Vitalik Buterin, co-founder of Ethereum, not too long ago highlighted each potential advantages and dangers, and shared his views on the Treasury’s position in ecosystems.

In an interview with the Bankles Podcast, Butalin jokingly known as the US authorities his favourite “finance firm,” noting his appreciation for the period when authorities confiscated stolen Ethereum.

Professionals and Cons of the Ministry of Finance

Ethereum’s Treasury Division contains firms that allocate a portion of their company reserves to ether (ETH), giving buyers an oblique publicity to cryptocurrency.

Buterin acknowledged the advantages of this observe and mentioned it provides another for finance firms to entry ETH. “It is also good to have completely different autos to make folks have entry to ETH,” he defined, including that the Ethereum ecosystem will finally be strengthened.

On the similar time, butarine warned towards the chance of over-leverage. “If I get up three years from now and say that the Treasury has led to the downfall of ETH, then… mainly, my guess as to whether or not they’ll someway flip right into a recreation of over-leverage,” he warned.

Regardless of issues, he expressed confidence in Ethereum group and establishment members, describing them as “accountable folks” who’re unlikely to permit the Treasury to destabilise the community.

Ethereum ETF hits data

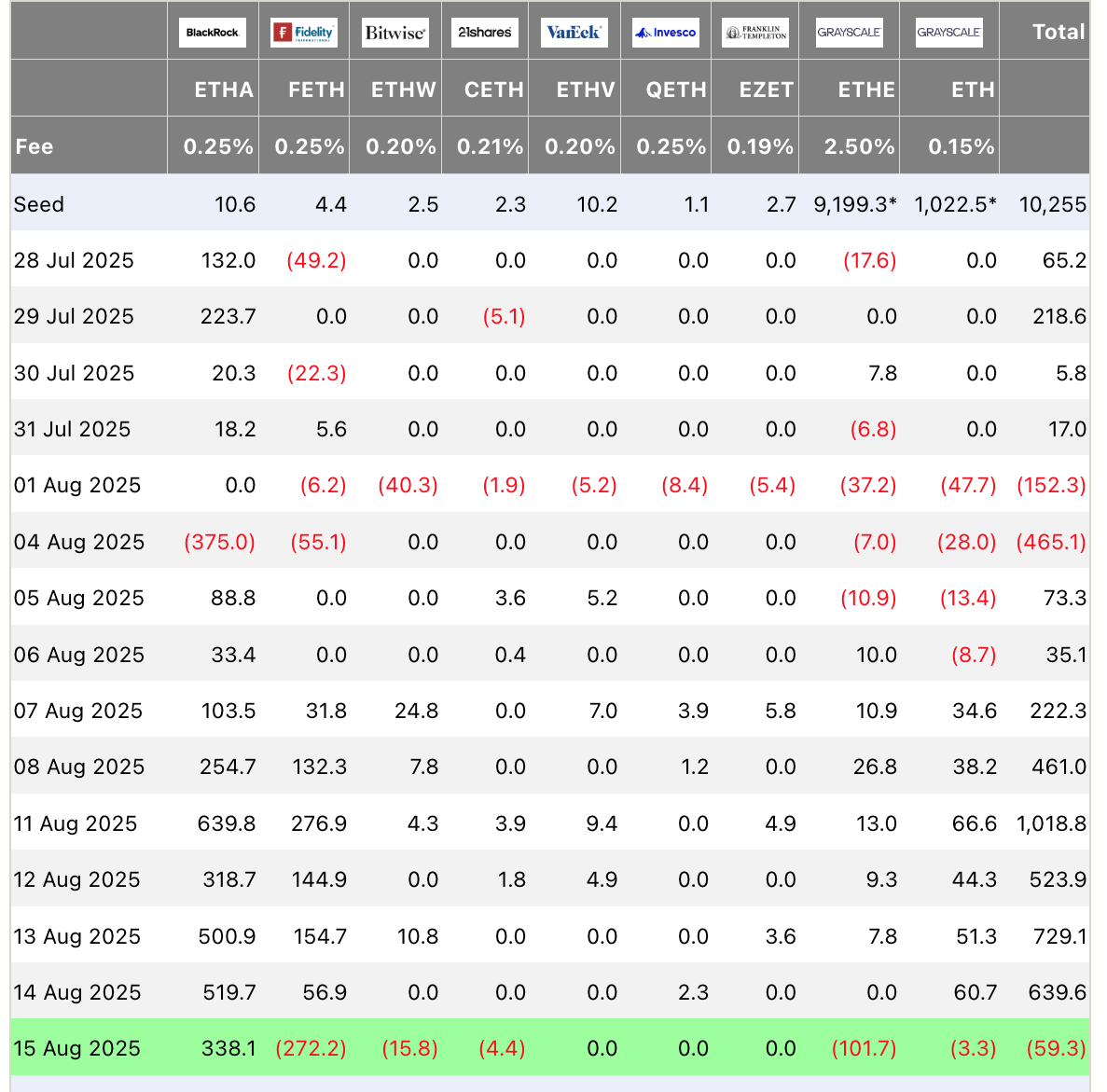

In the meantime, Ethereum ETFs are seeing unprecedented demand. This week alone, web inflows reached a report $2.85 billion, with buying and selling volumes rising sharply above $17 billion.

Spot Bitcoin + Ether Etfs gained a quantity of about $400 billion this week. It corresponds to an enormous quantity, high 5 ETFs or high 10 inventory volumes. pic.twitter.com/z89uv63a3w

– Eric Balchunas (@ericbalchunas) August 15, 2025

On Monday, Spot Ethereum ETFS recorded its largest day by day web influx to this point, totaling $1.01 billion. Over the primary two weeks of August, they’ve seen an inflow of over $3 billion.

BlackRock’s Ishares Ethereum ETF led the charges with an influx of $519 million on August 14th. In the meantime, all funds ended with a small web movement of $59 million.

On the finish of July, asset managers had already collected $11.4 billion price of Ethereum inside weeks, displaying robust perception in ETH regardless of market volatility.