Ethereum Validator exit queues develop daily, reaching the best stage ever. As ETH recovered, the community skilled the most important leakage of validators.

Validators have left Ethereum Community as of July twenty fifth utilizing a report variety of unknown requests. For the previous 10 days, Ethereum Community has launched an unprecedented withdrawal as merchants tried to free ETH. Validators happen as ETH trades round $3,465.55.

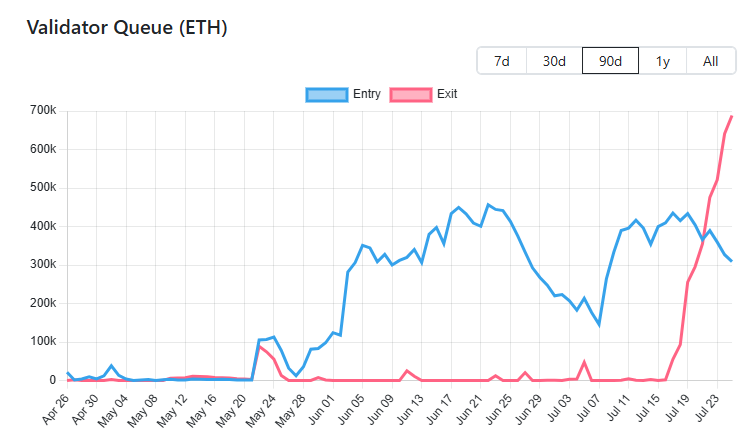

The sudden improve in demand to launch ETH from beacon chain contracts started on July sixteenth and initially seemed to be a traditional validator turnover. Quickly, the queue grew to 688,356 ETH and waited for launch to exceed $2.6 billion.

A request to withdraw ETH, which has been accelerated since July 16, as a consequence of elevated market gatherings and monetary corporations’ publicity. |Supply: Validator Queue

Ethereum launched at this charge won’t collide with the marketplace for a number of days. At present, ready occasions have grown to 11 days, with report highs. Present unstaked episodes point out that amenities might face obstacles when utilizing beacon chains as a consequence of unpredictable episodes.

Ethereum Community nonetheless has over 2M validators and there’s no main menace to community safety. The last word impact of ETH might be nearer to promoting some huge whales. Some early holders might put together free Treasury ETH or promote to finance corporations with OTC transactions.

Early Ethereum Validators might attempt to make a revenue

The principle purpose Rush bets is to make a revenue as ETH reaches $3,800. Many efficient folks wager cash at a a lot cheaper price and should need to unlock the worth of ETH.

Validator rollovers could also be partly as a consequence of community upgrades this 12 months. This enables the validator to deposit 2,048 ETH as a substitute of a number of deposits of 32 ETH.

Validator Exodus additionally occurred when a number of corporations started to announce ETH’s financials. The influence of Sharplink video games and Bitmine has elevated the demand for Ethereum as a long-term valued reservoir.

One other 308,713 ETH is able to wager on the beacon chain, indicating the demand for passive revenue. Ethereum Validator Staking is taken into account a viable choice for a set of ETFs, and a few Company Treasury Departments could also be partially locked for staking.

Lido dao unstaking accelerates

Lido dao Staking queue It is usually near the best peak ever. I am ready for greater than 223k ETH to be unorganized. Over the previous few days, Lido Dao’s wait occasions have greater than doubled from 70 hours to over 150 hours on common.

At this level, nearly all ETHs are just a few days away from getting into the spot market. Nonetheless, there are different use instances for the cash which might be launched.

For one, a portion of Lido Dao has flowed into Binance’s staking program. Binance carries round 20% of the prevailing ETH and options its personal vibrant commerce between liquid staking tokens and L1 ETH.

At present, market anomalies are rising demand for Binance’s liquid staking tokens. Wbeth costs have risen considerably Premium $3,957.52. Roughly 80% of the quantity of Wbeth depends upon binance and merchants can commerce for Ethereum, so there isn’t any must undergo the withdrawal queue.

Wbeth can be utilized for arbitration, however it’s a restricted alternative and should take a number of days to finish.