By Omkar Godbole (until in any other case indicated)

The previous 24 hours have witnessed uncommon dynamics. It is not a common narrative of token flows or institutional adoption, however a significant token that travels by means of expertise information.

Solana native Sol (Sol) has skilled a noticeable surge in value volatility, rising to $200 for the primary time since March, after infrastructure firm Jito Labs introduced the Shito Meeting Market (BAM), designed to counter the utmost extractable worth methods akin to front-running and sandwiches. Sol is at the moment infuriated with BNB because it ranks primary on the earth’s largest cryptocurrency by market worth.

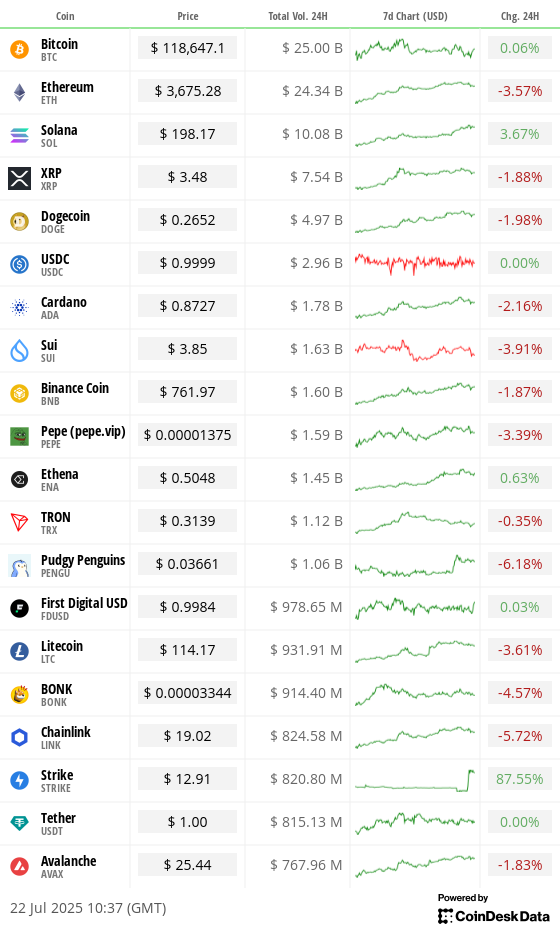

Bitcoin

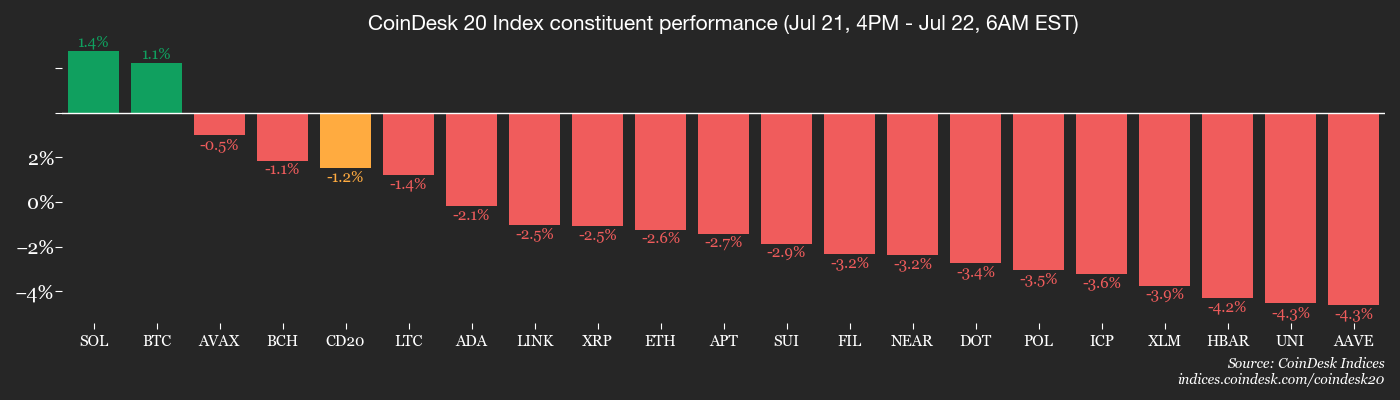

In the meantime, ether (ETH) was pulled again after printing the indecisive doji candles on Monday, nonetheless beneath $120,000. This has resulted within the index of the most important tokens in Coindesk 20 down 2% within the final 24 hours. The Coindesk 80 index, which incorporates the following 80 largest cryptocurrencies, is more likely to have dropped by 3.5%, reflecting Altcoins’ income in phases over the previous few days. The pullback comes proper after a succession of weekly income that seems to have set the stage for a outstanding bull run. (Test the TA part).

