Ethereum worth forecast: BlackRock raises bullish hope for a $4,000 ETH

Ethereum ($eth) has returned to the highlight after the report surfaced Black Rock– The world’s largest asset supervisor – bought ETH value $103 million. The information has rekindled bullish sentiment throughout the crypto market. $4,000 Resistance Stage As the following large milestone.

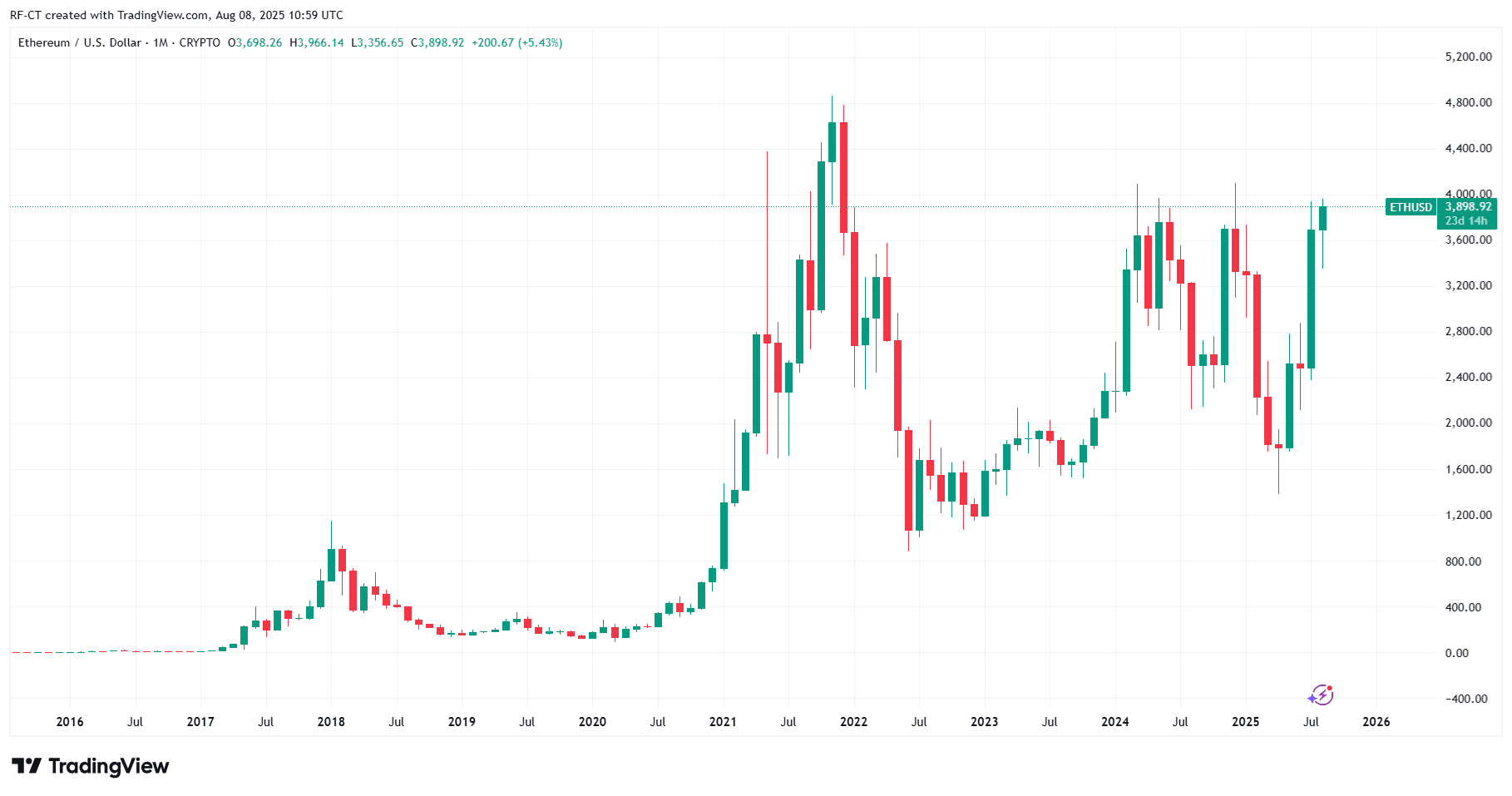

cordingView-ethusd_2025-08-08 (ytd)

Ethereum worth efficiency

On the time of writing, ETH trades about $3,894somewhat above that day. Final week, tokens have been holding a decent vary in between. $3,805 and $3,953suggests post-term integration of volatility.

- Speedy resistance: $3,950-4,000 (psychological and technical limitations)

- Predominant help: $3,800, with stronger help close to $3,600 if gross sales strain is elevated

BlackRock’s $103 million Ethereum buy

In line with Market Chatter, the BlackRock transfer is among the most essential institutional Ethereum purchases so far. Though it has not but been formally confirmed by way of regulatory submissions, the scale of the acquisition is enough to lift short-term sentiment.

- Institutional confidence: The BlackRock entry exhibits the rising acceptance of Ethereum as a facility-grade asset.

- Potential ETF play: This timing coincides with rising speculations concerning the launch of the US spot Ethereum ETF later this yr.

- Market impression: Giant-scale purchases might shift market liquidity and encourage retail traders to observe fits.

Technical Evaluation

- RSI (Relative Energy Index): Hovering close to neutrals, ETH exhibits that there’s room for motion earlier than hitting the acquired territory.

- MACD: Close to bullish crossovers, it means that persevering with purchases might enhance upward momentum.

- Bollinger Band: The worth is near the higher band and factors to doable short-term resistance earlier than trying a breakout.

If ETH breaks above $4,000 With a robust quantity, the following goal is round $4,150-$4,250. In any other case, you may even see a stage of help for retesting the worth.

Fundamental drivers past Black Rock

- Progress of the Ethereum Community: Rising Defi exercise and NFT quantity proceed to drive demand for ETH gasoline costs.

- On-Chain Metric: Lively addresses and staking participation are wholesome and reveal regular consumer engagement.

- Macro elements: The US Federal Reserve coverage and broader risk-on sentiment in equities and crypto play a job within the route of ETH.

Ethereum worth forecast

- Brief time period (1-2 weeks): If bullish momentum from BlackRock Information is held, ETH might try to break $4,000.

- Medium interval (1-3 months): A confirmed breakout might push in direction of ETH $4,250-$4,500particularly if ETF approval rumours achieve traction.

- Bearish situation: In case you do not break $4,000, your ETH might probably drift again in direction of the $3,600 help zone.

cordingView-ethusd_2025-08-08 (All)

The $103 million Ethereum buy reported by BlackRock provides a brand new bullish aspect to ETH’s market outlook. Whereas $4,000 resistance stays a horrifying barrier, institutional advantages mixed with sound technical indicators recommend that bulls have a combating probability.

💡 The place to purchase ETH: Evaluate Prime Exchanges right here

📊 Dwell ETH Value: Discover Ethereum costs in actual time