Ethereum costs have fallen greater than 5% as we speak, buying and selling round $4,300. This marks one of many sharpest each day declines in weeks. Nevertheless, month-to-month earnings remained at over 13%, indicating that the broader upward pattern has not damaged.

The query now’s whether or not autumn as we speak is merely a noise or is it the start of one thing deeper? On-chain and technical alerts counsel that DIP is not going to final lengthy, decreasing revenue bookings and whales intervening.

Income will probably be eased as whales add $1 billion in ETH

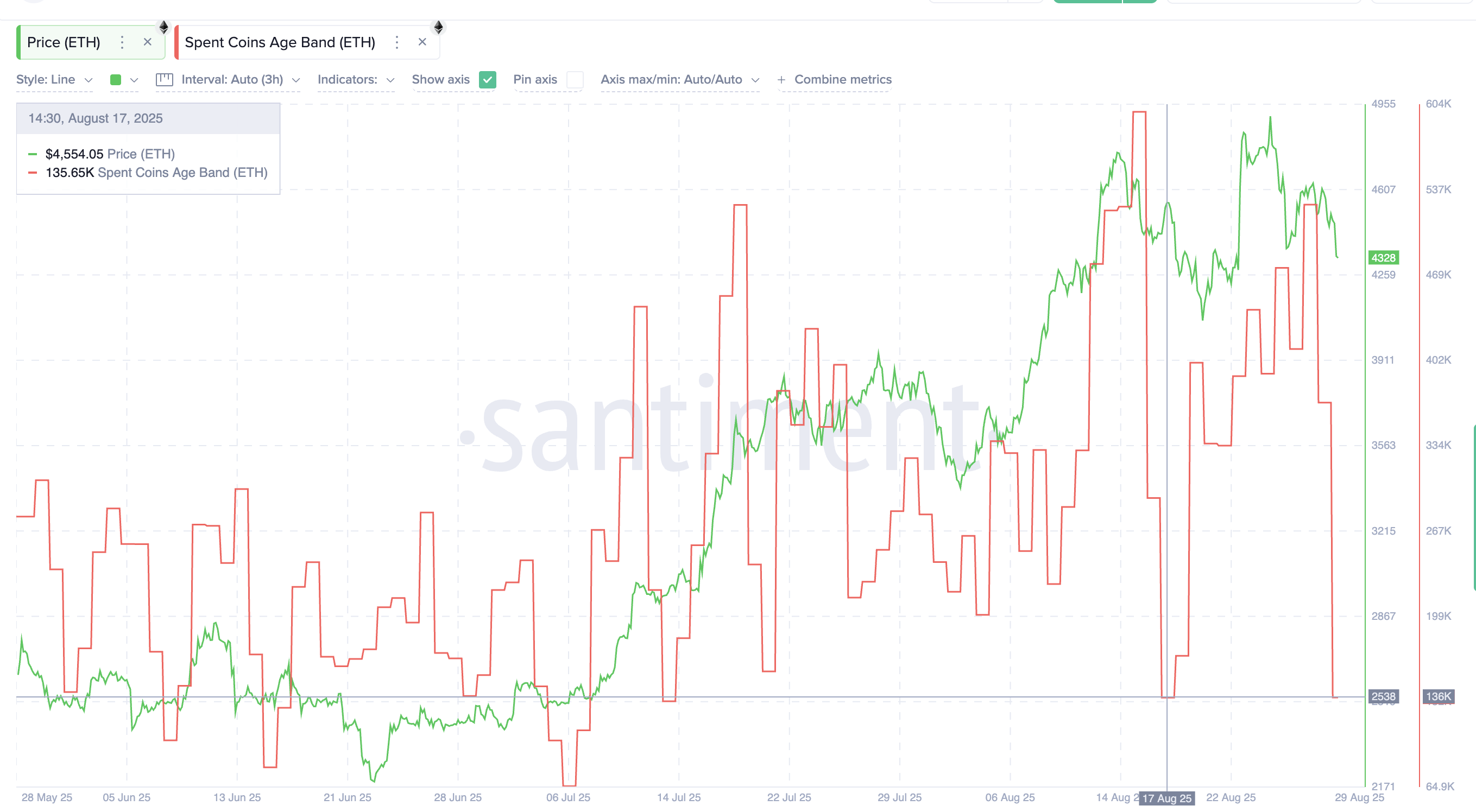

The used coin age bands monitoring when lengthy cash are on sale have fallen over a month of round 135,000 ETH. Because of this long run holders are promoting much less. Income eased sharply in comparison with the start of August when the metric was above 525,000 ETH. That is a 74% drop.