Valentin Fournier, BRN’s Lead Analysis Analyst, mentioned, “Solana continues to steer Altcoin’s efficiency, with the announcement of the Block Meeting Market, bringing higher transaction speeds and improved community effectivity. “Nevertheless, the broader market has been unable to carry on to its momentum, reflecting a rise in uncertainty as demand for ETFs slows.”

The chart might level out additional declines within the close to future, however the underlying market is poised for progress, he mentioned.

“Whereas short-term expertise might put extra strain on value, we stay constructive all through the cycle,” he famous, pointing to institutional and company demand as a long-term bullish catalyst.

Talking of institutional recruitment, JPMorgan is reportedly contemplating providing loans backed by crypto property held by prospects akin to BTC and ETH. Mexico-listed actual property firm Grupo Murano plans to undertake BTC as its core strategic asset, attaining its preliminary funding of $1 billion and a goal of $10 billion to attain its five-year goal.

In conventional markets, traders have withdrawn cash from leveraged technique (MSTR) ETFs, dug up double the shorter ETFs, and dug up indicators of a reassessment of directional bets. The buck was a bid for main currencies, together with the euro and the risk-sensitive Australian greenback. The Financial institution of Japan reportedly mentioned it might present US dollar-denominated loans to home establishments for pooled collateral. Preserve alerts!

What to see

- Crypto

- July twenty third 1pm: Improve of Hedera (HBAR) mainnet model 0.63. This course of is predicted to take about 40 minutes. In the meantime, community customers can expertise non permanent confusion.

- July 23-24: The foundation community (route) mainnet will endure technical upgrades (v11.79.0) that have an effect on NFT possession information storage.

- Macros

- July twenty second, 8:30am: Federal Reserve Chair Jerome H. Powell will make his opening remarks on the built-in evaluate of the Capital Framework of the Giant Financial institution Convention held at Washington, DC Livestream Hyperlink.

- July twenty second, 1pm: Supervisor Vice-Chairman Michelle W. Bowman will speak about innovation on the identical assembly. Stay stream hyperlink.

- July twenty fourth at 8:15am: The European Central Financial institution will maintain a press convention with President Christine Lagarde in half-hour to announce its rate of interest resolution. Stay stream hyperlink.

- Predominant Refinance Operation (MRO) Charge EST. 1.9% vs. 2.15%

- July twenty fourth at 9:45am: S&P World Relieses (Flash) Information on US manufacturing and repair actions for July.

- Composite PMI prev. 52.9

- Manufactured PMI EST. 52.5 vs. 52.9

- The PMI service is. 53 vs. 52.9

- August 1st 12:01 AM: Efficient for imports from buying and selling companions that haven’t been capable of attain the contract by July Ninth. These will increase in duties vary from 10% to 70%, affecting a variety of merchandise.

- Income (Estimation based mostly on reality set information)

- July twenty third: Tesla (TSLA), Put up Market, $0.42

- July 29: PayPal Holdings (PYPL), in entrance of the market, $1.29

- July 30: Robin Hood Market (Meals), Put up Market, $0.30

- July 31: Coinbase World (Coin), Put up Market, $1.35

- July 31: Reddit (RDDT), Put up Market, $0.19

- August fifth: Galaxy Digital (GLXY), former market

Token Occasion

- Governance votes and cellphone calls

- Aavegotchi Dao is voting for a $245,000 funding proposal to broaden Gotchi Battler right into a revenue-generating sport with PVE mode, NFT and Battle Move. Voting will finish on July twenty second.

- Ethereum Identify Service Dao is voting for a proposal from Tully to enter a one-year renewable settlement to strengthen ENS governance. Voting will finish on July twenty second.

- Rocket Pool Dao is voting to finalize the implementation of Saturn 1. The approval by the 75% Supermajority will ratify main protocol modifications, together with new transaction designs and the potential income share of the PDAO Ministry of Finance. Voting will finish on July twenty fourth.

- Lido Dao is voting for a brand new system that permits validator exits to be robotically triggered by means of the execution layer, not simply node operators. This consists of instruments for varied approval routes, emergency administration, and constructing restrictions to forestall misuse. This replace is predicted to make staking extra decentralized, safer and extra responsive. Voting will finish on July Twenty eighth.

- Gnosisdao is at the moment voting for a proposal to offer a $30 million quarter per 12 months to nonprofit group Gnosis Ltd. to take care of it to take care of its vital GNOSIS chain infrastructure, merchandise (akin to GNOSIS Pay and Circles), enterprise growth and operations. Voting will finish on July Twenty eighth.

