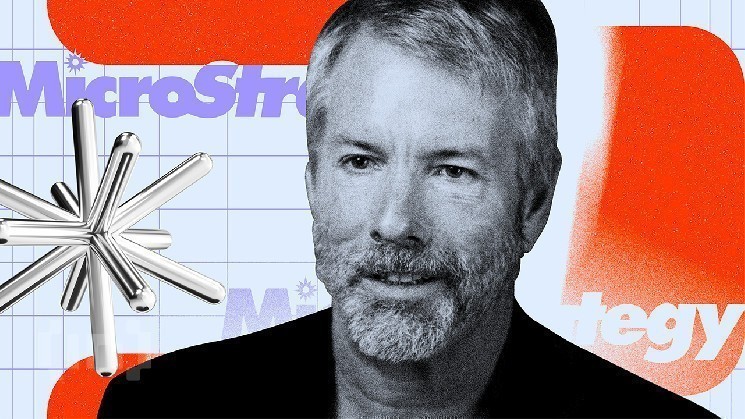

MicroStrategy CEO Michael Saylor has as soon as once more identified further Bitcoin purchases and is bolstering the corporate’s aggressive monetary technique.

On August thirty first, Saylor posted a chart from the unbiased “Saylor Tracker” platform.

Saylor suggests shopping for new bitcoin

The picture confirmed a cluster of orange dots representing the corporate’s buy historical past, accompanied by the remark “Bitcoin remains to be on sale.”

Bitcoin remains to be on sale. pic.twitter.com/rxp6g84rbs

– Michael Saylor (@saylor) August 31, 2025

This kind of put up has traditionally preceded the announcement of purchases up to now.

Observers notice that the corporate has submitted new Bitcoin buy disclosures each Monday up to now three weeks, suggesting that the sample may final via September.

Final week, the technique revealed that 3,081 BTC was added at a value of $356.87 million, paying a mean of $115,829 per coin. The acquisition raised the whole stash to 632,457 BTC, amounting to an estimated $68.6 billion.

The technique depends closely on the inventory market to fund purchases. Up to now, in 2025, the corporate raised $5.6 billion in IPOs, accounting for round 12% of all US listings.

Strategic IPO actions for 2025. Supply: Technique

In the meantime, this aggressive funding has not considerably affected the corporate’s inventory efficiency.

In keeping with the technique, its MSTR shares are constantly outperforming the so-called seven grand tech shares year-over-year.

The lawsuit has been eliminated

Saylor’s remarks coincided with the withdrawal of a category motion lawsuit, which had been held since Might.

Digital asset holdings may be marked quarterly at market costs, as buyers claimed that the technique misinterpreted shareholders by exaggerating the advantages of adopting honest worth accounting.

Bloomberg reported that the plaintiffs dismissed the case “on account of bias,” which prevents them from bringing the identical declare once more.

That call may take away a serious overhang for the corporate and set a helpful precedent for different corporations that maintain Bitcoin as a steadiness sheet reserve.

Moreover, by signaling Bitcoin accumulation and guaranteeing authorized cures, the technique strengthened its double strategy of leveraging capital markets and doubling the monetary mannequin as Bitcoin.

Michael Saylor is signaling new Bitcoin purchases as a micro technique is secured.