Ethereum Worth prolonged its restoration and rose to almost $3,450 from August fifth to check the $3,950 zone. The rally retested the resistance degree that broke above the downward construction and turned to $3,708 assist. That is at present serving because the launch level for the present push.

ETH Worth Dynamics (Supply: TradingView)

On the 4-hour chart, ETH is held above all main EMA. The EMA20 is $3,749, the EMA50 is $3,686, and the EMA100 is $3,623, and the EMA100 is under the worth. This alignment will assist continuity so long as $3,800 is held as short-term assist.

The Bollinger band has expanded and exhibits a rise in volatility, however costs are driving on the higher band, an indication of sustained bullish momentum. With a breakout, ETH has pushed ETH again over the broader pattern line since July, reestablishing a better construction.

Ethereum value forecast desk: August 9, 2025

Why are Ethereum costs rising right this moment?

ETH Worth Dynamics (Supply: TradingView)

At the moment’s rise in Ethereum costs is pushed by each know-how and derivatives markets. Technically, the breakouts above $3,708 point out a shift to purchaser management after per week of pullback. This triggered contemporary lengthy positioning and buy cease activations of over $3,800.

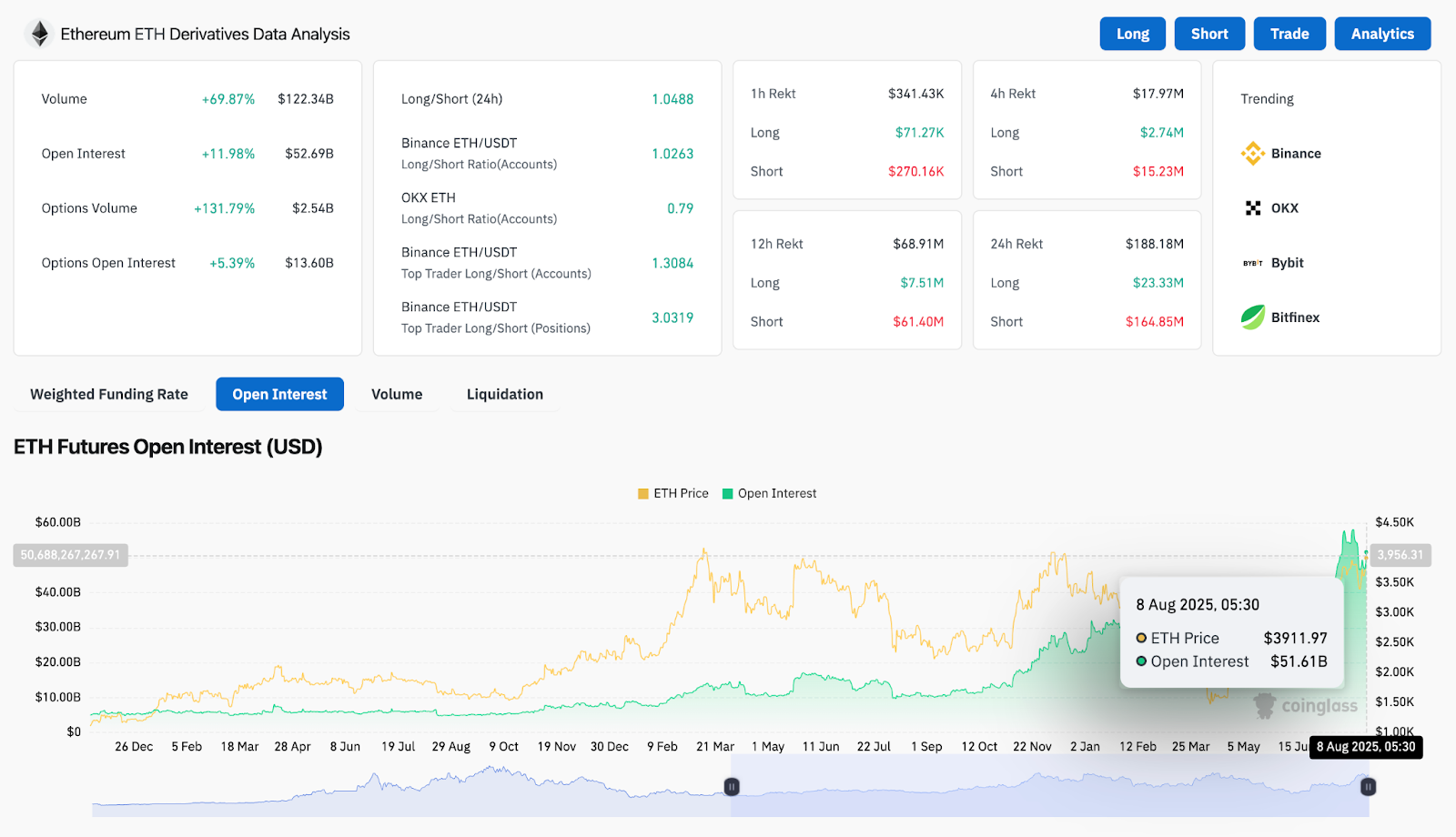

ETH by-product evaluation (supply: Coinglass)

Within the derivatives market, buying and selling volumes rose almost 70% to $122.34 billion, and open curiosity reached 11.98% to $5.269 billion. The long-term ratio of Binance’s high merchants is 3.03, highlighting a powerful lengthy bias among the many giant variety of merchants. The quantity of choices additionally surged above 131%, indicating an aggressive bullish place forward of a possible breakout to $4,100.

ETH Worth Dynamics (Supply: TradingView)

On the 30-minute chart, the RSI sits close to 60 after being cooled from the acquired territory, and is instantly turned the other way up additional with out fatigue. MACD stays within the optimistic area regardless of delicate histogram contraction, indicating that bullish momentum continues to be current.

Worth indicators and market construction

ETH Worth Dynamics (Supply: TradingView)

The weekly chart highlights a key resistance zone of $4,106. This coincides with the 1.0 Fibonacci enlargement from the 2021 excessive. A break above this degree might open the door in the direction of Fibonacci’s targets, that are $5,070 and $5,788.

ETH Worth Dynamics (Supply: TradingView)

Each day supertrend ranges stay bullish above $3,387, with no inverted alerts seen. DMI exhibits +DI Studying-DI supported by over 32 rising ADX, confirming the trending market.

The low timeframe VWAP is mounted at almost $3,918 and serves as a important daytime pivot. So long as the ETH is held above this zone, the trail with minimal resistance stays upward.

Ethereum value forecast: short-term outlook for August ninth

Over the subsequent 24 hours, Ethereum costs ought to stay at greater than $3,800 to take care of a bullish construction. A clear breakout from $3,950 to $3,960 might rapidly result in a retest of $4,100. That is a very powerful resistance earlier than a better goal acts.

If the Bulls fail to take care of momentum and the worth falls under $3,800, they may probably get a pullback to $3,749 (EMA20) and $3,708 assist. Nevertheless, given the EMA alignment, bollinger band extensions, and placement derivatives that want lengthy, the likelihood stays leaning in the direction of one other breakout try.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.