This week’s Bitcoin (BTC) quick bounce was operating out of fuel on Thursday, bringing costs under $110,000, with some market watchers warning of a deeper pullback.

The most important cryptocurrency fell 2.2% in 24 hours to $109,500, over $112,600 on Wednesday, eliminating half of its earnings from its weekend’s minimal of $107,000. Ether (ETH), Solana’s Sol (SOL) and Cardano’s ADA (ADA) all have dropped by greater than 3% up to now 24 hours.

The Ministry of Digital Belongings Treasury additionally suffered bleeding. The biggest Company BTC Proprietor Technique (MSTR) fell 3.2%, down 30% since July. Japan-based Metaplanet (3355) misplaced 7%, buying and selling 60% decrease than its June excessive, and KindlyMD (NAKA) slipped one other 9%, down 75% since mid-August. Ether-centric automobiles Bitmine (BMNR) and Sharplink Gaming (SBET) fell by 8%-9%.

How low is BTC attainable?

The priority about additional downsides has grown, with some observers stating that it has traditionally been one in all Bitcoin and the weakest month within the crypto market.

On the similar time, Gold, a standard secure haven and inflation hedge, broke out right into a contemporary file of over $3,500 following a number of integrations, showing to be inhaling capital from high-risk performs.

A brand new Bitfinex report famous that BTC entered a 3rd consecutive week of retracement, ranging from August’s all-time excessive of $123,640. Traditionally, the Bull Market revision averaged from a peak of about 17% to trauf, suggesting that the market is approaching the standard limits of drawdowns, the report says.

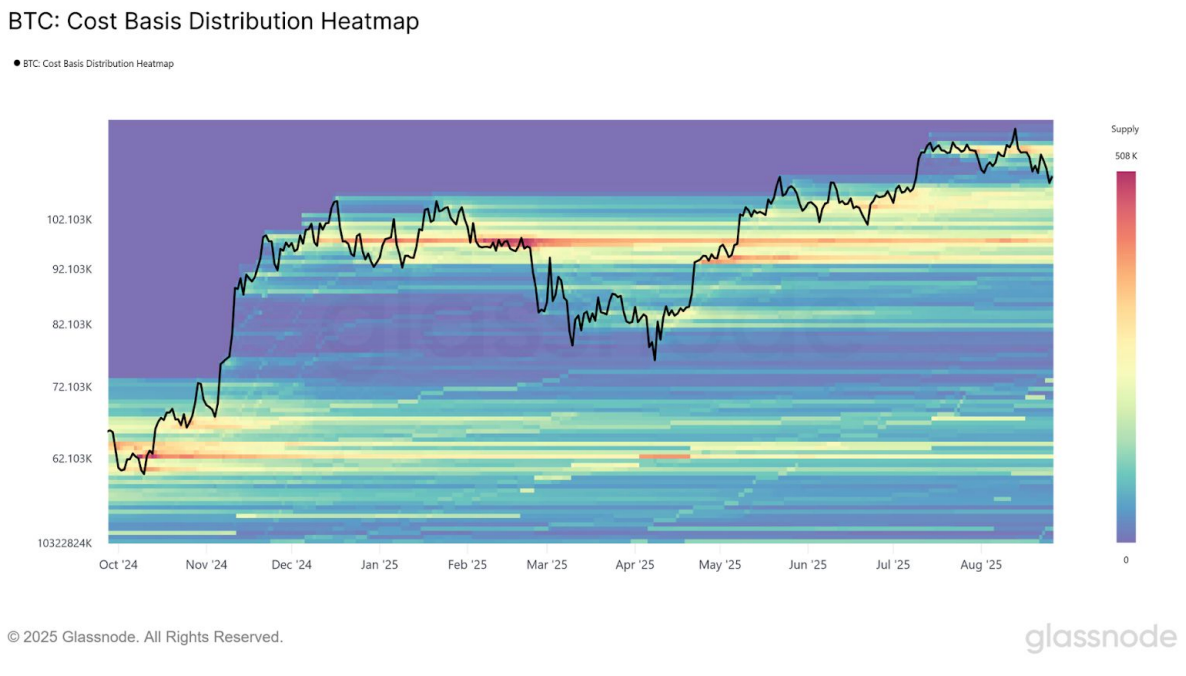

Nevertheless, analysts warned him. Brief-term holders have realized the worth, a measure of the price foundation for brand new traders shopping for BTC, and at the moment are near $108,900, lower than 1% of BTC’s present value. If that degree fails as help, it may pave the way in which for deeper retracement, with dense provide clusters starting from $93,000 to $95,000 probably to offer sturdy flooring, the report says.

BTC Provide Cluster $93K-$95K (Bitfinex/GlassNode)

Joel Kruger, market strategist at LMAX Group, stays extra optimistic.

September is often a one-month consolidation forward of fourth-quarter efficiency enhancements, including that this yr’s revisions might be shallow if ETF inflows, Company Treasury allocations and regulatory tailwinds are realized.

Learn extra: Bitcoin Choices to curb bearish forward of Friday expiration date: Crypto Daybook Americas

Replace (September 4, 16:00 UTC): Add a BTC energy cluster chart.