Bitcoin’s Bull Cycle approaches its remaining stage 997 days after the cycle backside on November 21, 2022.

This means that the height can happen inside 70 days. This will probably be between October fifteenth and November fifteenth, 2025.

Bitcoin Cycle Peak from October to November 2025

In a latest remark on the historic cycle of Bitcoin, analyst Cryptobirb shared some notable insights.

Historic knowledge offered by this analyst offers an outline of the size of previous bull cycles. 2010 to 2011 (as much as 350 days). 2011-2013 (~746 days); 2015-2017 (~1,068 days); 2018-2021 (~1,061 days). If historical past repeats, the present cycle is anticipated to final round 1,060-1,100 days.

As of now, Bitcoin’s Bull Run continues for 997 days, approaching the ultimate stage, because it counts from the cycle backside earlier than November 21, 2022. If historical past follows the identical sample, the peaks might seem throughout the subsequent 70 days.

Bitcoin cycle. Supply: x’s cryptobirb

“The height odds may even be the best within the subsequent three months, with candy spots from October fifteenth to November fifteenth, 2025,” Cryptobirb mentioned.

Timing the cycle peak based mostly on the Bitcoin Harving occasion provides an identical projection. Half of 2012 to its peak in 2013 took about three hundred and sixty six days. Roughly 526 days from 2016 to 2017. Roughly 548 days from 2020 to 2021. Based mostly on this, the interval from half of 2024 to the subsequent peak may very well be round 518-580 days.

“It will place the subsequent peak between October nineteenth and November twentieth (518-580 days),” Cryptobirb added.

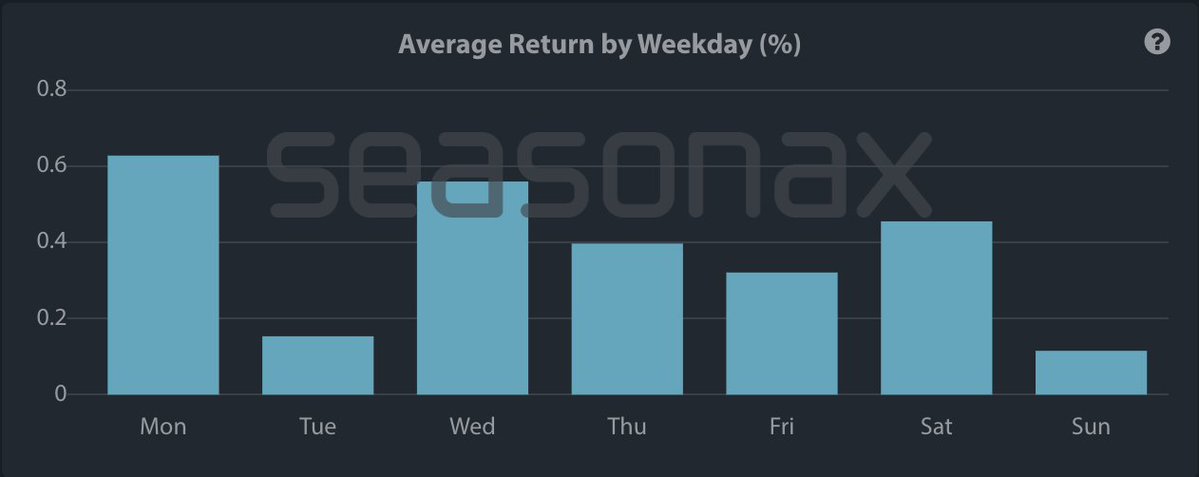

To additional help this view, Cryptobirb famous previously cycle that October and November are sometimes Bitcoin’s strongest progress months, significantly on main dates similar to Monday (October 20, October 27) and Wednesday (October 22, October 29). Of those, October twenty second is the most certainly window for value breakouts.

Common return as much as common day. Supply: Cryptobirb

The overlap between the four-year cycle of the US presidential election and the provision of Bitcoin additional strengthens the speculation that cycle peaks will decline between mid-October and mid-November 2025.

“The subsequent ATH odds will cluster strongly between October fifteenth and November fifteenth, 2025. Right here, the momentum of historical past, arithmetic and markets coincides. My guess is that they don’t seem to be removed from the fourth week of October,” Cryptobirb mentioned.

That is according to the views of Alphractal’s CEO, who believes the Bitcoin cycle stays intact, and whereas it’s prone to peak in October, buyers are warning them to brighten superior volatility earlier than reaching the highest.

Bear Market in 2026

From a market psychology perspective, the pre-peak stage exhibits excessive happiness, a surge in buying and selling quantity, and curiosity in looking for peak Bitcoin-related key phrases. This part may have a short-term repair to “wave” a weaker hand earlier than costs go up.

Bitcoin has already skilled a powerful upward momentum, together with the latest corrective pullback.

Bitcoin Bear Market. Supply: Cryptobirb

Following the height, the historic pattern exhibits that the bear market sometimes lasts between 370 and 410 days, with a median decline of round 66%. If this state of affairs is repeated, a downtrend might start in 2026, and we’ll information you thru deep revision phases earlier than the subsequent accumulation interval begins.

Because of this many analysts suggest exit methods earlier than the market reversal. Some buyers plan to money out Crypto by December to make sure full income.

Nevertheless, as Beincrypto beforehand reported, some specialists consider that the Bitcoin cycle is “lifeless.” Forecast threat is now harder as potential institutional panics may redefine future bear markets.

Postalists will reveal when the present Bitcoin cycle will peak in Bainterput.