twitter.com/VydvLou9IE

— CryptosRus (@CryptosR_Us) December 4, 2025

Lee connects these ratios on to the tokenization narrative. “If 2026 is all about tokenization, meaning the utility worth of Ether ought to rise, so this fee is one thing to regulate,” he informed the group, arguing that valuation ought to monitor rising demand for ETH block area and its function as “the cost rail of the long run.”

He concluded with a pointy evaluation of present ranges. “In fact, I believe Ethereum at $3,000 is considerably undervalued.”

At press time, ETH was buying and selling at $3,128.

Featured picture created with DALL.E, chart from TradingView.com