Stripe and Paradigm have launched Tempo, a “payment-first” blockchain designed to optimize Stablecoin transactions. This sparked intense debate over the affect on Ethereum, Solana and different current payment-focused chains.

Whereas many consultants see this as a possibility to increase person adoption and improve cross-chain infrastructure, others are skeptical of its alleged “neutrality” and the true motivations of Stripe. Whereas Tempo could possibly be a key catalyst for the Stablecoin market, it additionally runs the danger of reshaping the aggressive panorama of cryptos.

The tempo of Libra V2?

Stripe and Paradigm attracted market consideration by unveiling the idea of payment-first blockchain known as Tempo. The announcement promptly sparked debate on the “payment-first” mannequin. This can be a design that prioritizes secure switch and cost expertise relatively than specializing in multipurpose sensible contracts like Ethereum.

On the macro stage, payment-first blockchain offers new customers (retailers and Stripe buyer base) with a direct path to entry range cash and funds on the chain, with out going via a number of bridges or advanced Layer 2 (L2) options. This explains why the Fintech large prefers Layer-1 (L1) over L2.

Apparently, many individuals have in contrast the tempo with Libra. Tempo is an unlucky undertaking that was as soon as led by Meta (previously Fb). Nevertheless, Crypto presently enjoys higher political and institutional help, so the tempo could have higher odds.

“The striped tempo chain is the Libra V2, but it surely has a political local weather that does not choke it down in a crib,” mentioned Ryan Adams of Bankless.

That mentioned, Tempo’s true worth is dependent upon whether or not it attracts significant cost volumes or whether or not it may change into a “one other chain” of the ecosystem.

Many questions

Tempo is labelled “Libra V2,” however some argue that its technical basis could not match the present state of the market, provided that different platforms supply excess of what Tempo is proposing.

“There could also be enterprise causes for the Stripe L1, however in 2025, the technical motivation cited is a bit SUS,” commented Mysten Labs CEO/CTO.

Different consultants have expressed concern concerning the undertaking’s claims of “neutrality” concerning stubcoins and fuel tokens inside tempo ecosystems. Regulatory threat stays as Stablecoin issuers could face conflicts of curiosity or lack confidence within the chain’s framework.

“There is a motive why a profitable L1 solely accepts their very own native token for fuel. The counterparty threat of doing it in different methods is excessive and solely grows if the chain is profitable…”

The affect of tempo on the crypto market

Some views spotlight that “chain fragmentation” may gain advantage cross-chain interoperability protocols as demand for bridges and oracles will increase. Because of this, infrastructure gamers corresponding to bridges, Oracle suppliers corresponding to chain hyperlinks (hyperlinks), and on-chain cost service suppliers can take advantage of income as companies change into important for worth switch throughout the ecosystem.

Nevertheless, whereas stubcoin’s progress is mostly a optimistic sign for crypto, and new stripe customers can nonetheless make the most of Ethereum debt, analyst Ignus warned that it could be tough to interpret this as a bullish sign for ETH.