- Aavegotchi Dao is funding three new options in its official decentralized software. Wearable lending UI, Gotchis Batch Lending, and BRS Optimizer. Voting will finish on July Twenty ninth.

- Close by protocols are voting for the opportunity of lowering Close to’s inflation from 5% to 2.5%. Two-thirds of validators should approve the proposal for it to go, and in that case it may be applied by the second half of the third quarter. Voting will finish on August 1st.

- July Twenty ninth, 10am: ether.fi will maintain a two-way analyst name.

- Unlock

- July twenty fifth: venom unlocks 2.84% of its distribution provide price $12.48 million.

- July 31: Optimism to unlock 1.79% of distribution provide price $23.45 million.

- August 1: SUI unlocks 1.27% of its distribution provide price $16,938 million.

- August 2: Ecena unlocks 0.64% of distribution provide price $19.75 million.

- August 9: Unlocking 1.3% of the round provide price $1511 million (IMX).

- August 12: APTOS unlocks 1.73% of distribution provide price $59.26 million.

- Token launch

- July 22: Binance to open new buying and selling pairs of Ethereum Basic, The Graph and Oasis (Rose).

- July twenty second: Kucoin lists Delphinus Lab (Zkwasm), Nonocoin (NOC), and snakes (snakes).

- July twenty third: Binance Alpha that includes Alliance Video games (COA).

assembly

Coindesk Coverage & Regulation Convention (Previously often called Cryptographic State) At a one-day boutique occasion held in Washington on September Tenth, generals, compliance officers and regulatory executives will be capable to meet with civil servants answerable for crypto regulation and regulatory oversight. House is restricted.

- Day 2: Malaysian Blockchain 2025 (Kuala Lumpur)

- July twenty fourth: Decasonic’s Web3 Investor 2025 (Chicago)

- July twenty fifth: Blockchain Summit World (Montevideo, Uruguay)

- July Twenty eighth-Twenty ninth: TWS Convention 2025 (Singapore)

- August. 6-7: BlockChain.rio 2025 (Rio de Janeiro, Brazil)

- August Sixth-Tenth: Rarebo (Las Vegas)

- August 7-8: Bitcoin++ (Latvia, Riga)

- August Ninth-Tenth: Baltotic Honey Badger 2025 (Riga, Latvia)

- August Ninth-Tenth: Conviction 2025 (Ho Chi Minh Metropolis, Vietnam)

Token speak

By Shaurya Malwa

- Pengu, a Solana-based Memecoin linked to Pudgy Penguins, jumped 27% in 24 hours, surpassing all prime 100 tokens by market capitalization and pushing the valuation to over $2.4 billion.

- The transfer is available in parallel with a wider revival within the NFT market, which was triggered by unknown patrons late Sunday, with a 17% improve in flooring costs for punks unfold throughout the X.

- As dealer sentiment modified, the ground value of Pudgy Penguins rose to 13% to 16.57 ETH ($63,150) (highest in these few months) – immediately provided to the demand for Memocoin.

- Pudgy Penguins is the Ethereum-Native NFT assortment. They launched their pen at Solana in December, reaching a brand new retail viewers. The technique paid off. The token is 310% over 30 days, and is quantity 59 in market capitalization.

- The NFT Ripple additionally enveloped the boring monkey yacht membership. It will rise 23% to 13.5 ETH flooring, with numerous forecast markets supplying you with a 64% likelihood of over 12.75 ETH by the top of the weekend.

- Collections akin to Moonbirds, Azuki, Cool Cats, Goblintown, and Cryptodickbutts additionally function double-digit flooring value will increase, marking the NFTS’ largest 24-hour motion since early 2024.

Positioning of derivatives

- Open curiosity in everlasting offshore BTC futures has declined greater than 0.5% immediately. Signature merchants aren’t chasing restoration from an in a single day low of lower than $116,000. Within the case of ETH, the OI falls together with the weak spot in value and takes the revenue of the sign.

- The everlasting funding fee for key tokens continues to be reset to a reasonably bullish degree, almost 10%, from the 20% we noticed final week. The place of pump and fart bulls is starting to look like rising barely, with an annual funding fee rising by 40%.

- At Deribit, the reversal of BTC danger was reversed till the top of August, giving up the decision bias. ETH calls proceed to be dearer on all tenors.

- Blockflows over the OTC community paradigm function a name unfold that features a December $140,000/$200k BTC unfold and an August 3.8k/$4.4k ETH unfold.

