Ethereum’s derivatives market is rising in exercise as open curiosity rises throughout the longer term and choices.

With August over, Ethereum open curiosity and non-compulsory actions will hit new highs

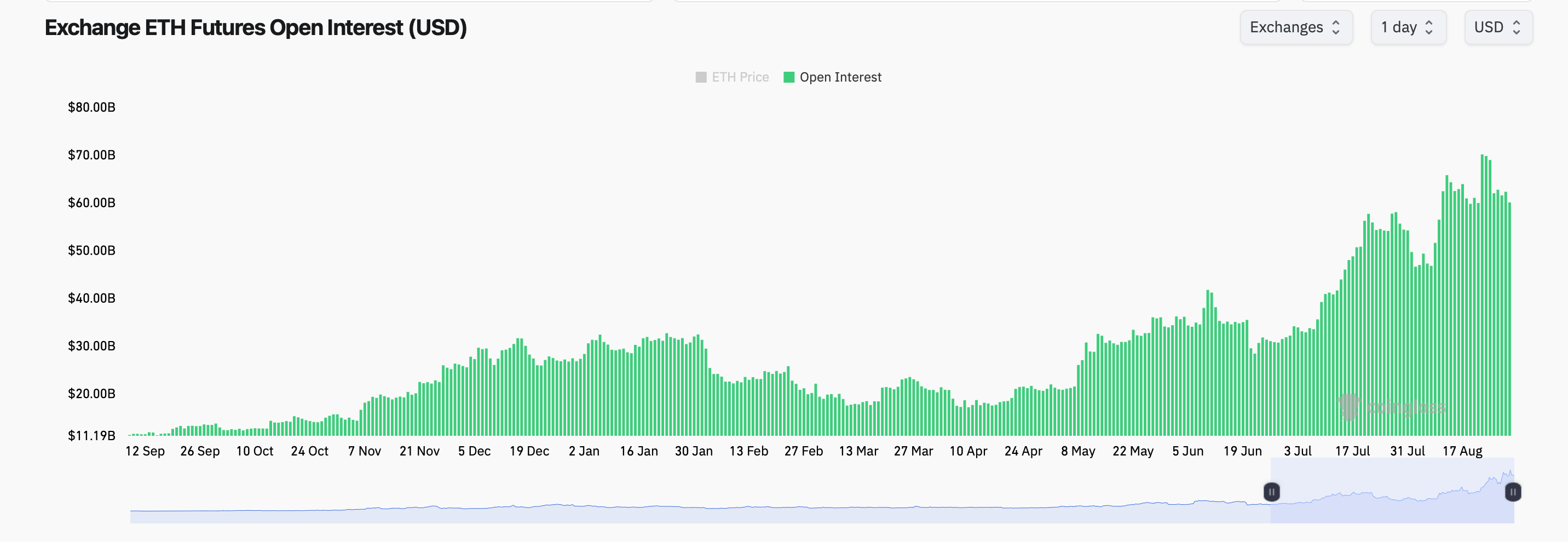

Ethereum Futures Open Curiosity has expanded sharply in current weeks, rising to greater than $60 billion throughout the trade. This exhibits a pointy improve from the early summer season stage of almost $30 billion, suggesting that merchants have constructed a quickly exploited place.

In keeping with statistics from Coinglass.com, ETH futures have an interest on August 29, 2025.

CME, Binance and Bybit stay dominant venues, with CME reporting 2.12 million ETH on open contracts and 272 million Ethereum main Binance. Progress in futures positions signifies that merchants are more and more positioned for directional bets, whereas the distribution of the general exchanges signifies fluctuations in emotion and publicity.