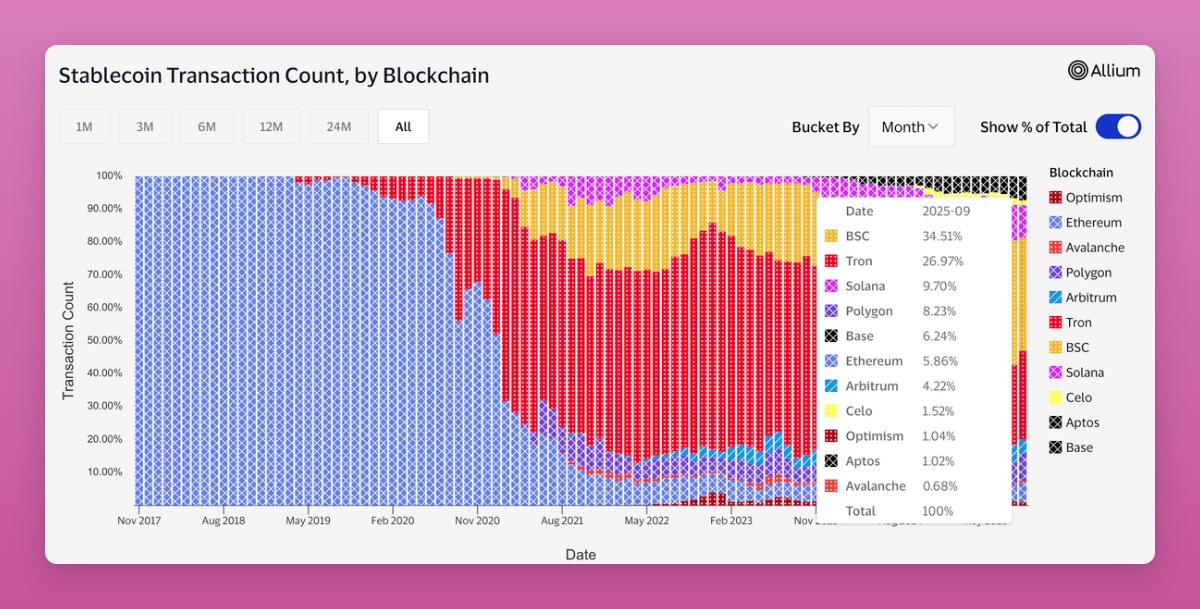

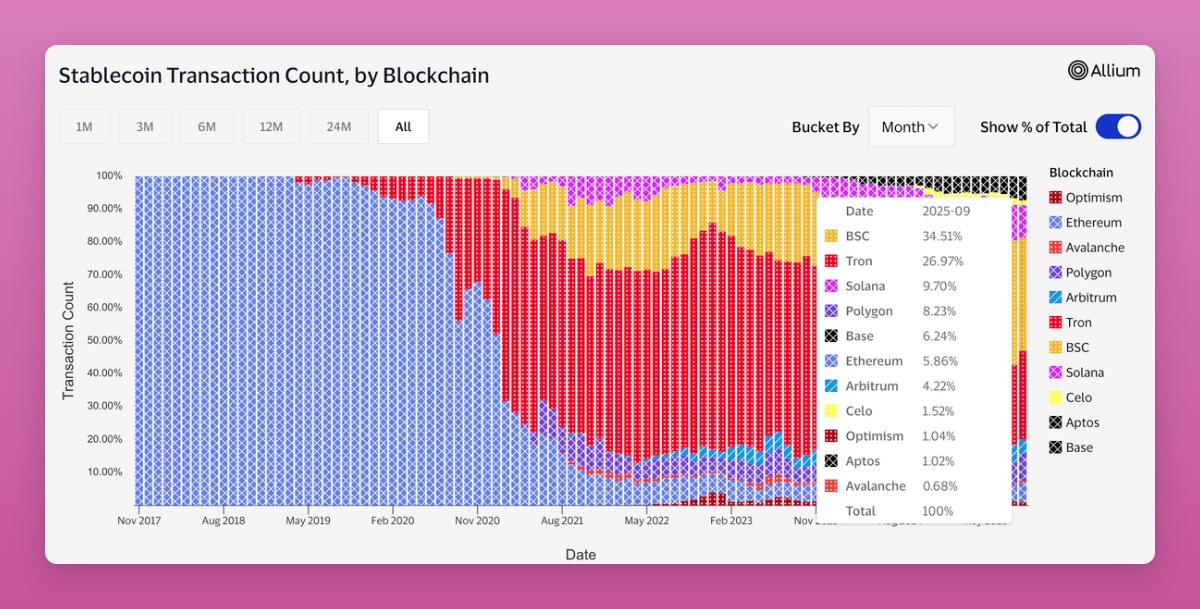

Most Stablecoin transactions happen in Tron, Solana, Polygon, and L2 networks. Tempo entries can compete straight with these ecosystems. Nonetheless, consultants predict that Ethereum can be an enormous winner within the new stubcoin economic system.

Stablecoin transactions through blockchain. Supply: Ignas of x

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo may change into a critical competitor to Tether, Circle, Ethereum and Solana within the cost area of interest. If Tempo efficiently captures liquidity and vendor recruitment, the Stablecoin circulation could possibly be considerably redirected.

Stripe and Paradigm have launched Tempo, a “payment-first” blockchain designed to optimize Stablecoin transactions. This sparked intense debate over the affect on Ethereum, Solana and different current payment-focused chains.

Whereas many consultants see this as a possibility to increase person adoption and improve cross-chain infrastructure, others are skeptical of its alleged “neutrality” and the true motivations of Stripe. Whereas Tempo could possibly be a key catalyst for the Stablecoin market, it additionally runs the danger of reshaping the aggressive panorama of cryptos.

The tempo of Libra V2?

Stripe and Paradigm attracted market consideration by unveiling the idea of payment-first blockchain known as Tempo. The announcement promptly sparked debate on the “payment-first” mannequin. This can be a design that prioritizes secure switch and cost expertise relatively than specializing in multipurpose sensible contracts like Ethereum.

On the macro stage, payment-first blockchain offers new customers (retailers and Stripe buyer base) with a direct path to entry range cash and funds on the chain, with out going via a number of bridges or advanced Layer 2 (L2) options. This explains why the Fintech large prefers Layer-1 (L1) over L2.