Market actions

- BTC rose 1.26% from 4pm on Monday, $118,441.44 (24 hours: unchanged)

- ETH is down 2.55% at $3,661.35 (24 hours: -3.67%)

- Coindesk 20 is down 0.76% at 4,094.63 (24 hours: -1.49%)

- Ether CESR Composite staking fee is up 9 bps at 3.04%

- BTC’s funding fee is 0.0157% (17.2233% per 12 months) on OKX

- DXY has not modified at 97.85

- Gold futures fell 0.27% to $3,397.30

- Silver futures fell 0.65% at $39.08

- Nikkei 225 closed 0.11% at 39,774.92

- Dangle Seng rose 0.54% to 25,130.03

- FTSE has not modified at 9,017.56

- The Euro Stoxx 50 is down 0.64% at 5,308.76

- DJIA didn’t change on Monday at 44,323.07

- S&P 500 closed 0.14% at 6,305.60

- NASDAQ Composite rose 0.38% at 20,974.17

- S&P/TSX composite was unchanged at 27,317.00

- S&P 40 Latin America closed 0.4% at 2,588.28

- The ten-year monetary ratio within the US is up 1.8 bps at 4.388%

- E-Mini S&P 500 futures fell 0.13% at 6,336.50

- E-Mini Nasdaq-100 futures fell 0.29% at 23,274.00

- E-Mini Dow Jones Industrial Common Index has not been modified at 44,545.00

Bitcoin statistics

- BTC dominance: 61.2% (1.04%)

- Ether Bitcoin Ratio: 0.03089 (-3.63%)

- Hash fee (7-day transferring common): 911 EH/s

- Hashpris (spot): $59.39

- Complete price 4.26 BTC/$503,658

- CME Futures Open Curiosity: 154,600 BTC

- Gold value BTC: 35.0 oz.

- BTC vs. Gold Market Cap: 9.9%

Technical Evaluation

- The Coindesk 80 index cuts open a double backside sample, suggesting out-of-performance of Altcoin.

- Double bottoms are bullish inversion patterns recognized by two troughs separated by restoration. Strikes passing by means of trendlines connecting restoration are mentioned to verify modifications in bullish developments.

Crypto shares

- Technique (MSTR): Monday closed at $426.28 (+0.72%), +0.65% at +0.65% at $429.06

- Coinbase World (Coin): $413.63 (-1.47%), +0.42% at 415.36 +0.42%

- Circle (CRCL): Closed at $216.1 (-3.43%), with -3.67% being $208.16

- Galaxy Digital (GLXY): $27.45 (+1.18%), closed at $27.97 at +1.89%

- Mara Holdings (Mara): $18.83 (-3.49%), +0.64% at $18.95

- Riot Platforms (Riot): $14.02 (+1.15%), +1.43% closes at $14.22

- Core Scientific (CORZ): $13.27 (-0.6%), +0.45% closed at $13.33

- CleanSpark (CLSK): $12.39 (-3.05%), +1.13% at $12.53

- Coinshares Valkyrie Bitcoin Miners ETF (WGMI): Closed at $26.48 (-1.01%)

- Semler Scientific (SMLR): $39.67 (-3.81%), closed at -1.94% at $38.90

- Exodus Motion (Exod): Closed at $33.61 (-11.78%) and has not modified earlier than the market