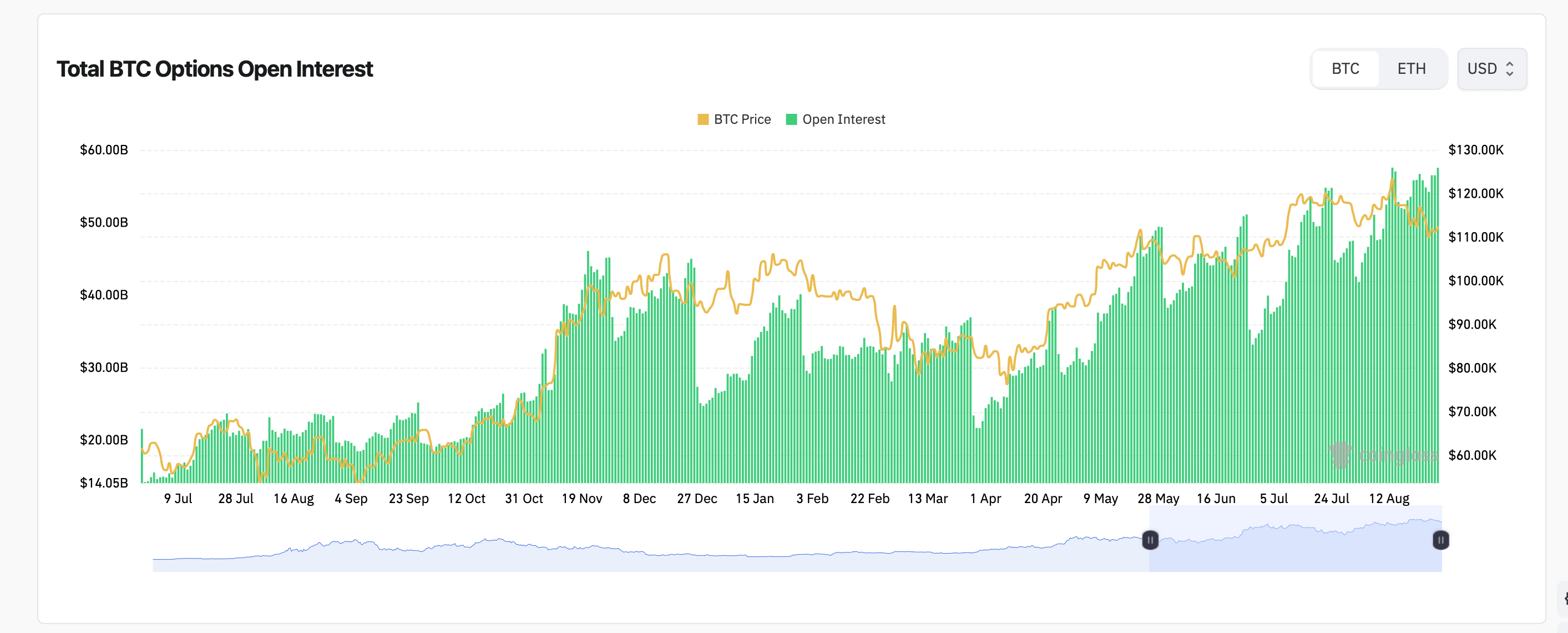

Choice actions are additionally sizzling, with Delibit dominating the market. The December 2025 name has the most important open curiosity, with the $6,000 strike holding 86,431 ETH on the contract. An extra focus cluster of $4,000, $5,000 and $7,000 strikes of round $4,000 and $7,000.

ETH Choices In keeping with Coinglass.com Statss, there may be an curiosity on August twenty ninth, 2025.

The broader choices market exhibits exceptional skew. The decision represents 66.06% of open curiosity with 2.29 million ETH in comparison with Places’ 1.17 million ETH. This positioning displays bullish slopes, however current volumes present a extra sophisticated story. Over the previous 24 hours, name accounted for 51.32% of the deal, whereas Places took 48.68%.

Over the previous week, Skews has shifted rapidly, reflecting modifications in dealer sentiment as Ethereum spot costs examined at a $4,288 stage from the $4,900 vary. It is very important be aware that choices sellers are actively hedging with places whereas short-term merchants preserve lengthy publicity over lengthy durations of calls.

Ethereum additionally leads the market in liquidation. Over $190 million in ETH positions have been liquidated within the final 24 hours, the best of all cryptocurrencies. Longs managed these liquidation at $169 million, in comparison with $21.8 million from shorts throughout the ether market.

This wave of pressured rewinding highlights the speedy modifications by way of the derivatives market. Mixed with the sharp actions of ETH, excessive leverage mixed has led many uncovered merchants to get caught up within the unsuitable aspect of volatility. Merchants like these are shipwrecked.

At Change Entrance, CME open curiosity accounts for round 15% of the ETH futures market, whereas Binance leads by nearly 20%. Different notable venues embody BYBIT, which has 1.19 million ETHs, and OKX of 854,890 ETHs. This distribution highlights the rising function of each regulatory and offshore venues in ETH spinoff buying and selling.

Ethereum’s derivatives market is operating sizzling, with the longer term and choices increasing to ranges and liquidation indicating the dangers related to level-level positioning. With choices skew spinning and heavy calls stacked up in late 2025, the market seems poised for the uptick in volatility sooner or later.