The second half of 2025 is only some weeks, and it’s no exaggeration to say that Bitcoin and world monetary markets have seen most of this 12 months. From world commerce wars to precise conflicts between nations (together with severe army motion), markets have been affected by a wide range of types of exterior strain all year long.

Consequently, the world has seen an enormous quantity of correlations and direct relationships between conventional monetary and crypto markets. The US inventory market and Bitcoin haven’t been notably linked in latest months, however they haven’t denied the existence of relationships between asset lessons.

What does historically decrease volatility imply for BTC?

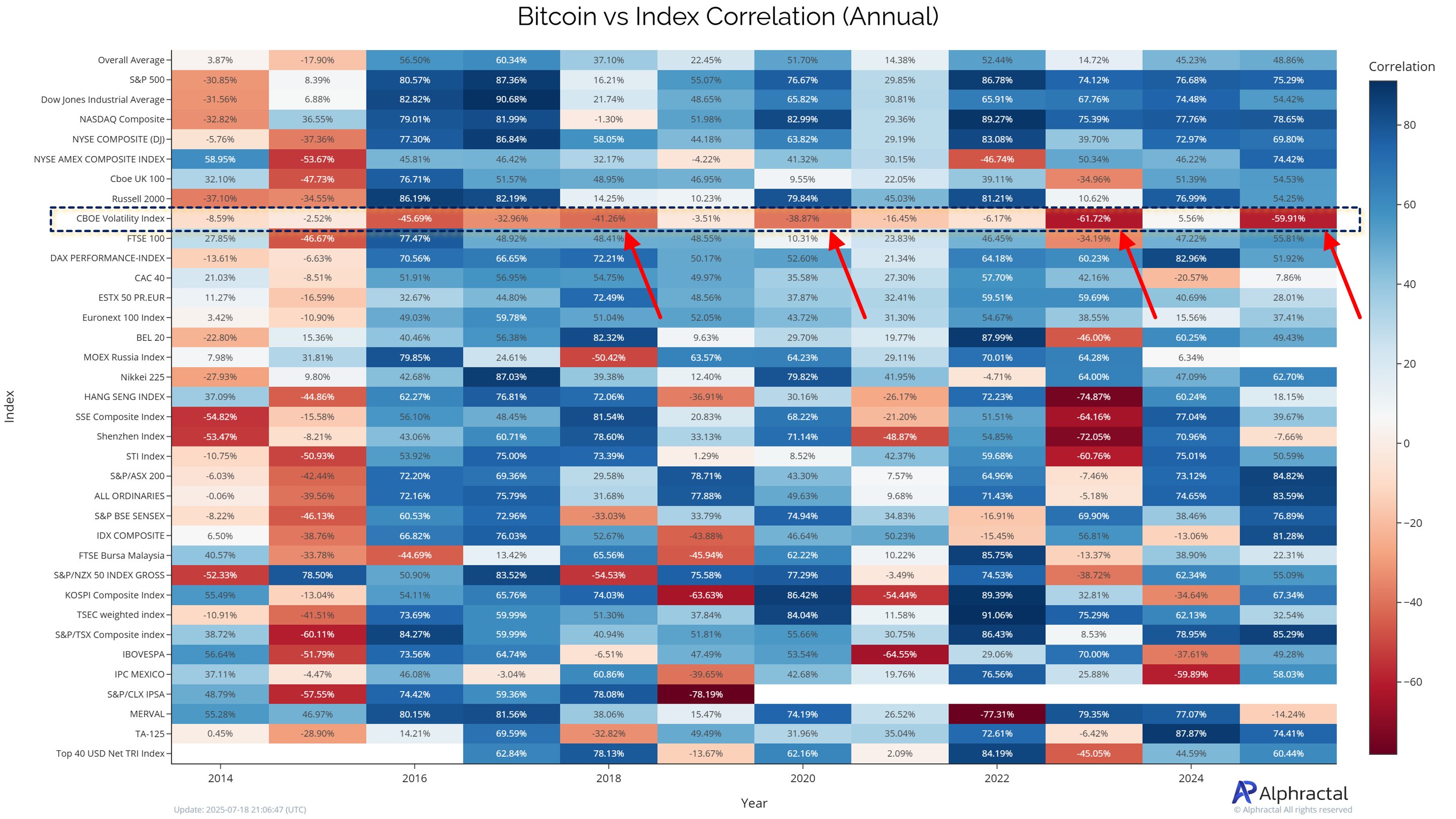

In a brand new publish on social media platform X, Alfractal CEO and founder Joao Wedson delves into the connection between Bitcoin and the US inventory market (via the S&P 500 Index). Based on consultants at Crypto, the perfect cryptocurrencies present a low correlation with the CBOE Volatility Index (VIX), which tracks market expectations for S&P 500 Index volatility.

Within the context, volatility refers to how shortly costs change in a brief time frame, and is commonly seen as a manner of measuring market sentiment. Wedson stated the VIX index, also referred to as the Concern Index, is broadly used as a danger thermometer amongst individuals in conventional monetary markets.

Based on Wedson, Bitcoin costs have traditionally tended to maneuver extra independently and considerably the next 12 months, particularly throughout low VIX, each time there’s a unfavorable correlation with the S&P 500 index. Analysts say this improve in volatility has usually resulted in vital value will increase prior to now.

Wedson stated:

In different phrases, don’t waste evaluation time on BTC and S&P 500 if the correlation between BTC and BTC and VIX is low or unfavorable. That is normally when BTC is prone to enter the explosion section.

Supply: @joao_wedson on X

On-chain analysts stated it is price trying on the relationship between Bitcoin and the US inventory market when Bix is excessive. It’s because worry within the latter can have an effect on the previous conduct. Nevertheless, Wedson identified that with VIX at the moment declining, the S&P 500 index will not be very helpful in analyzing Bitcoin’s subsequent transfer.

Wedson concluded that the extra BTC is dissociated from conventional volatility (VIX), the stronger it turns into as an unbiased asset. Finally, it is a optimistic indication of Bitcoin costs and will present recent alternatives for traders trying to enter the market.

Bitcoin value at a look

On the time of writing, BTC is valued at round $117,888, because it has not mirrored any vital value actions over the previous 24 hours.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

ISTOCK featured photos, TradingView chart