- Sharplink Gaming (SBET): $25.25 (-12.89%), closed at -1.92% at $24.76

ETF Stream

Spot BTC ETF

- Each day Internet Stream: -$131.4 million

- Cumulative web stream: $545.9 billion

- Complete BTC holdings: 1.3 million

Spot ETH ETF

- Each day Internet Stream: $296.5 million

- Cumulative web stream: $7.8 billion

- Complete ETH holdings: 505 million

Supply: Farside Traders

One evening stream

The chart of the day

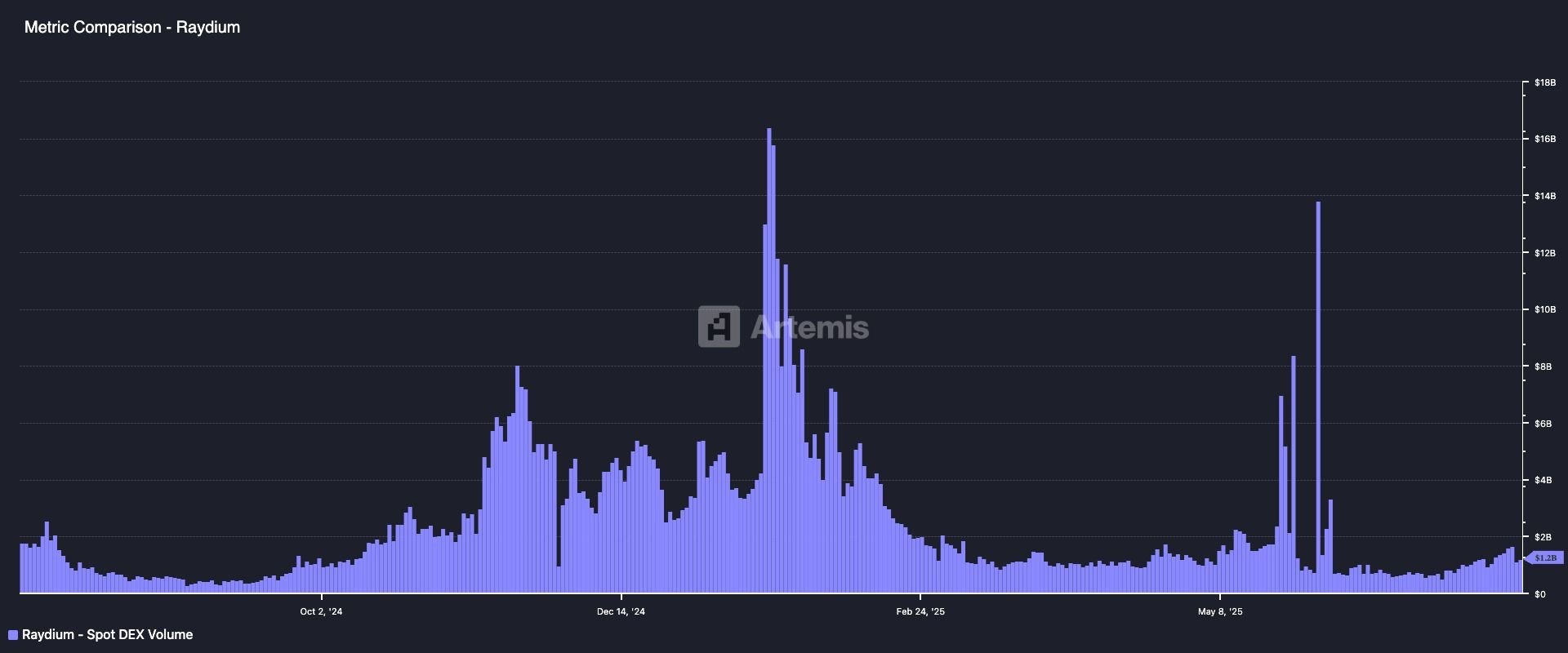

Solana-based Dex Raydium quantity. (Artemis)

- The chart exhibits the every day buying and selling quantity of Solana-based distributed change radium.

- Actions are falling regardless of BTC hitting document highs and Altcoins receiving bids.

- That is in stark distinction to earlier Bull Runs, which generated DEX windfall income by way of buying and selling quantity.

Whilst you’re asleep

- Trump Media’s $20 billion Bitcoin peaked at 2025 BTC’s Harving Cycle Knowledge (Coindesk): Professional-crypto’s US presidency might assist Bitcoin ignore the traditional growth bust cycle, however Trump Media’s $2 billion funding might point out a strategic guess on monetary easing and greenback weak spot.

- Kathy Wooden’s Ark is stacked on the Ether Trejury Bette Bitmine Immersion (Coindsk). Past the ETF, ARK invested $116 million in ETH Treasury Division’s Bitmine Immersion Applied sciences (BMNR) and decreased Coinbase shares by $9,000.6 million with the acquisition of 4.4 million shares.

- The Financial institution of England is contemplating the Digital Pound (Bloomberg) shelf plans. BOE Chief Andrew Bailey is believed to require a retail CBDC and ultimate choices on the challenge might be required till the present design part is full.

- JPMorgan explores shoppers’ lending to Monetary Instances. Banks might start lending to Bitcoin and ether in 2026. These acquainted with the plan have acknowledged that they adopted earlier steps to just accept Crypto ETF Holdings as collateral.

- Solana will beat Jito’s Bam Attracts Bullish Bets (Coindesk) over $200. The brand new system of personal, programmable transaction sequences has boosted confidence in Solana’s infrastructure and has attracted traders’ consideration amid rising optimism about developer exercise and the utility of long-term networks.

- How China has curbed its oil poisoning and slowed down the US strain level (Wall Avenue Journal): Fearing disruption to the US overseas oil provide, China has poured billions of {dollars} into the manufacturing of electrical automobiles, changing imports with home made vitality, lowering financial vulnerability.

With ether