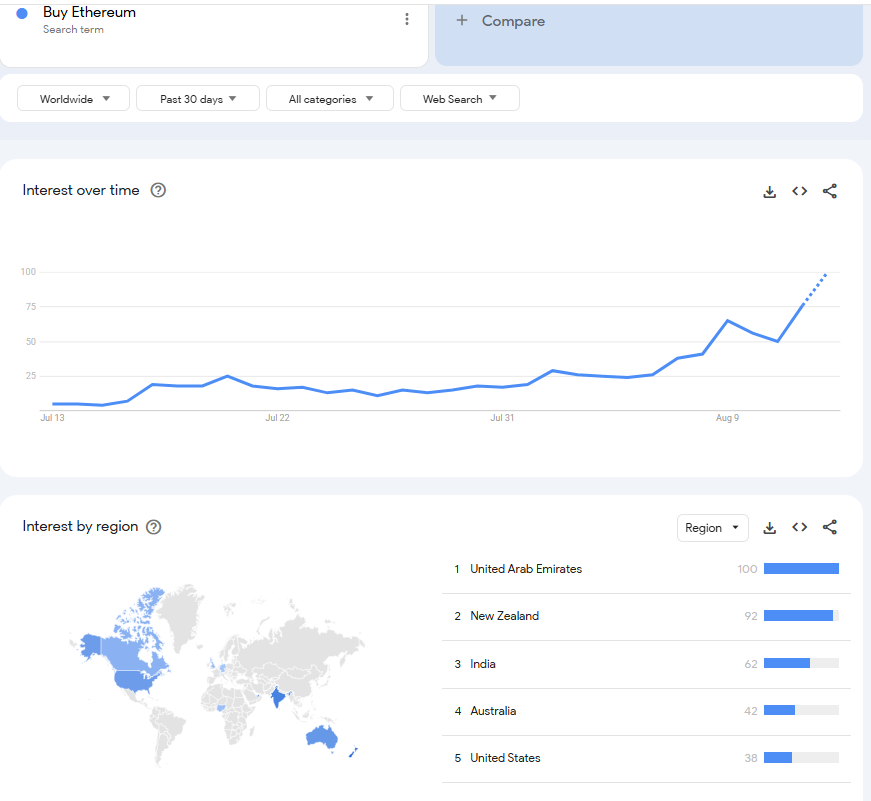

Over the previous month, world curiosity in buying belongings has skyrocketed, leaping almost 20 instances as Ethereum’s (ETH) costs have ripped past key resistance ranges.

On July thirteenth, there was 5 looking out curiosity on Google’s 0-100 scale. By August 13, it’s projected to succeed in 100, the very best stage in not less than a yr, marking a 1,900% enhance. Google Developments Knowledge retrieved by Finbold.

Geographically, the United Arab Emirates recorded the very best curiosity with a rating of 100, adopted by New Zealand (92), India (62), Australia (42), and the US (38).

It’s price noting that search pursuits are usually not immediately transformed into buying actions. Nonetheless, such a surge in on-line consideration usually precedes a interval of elevated market volatility.

If the pattern continues, Ethereum could face a rise in upward strain and should take a look at essential resistance ranges in doubtlessly shut circumstances.

ETH Worth Evaluation

This surge comes after Ethereum has gathered past the $4,600 mark. As of press time, ETH traded at $4,618, up over 6% during the last 24 hours. On the weekly chart, belongings are up 27%.

Moreover, the technical setup means that Ethereum can increase this momentum. Particularly, an evaluation by Gert Van Lagen, shared on the X Publish on August 13, exhibits that the second-largest cryptocurrency by market capitalization is break up from a four-year reverse head and shoulder sample, doubtlessly paving the way in which for a rally to $22,000.

In response to analysts, Ethereum is on observe to finish the 2019-2025 bull market cycle, with textbooks increasing their diagonal formation. This bullish construction maintained an upward risk if the sample continued as anticipated.

On the identical time, for sustained momentum, Ethereum could require steady inflows from institutional buyers by exchange-traded funds (ETFs).

on this regard, Coinglass Knowledge obtained by Finbold on August 13 exhibits that Ethereum Spot ETF recorded a web influx of $523.9 million on August 12, with BlackRock’s ETHA led at $318.7 million and Constancy’s FETH led at $144.9 million.

Grayscale’s ETH and ETHE merchandise added $44.3 million and $9.3 million, respectively, whereas different publishers recorded much less income. The day earlier than, we noticed much more inflows of $1.02 billion.

If these inflow continues and a assist stage of $4,500 is retained, Ethereum may go effectively to focus on the $5,000 mark.

Featured Photos by way of ShutterStock