Ethereum advantages are eased: santiment

Historical past reveals that when this metric reaches the underside, Ethereum typically bounces again. for instance:

- On July seventh, spent cash fell to 64,900 ETH, with Ethereum costs rising from round $2,530 to $3,862. It is a 52% leap.

- On August seventeenth, the identical sample led to a 20% transfer as ETH rose from $4,074 to $4,888.

Now, the most recent drop to native lows might as soon as once more counsel that the wave of gross sales is waning.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s each day crypto e-newsletter.

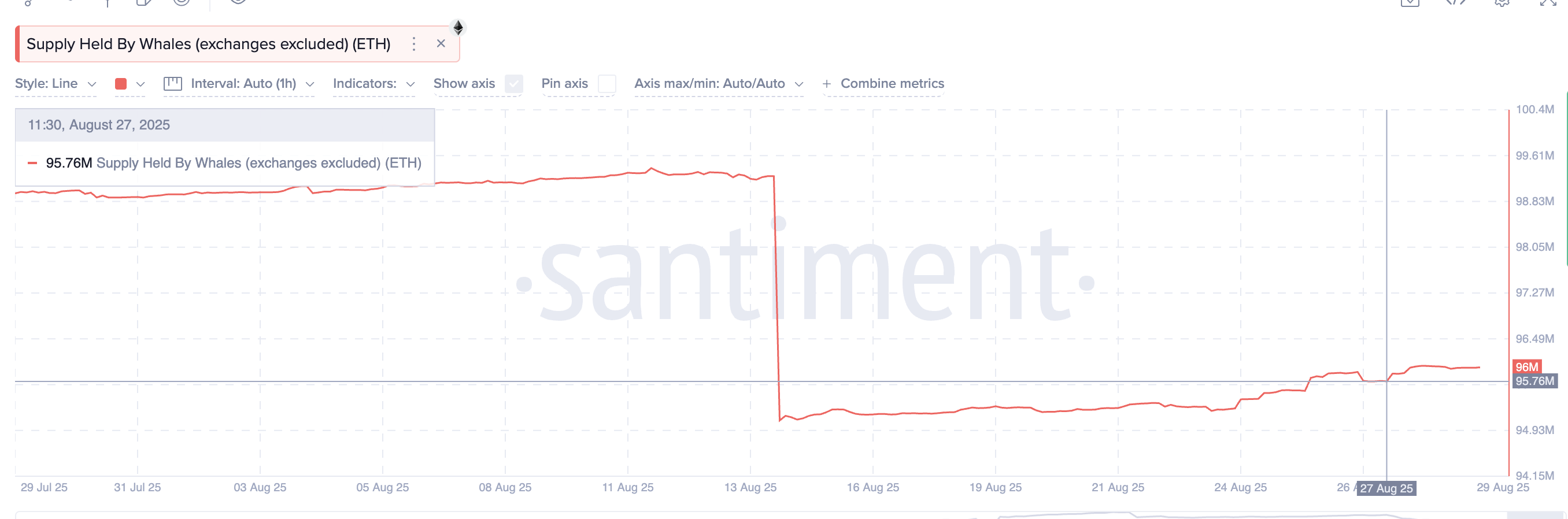

Moreover, the whales are quietly shopping for dip. The addresses holding over 10,000 ETHs are hidden from 9,576 million ETHs on August twenty seventh at round 96 million ETHs as we speak.

Ethereum whales are accumulating: santiment

At present costs, the whales have added round $1 billion price of ETH in simply two days. Collectively, mitigating revenue reserving and recent whale accumulation will increase the following leg base to Ethereum.

