Ethereum at this time prices round $4,355, somewhat decrease than after the tough development in August between $4,200 in help and $4,800 in resistance. The market is rising throughout the channel, with merchants splitting on whether or not the subsequent large transfer is a breakout or a correction.

Latest knowledge reveals how weak the stability is. The whale stream reveals that internet spills have been $12.8 million on August 30, with a lot gross sales strain nonetheless underway, and leveraged positions at almost $4,200 are additionally prone to liquidation. On the similar time, ETF inflows of $27.6 billion and extra institutional staking point out there’s structural demand.

This battle between short-term volatility and long-term resilience defines the outlook for September. Ethereum’s subsequent transfer will rely on whether or not the Bulls are in a position to defend key help or whether or not sellers can drive deeper retracements.

Ethereum Worth retains channel help because the indicator tightens

ETH Worth Dynamics (Supply: TradingView)

Ethereum worth motion stays throughout the uptrends since July. Help is tiered at round $4,200, and resistance capping is near $4,800. The midpoint of the roughly $4,500 channel served as a pivot zone with repeated momentum shifts.

ETH Worth Dynamics (Supply: TradingView)

On the day by day chart, the parabolic SAR is near $4,957, which boosts the overhead of the resistance cluster. In the meantime, the 20-day EMA, near $4,420, and the 50-day EMA, round $4,200, supply a short-term demand zone. A break under $4,200 exposes an space between $3,800 and $3,600 the place the historic liquidity zones align.

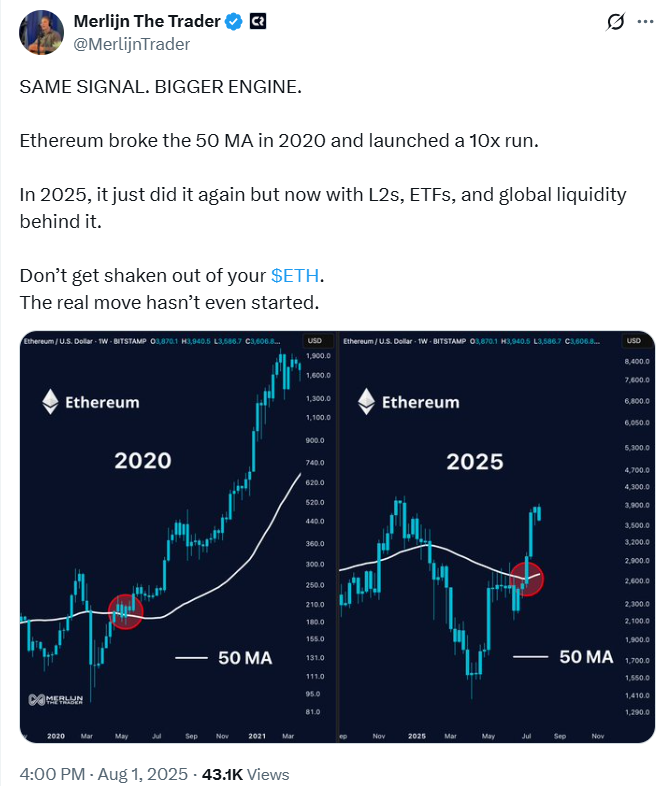

Momentum indicators recommend warning. The four-hour chart reveals the bollinger band narrower, pointing to the upcoming growth of volatility. The RSI approaches impartial ranges, however the MACD flattens after signaling fatigue from the August rally. X’s analysts noticed similarities to the 2021 breakout sample, explaining dealer Merlijn as “a retest the place legends purchase, and a breakout the place destiny is made.”

Ethereum repeats historical past

2021 confirmed a sample.

2025 reveals us alternatives.Retest is the place legends purchase it.

A breakout is the place property is created. $eth will not be full. I’ve simply began. pic.twitter.com/81tvrnlp70-Merlin The Dealer (@merlijntrader) August 29, 2025

Whale exercise and ETF movement drive inconsistent alerts

Ethereum’s fluidity dynamics have turn out to be more and more sophisticated. Whale conduct amplifies volatility, with some entities actively accumulating whereas others perform fast gross sales. Within the third quarter, whales pushed over 9% since October 2024, however the latest spill highlights vulnerability. A $37 million sale of single whales in August triggered a ten% keep.

ETH Spot Influx/Outflow (Supply: Coinglass)

Spot trade knowledge strengthens the hole. On August thirtieth, ETH recorded a internet spill of $12.8 million. On the similar time, institutional staking added structural demand. Presently, nearly 30% of Ethereum’s provide is piled down, with a $17.6 billion company allocation following a transparent act.

The inflow of ETFs additionally emphasised adoption. The info reveals a internet influx of $27.6 billion into Ethereum merchandise this 12 months, supporting the narrative of institutional acceptance. These influxes present resilience to whale-driven volatility, however threat stays rising given the lengthy, $2 billion-taking positions approaching the liquidation threshold.

The Bulls goal $4,800, whereas the Bears warn a couple of breakdown of $4,000

The market is polarised between bullish and bearish tales. The Bulls declare that structural power has been confirmed when Ethereum consolidation exceeds $4,200. With TVL exceeding $200 billion and improved regulatory readability, we take into account $4,800 as our subsequent goal. A breakout above this degree may cause momentum to $5,200, probably $6,000 per 12 months finish.

The Bears counter that Ethereum worth volatility stays tied to leverage and whale flows. If ETH falls under $4,200, it highlights a weak $2 billion open lengthy place. That degree of violation triggered a cascade liquidation, just like a $3 billion wipeout earlier this month, bringing the worth again to $3,600. The unfavorable threat can’t be dismissed because the Bollinger band is tightened and Netflows is unfavorable.

This pressure leaves Ethereum merchants within the holding sample, and each situations are believable in response to the subsequent liquidity shock.

Ethereum Brief-Time period Outlook: Breakouts or Breakdowns?

Ethereum’s worth forecast heading into September will depend on whether or not patrons can recuperate momentum to greater than $4,450. A closure above this degree will bias in direction of a $4,800 retest, with a possible extension of $5,200.

Conversely, if you cannot maintain $4,200, you will be uncovered to deeper help at $3,800 and $3,600. The presence of heavy leverage under $4,200 amplifies the chance of sharp flashes if gross sales are enhanced.

For now, Ethereum worth updates point out a market in equilibrium, with structural influx offset by fragile liquidity situations. Merchants will use intently positioned positioning to look at whales’ actions and measure their subsequent essential motion.

Ethereum Prediction Desk

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version will not be answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.