Two giant Ethereum traders have seized latest market corrections to extend their funding in belongings.

In the course of the first few days of August, whale wallets spent greater than $400 million on ETH, renewing their confidence within the long-term worth of their belongings.

Ethereum whales purchase dip when exercise on the chain rises

Some of the notable transactions got here from a pockets tracked by Arkham Intelligence. Over three days, the pockets has acquired roughly $300 million price of ETH by Galaxy Digital’s over-the-counter buying and selling desk.

The pockets at present has an unrealized lack of roughly $26 million.

Nonetheless, the size and fast tempo of purchases counsel a strategic, long-term accumulation quite than a speculative short-term transaction.

One other essential participant on this buy is Sharplink, specializing in Ethereum.

In response to LookonChain, the corporate added 30,755 ETH to its steadiness sheet over two days, spending $108.57 million at a mean worth of $3,530 per token.

Sharplink at present holds 480,031 ETH, with its present stash valued at round $1.65 billion.

These acquisitions got here when Ethereum fell to a weekly low of practically $3,300. In response to Beincrypto knowledge, ETH has recovered barely, buying and selling round $3,477 on the time of writing.

Trade consultants famous that these whales’ actions mirror Ethereum’s broader, optimistic outlook.

In July, ETH spiked above $3,900, pushed by document institutional inflow, elevated ETF publicity and stable-driven Defi expansions.

Specialists argue that this isn’t a short-lived gathering, however an indication of a rising position for Ethereum in world finance.

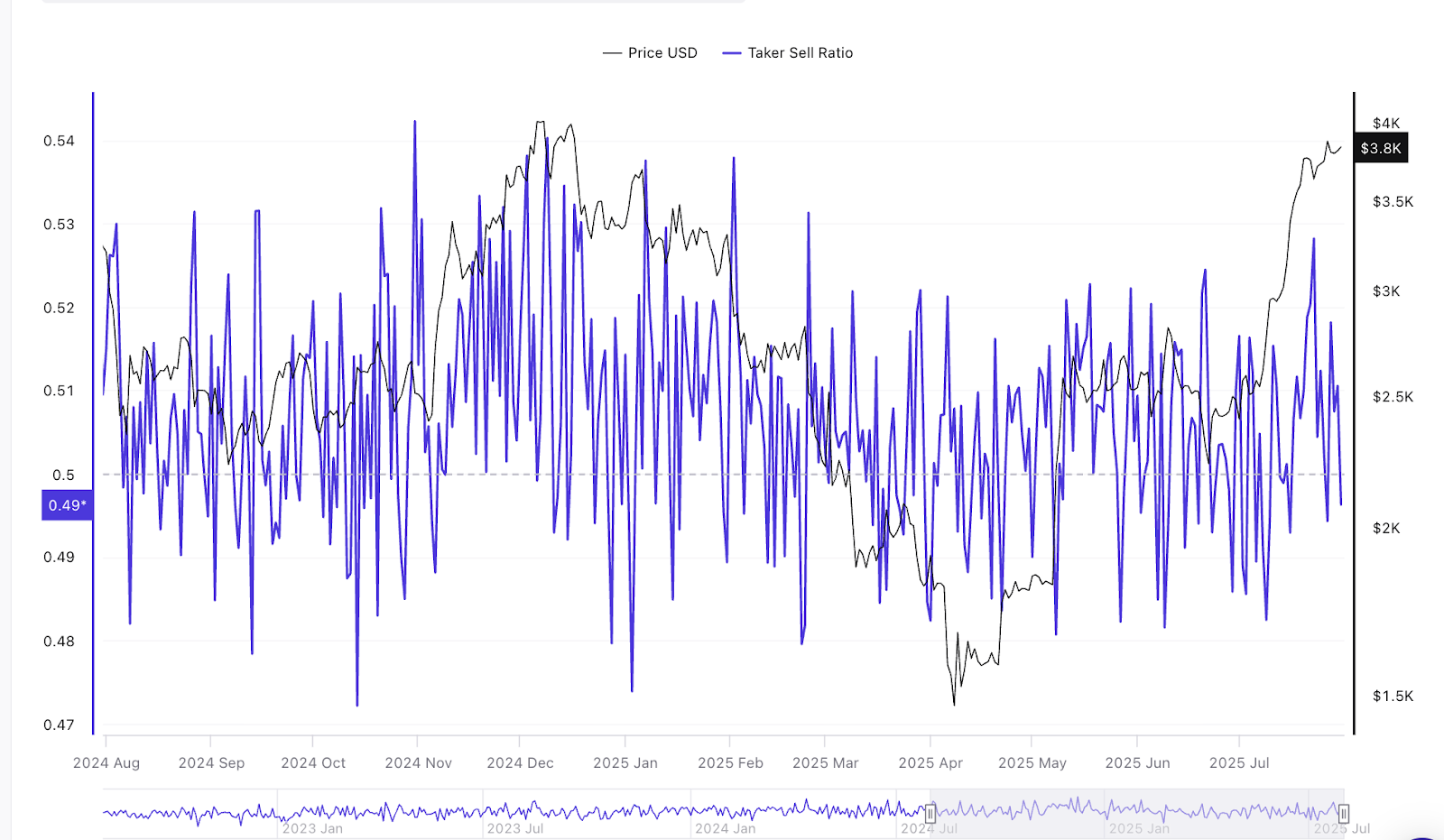

The surge in community on-chain exercise helps this view.

Sentora (previously Intotheblock) just lately reported that Ethereum registered 931,000 lively addresses in someday, registering the very best depend in practically two years. This rise highlights elevated consumer engagement and curiosity throughout the community.

Ethereum lively deal with. Supply: Sentora (previously Intotheblock)

Moreover, regulatory developments might additional strengthen Ethereum’s outlook as US officers are prepared to steer world finance into an period of blockchain-based.

Fundstrat’s well-liked enterprise capitalist Thomas Lee urged that if Ethereum continues to be dominated as a beneficial good contract platform for Wall Road companies, its valuation might rise considerably, doubtlessly reaching $60,000.