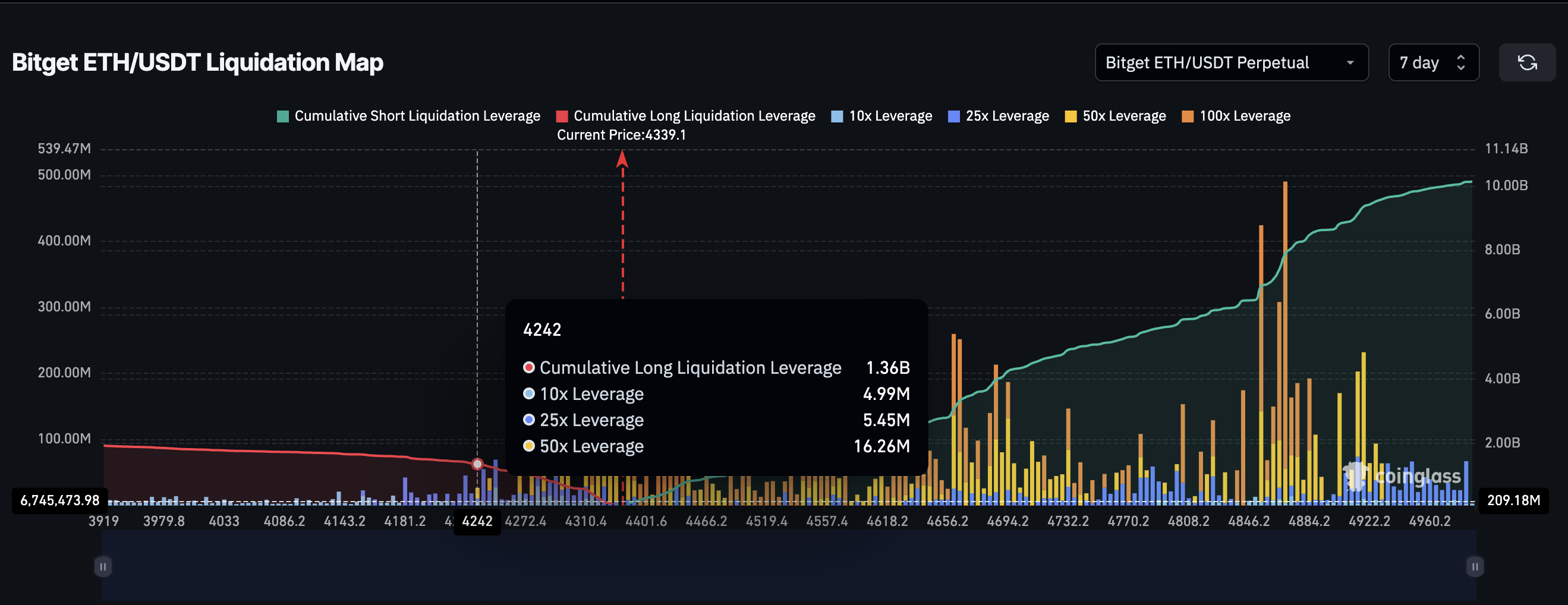

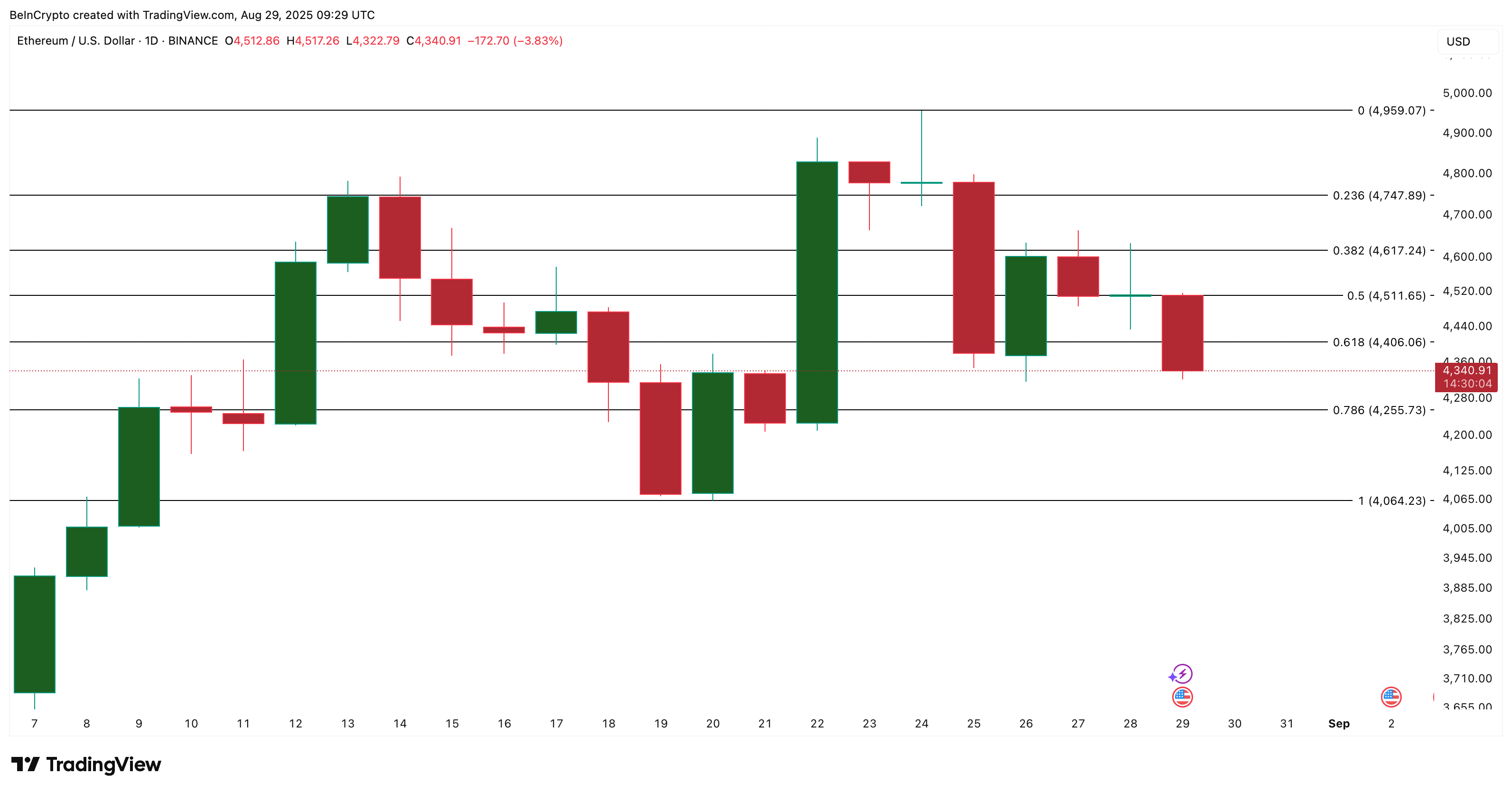

Ethereum worth motion and liquidation maps are organized at key ranges

Past the on-chain sign, the chart additionally matches the uptrend view. Within the Bitget Clearing Heatmap, quick place stacking begins at $4,400, with ranges changing into a pivot the place the extent is vital.

If ETH manages each day candles above $4,406, it might trigger liquidation of those shorts and drive merchants to boost the value of Ethereum and push them for the next push.

The liquidation mapping reveals the place the merchants positioned heavy leverage positions (longs and shorts) and the place price-level liquidation happens.

Ethereum liquidation map: Coinglass

On the draw back, quick assist is round $4,255, in line with the $4,242 stage on the liquidation map. That is the extent at which essentially the most utilized lengthy positions are settled.

So if Ethereum costs are held at $4,255, a dip reversal might happen as leveraged draw back threat weakens.

If the ETH worth is damaged under that, the following key stage is $4,064. Dips beneath this stage can flip traits the wrong way up within the quick time period.

Ethereum Worth Evaluation: TradingView

The alignment between the liquidation cluster and the value chart stage will increase reliability in these zones. That implies that merchants are all wanting on the identical quantity, making the response at these factors even stronger.

For now, the trail is obvious. It is going to regain $4,406 over $4,255, strengthening the reversal case. Failing at these ranges, there’s a threat that Ethereum costs will increase its penetration.

Publish Ethereum Dip could possibly be momentary and it was gradual to purchase a billion greenback whale and scale back earnings first with Beincrypto.