GlassNode information can imply that Etherrium value epidemiology is extra affected by derivatives and different off chain markets than Bitcoin.

CBD information reveals the discharge of the spot exercise of Bitcoin & Ethereum.

Within the new put up of X, GlassNode, an on-chain analytics firm, not too long ago talked about how the associated fee customary distribution (CBD) between Bitcoin and Ethereum branched.

CBD signifies an indicator of the quantity of an asset given a given worth or investor at every value degree visited by the worth degree visited by the password.

This metrics are helpful as a result of buyers are likely to make a particular emphasis on the breakthrough degree and have some form of motion when a re -test happens. The upper the quantity of belongings bought at a particular degree, the stronger the response to the re -test.

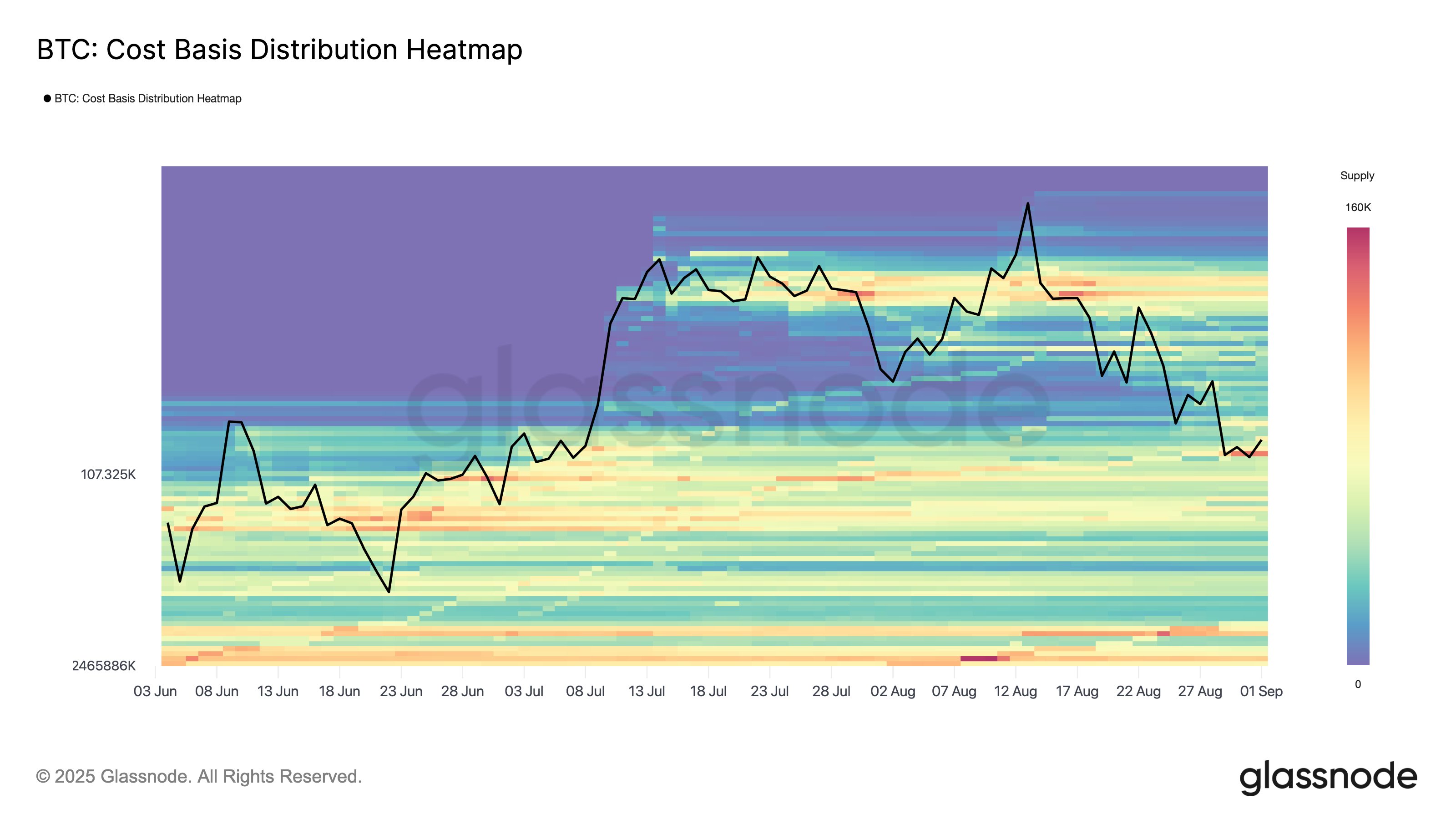

First, there’s a chart that reveals Bitcoin’s CBD development over the previous few months.

Seems to be like BTC is at present retesting a significant demand zone | Supply: Glassnode on X

As proven within the graph above, Bitcoin CBD gained an enormous “air hole” when Bitcoin noticed an explosive rally in July. As a result of the BTC was too quick to purchase and promote the worth, the coin couldn’t be acquired primarily based on the associated fee.

After the rally cooling, the BTC started to be stuffed with provide. The identical was true on the newest decline, and now the earlier air hole has disappeared. This reveals that the demand for spot transactions has been maintained for cryptocurrency.

