TL; PhD

- The Bitcoin chart exhibits that reverse head and shoulder patterns have been confirmed, holding a breakout retest of practically $115,000.

- Future Sentiment Index reverses optimistic after 5 bearish days, easing short-term stress on the Bitcoin market.

- Costs might be built-in between $112,000 and $124,000, however the technical sample suggests one other upward breakout vary.

Double backside construction throughout regeneration

In keeping with Zyn, Bitcoin printed one other double backside sample. The same setup was adopted by a pointy gathering earlier this 12 months.

In April, BTC rose greater than 50%, exceeding $125,000 from round $86,000. The second sample in June brought on a 25% enhance, elevating costs from practically $100,000 to $125,000.

$BTC double backside printed.

April: +50% pump.

June: +25% rally.Even half of that transfer noticed Bitcoin go above $127,000 earlier than Q3 ended.

This isn’t a chart sample, it’s a launchpad. pic.twitter.com/romgmryhydr

-Zyn (@Zynweb3) August 22, 2025

The most recent construction is shaped practically $112,000, particularly as BTC has bounced over $117,000 since slipping into that stage Friday. Up to now, asset value measures have been held throughout the vary of $112,000 to $124,000. Integration After a latest swing.

Reverse head and shoulder formation

Charts shared by dealer Merlijn present Bitcoin completes the reversed head and shoulders. The left shoulder shaped to the fitting in December 2024, with the top practically $70,000 in April 2025 and in June 2025.

The upward tilted neckline has damaged practically $113,000 and is being retested. Holding above this zone is marked as a breakout affirmation. Primarily based on the size of the setup, if momentum continues, the sample refers to a better stage.

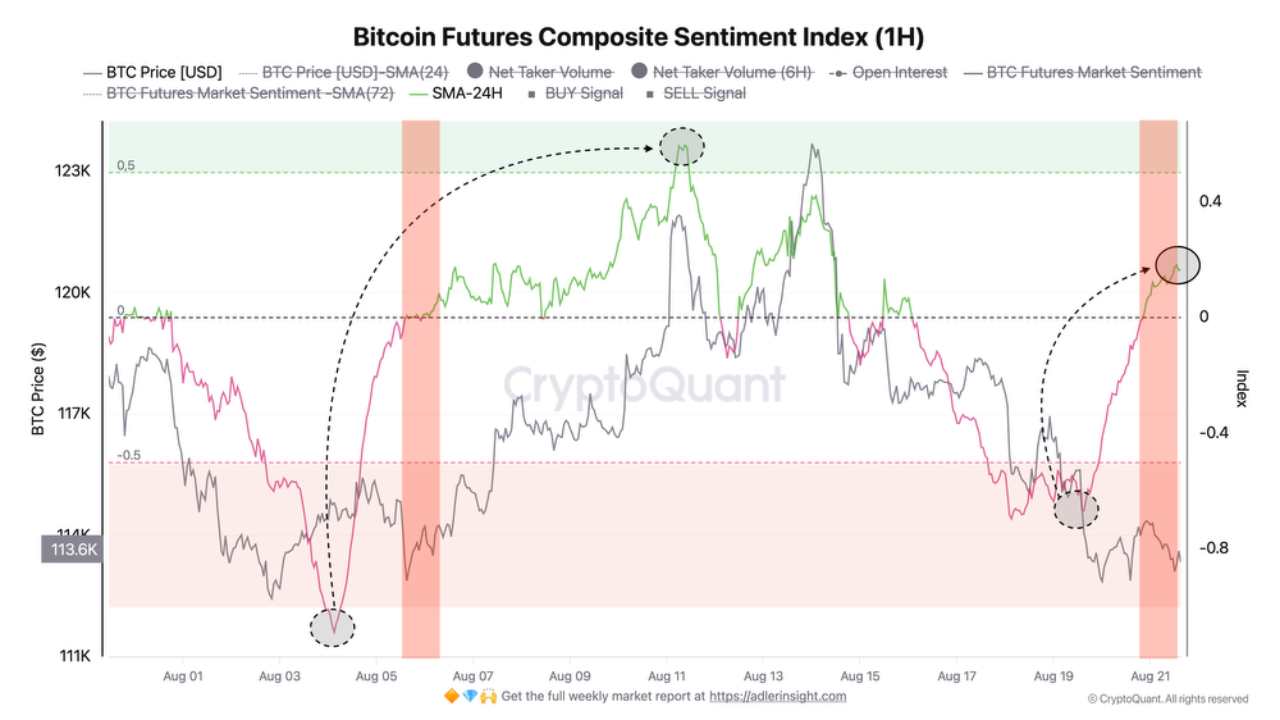

Futures market sentiment is optimistic

Information from cryptographic analyst DarkFost exhibits that BTC futures sentiment has returned to optimistic territory after a 5-day unfavourable measurement. The sentiment index combines internet taker circulate, open curiosity and lengthy/brief quantities to replicate short-term positioning within the derivatives market.

In early August, sentiment adopted an analogous path when the ratio fell under -1 earlier than recovering to the optimistic area. That shift coincided with value rebounds. That is the present bounce from -0.7 sign, which eased bear stress in latest classes.