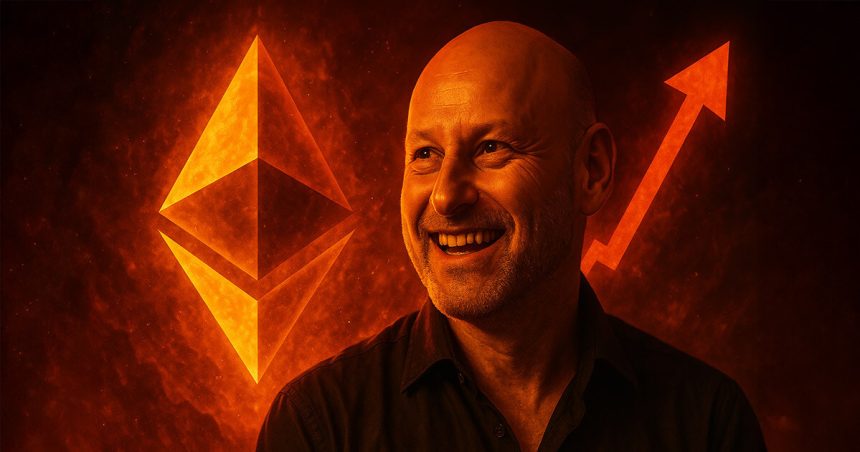

Joseph Lubin, co-founder and consensy CEO of Ethereum, gave Eth Bulls one thing to chew. In a put up on X, he praised Fundstrat’s Tom Lee for his imaginative and prescient for the way forward for funds and the function of Ethereum’s enlargement in conventional establishments.

“Sure, ETH will most likely be 100 instances extra from right here. Most likely extra.”

Joseph Rubin agrees. Wall Road bets on Ethereum

As a pioneer in blockchain, Josefulvin is finest often known as the co-founder of Ethereum and the founder and CEO of Consensys, the most important web3 software program studio. Utilizing his deep monetary roots as former Vice President of Goldman Sachs, Rubin has helped him develop Ethereum since 2014 as an excellent platform for decentralized finance and sensible contracts.

In response to Tom Lee’s bullish outlook, Rubin is forecasting earthquake modifications in world finance. The Wall Road large instantly runs validators, manipulates L2 and L3, writes sensible contracts, and strikes enterprise infrastructure to Ethereum Rail.

For instance, JPMorgan has been utilizing Ethereum-based expertise for permitted blockchain tasks for almost a decade, with an rising variety of main banks launching Stablecoin and Defi initiatives at Goldman Sachs, Onyx and Ethereum.

Since June 2025, finance corporations together with Bitmine Immersion and Sharplink Gaming have added 2.6% of all ETH to their reserves.

Mixed with the inflow of recent ETH ETFs, institutional patrons account for nearly 5% of Ethereum provide up to now this 12 months. Sharplink and Bitmine at present have greater than $6 billion in ETH and are setting business benchmarks for firm recruitment.

Additionally, with approval from a number of Ethereum ETFs, asset managers like BlackRock and Vaneck have invested billions of their clients in ETH and marked them as the important thing digital belongings to introduce a tipping level in hiring.

Why Ethereum? “Decentralized Belief”

Vanek’s CEO is not too long ago referred to as the Ethereum “Wall Road Token,” and Rubin argues that Ethereum’s potential for transformation stems from “decentralized belief.”

As legacy businesses transfer from fragmented, siloed infrastructure to unified distributed rails, staking es turns into each technical and financial orders.

“Nobody on the planet can guess how huge and quick, precisely a distributed financial system saturated with hybrid heu machine intelligence that runs on decentralized Ethereum trustware.”

In his view, L2 and L3 not solely drive extra use of the Ethereum base layer, but additionally “ETH is prone to be 100 instances extra from right here”, and in the end “flip the Bitcoin/BTC foreign money base.”

September is the hardest month in Ethereum

Ethereum’s burgeoning momentum will not come with out highway bumps. September has traditionally been the hardest month in Ethereum, with a median return of -6.42% since 2016.

The mix of meteor summer time gatherings (up 76% because the begin of the 12 months, virtually 25% in August) and seasonal developments might doubtlessly be pulled again within the coming months, notably in macro sentiment, financial coverage, and revenue acquisition, to weigh costs.

Nonetheless, the fundamentals of bullishness stay. Web ETH inflows from establishments, secure rise in company finance holdings, rising yields from staking (~3% APY), and ongoing upgrades all supply stronger long-term outlook, as Rubin stated.

“The one odd factor I’ve about what Tom is saying is that I hold telling him this. He is barely bullish.”