Bitcoin has seen this development, however CBD acted in a different way within the second largest asset in Ether Leeum.

How the CBD has modified for ETH over the previous few months | Supply: Glassnode on X

On this chart, Ether Lee’s rally additionally made an air hole, however not like Bitcoin, it was not stuffed with any degree as a notable degree because of the slowing stage. GlassNode stated, “This means that ETH value epidemiology will be extra affected by the off chain market, resembling derivatives.

Traditionally, value conduct primarily based on merchandise resembling derivatives has usually been confirmed to be extra risky. Provided that Ether Lee doesn’t observe a excessive -level spot buy, you’ll be able to see what the destiny of bull run is.

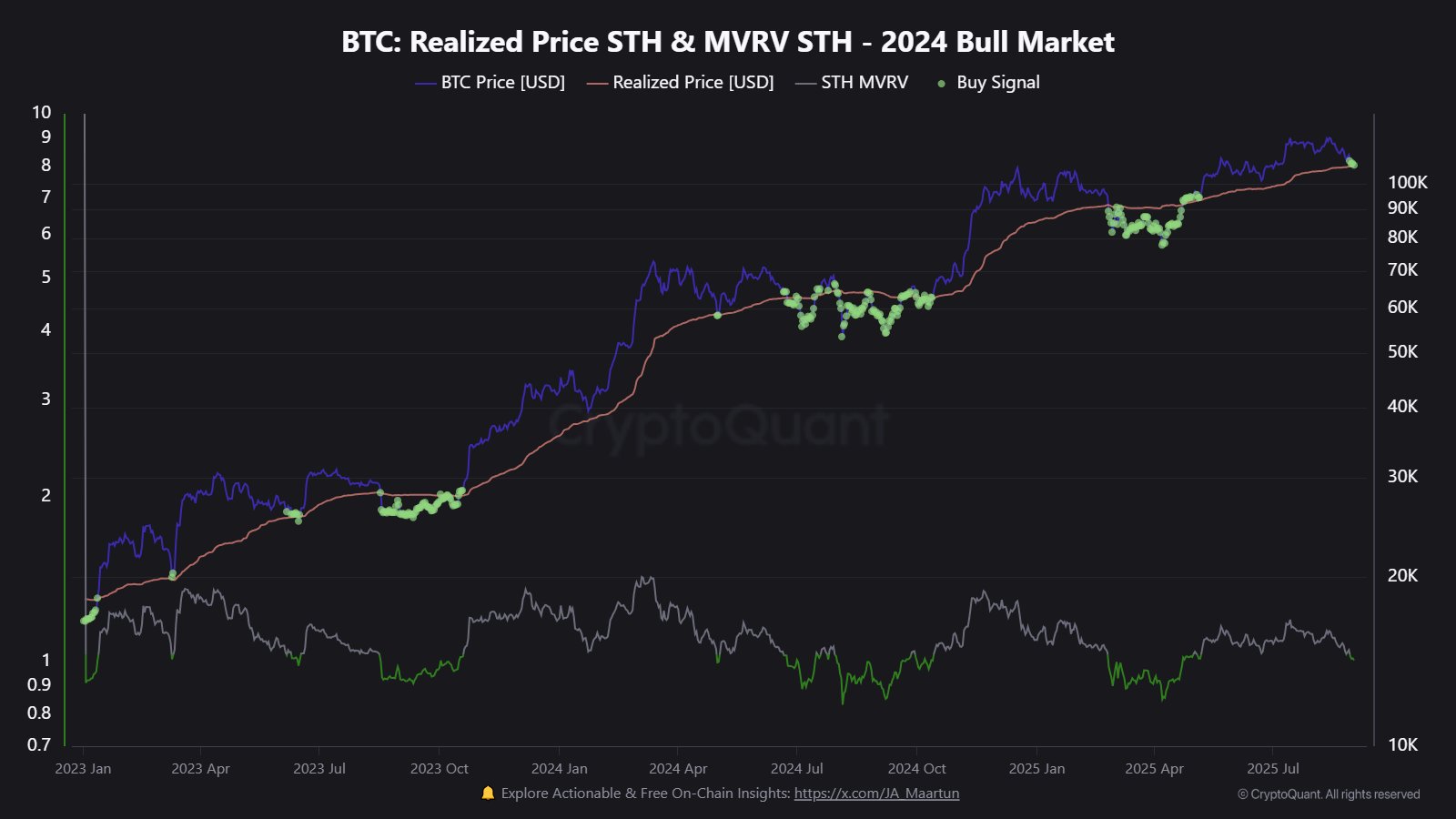

In different information, Bitcoin is buying and selling close to the extent of vital sizzling chain prices after the latest drop within the value, because the encryption writer Maartunn identified within the X Submit.

The development within the Realized Worth of the BTC short-term holders | Supply: @JA_Maartun on X

This degree is the typical value of brief -term holders who’ve bought Bitcoin for the final 155 days. Up to now, brief -term shifts occurred after shedding the extent.

ETH value

Ether Lee has not too long ago declined as the worth fell to $ 4,270 with a full again of 6percentper share.

The worth of the coin seems to have gone down not too long ago | Supply: ETHUSDT on TradingView

Dall-E, Cryptoquant.com, GlassNode.com, TradingView.com