Apparently, many individuals have in contrast the tempo with Libra. Tempo is an unlucky undertaking that was as soon as led by Meta (previously Fb). Nevertheless, Crypto presently enjoys higher political and institutional help, so the tempo could have higher odds.

“The striped tempo chain is the Libra V2, but it surely has a political local weather that does not choke it down in a crib,” mentioned Ryan Adams of Bankless.

That mentioned, Tempo’s true worth is dependent upon whether or not it attracts significant cost volumes or whether or not it may change into a “one other chain” of the ecosystem.

Many questions

Tempo is labelled “Libra V2,” however some argue that its technical basis could not match the present state of the market, provided that different platforms supply excess of what Tempo is proposing.

“There could also be enterprise causes for the Stripe L1, however in 2025, the technical motivation cited is a bit SUS,” commented Mysten Labs CEO/CTO.

Different consultants have expressed concern concerning the undertaking’s claims of “neutrality” concerning stubcoins and fuel tokens inside tempo ecosystems. Regulatory threat stays as Stablecoin issuers could face conflicts of curiosity or lack confidence within the chain’s framework.

“There is a motive why a profitable L1 solely accepts their very own native token for fuel. The counterparty threat of doing it in different methods is excessive and solely grows if the chain is profitable…”

The affect of tempo on the crypto market

Some views spotlight that “chain fragmentation” may gain advantage cross-chain interoperability protocols as demand for bridges and oracles will increase. Because of this, infrastructure gamers corresponding to bridges, Oracle suppliers corresponding to chain hyperlinks (hyperlinks), and on-chain cost service suppliers can take advantage of income as companies change into important for worth switch throughout the ecosystem.

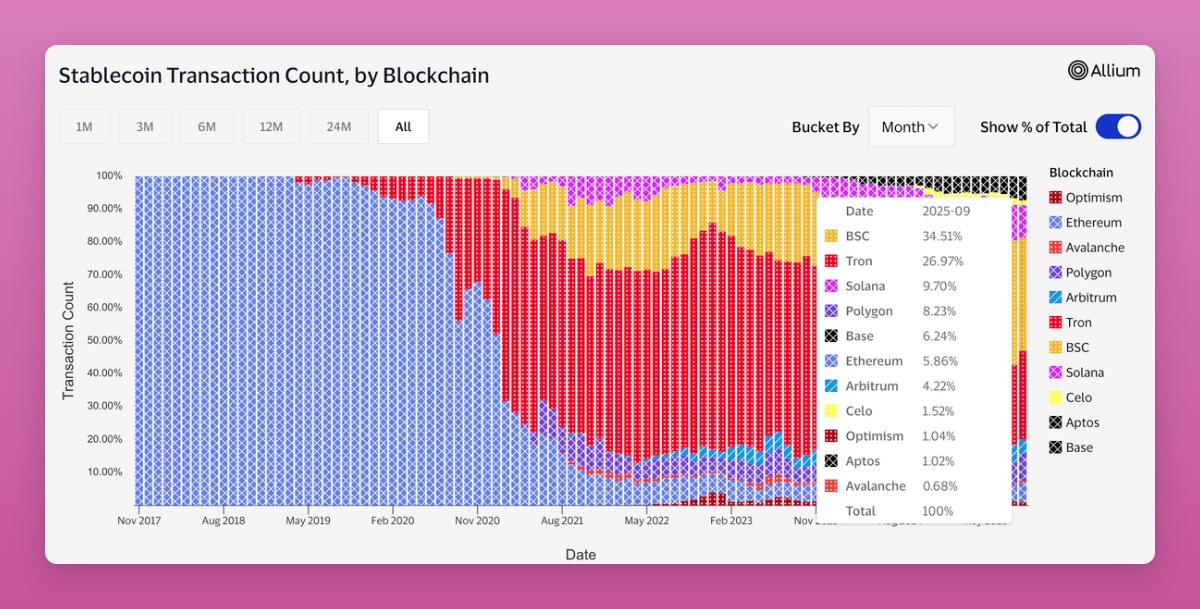

Nevertheless, whereas stubcoin’s progress is mostly a optimistic sign for crypto, and new stripe customers can nonetheless make the most of Ethereum debt, analyst Ignus warned that it could be tough to interpret this as a bullish sign for ETH.

Most Stablecoin transactions happen in Tron, Solana, Polygon, and L2 networks. Tempo entries can compete straight with these ecosystems. Nonetheless, consultants predict that Ethereum can be an enormous winner within the new stubcoin economic system.

Stablecoin transactions through blockchain. Supply: Ignas of x

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo may change into a critical competitor to Tether, Circle, Ethereum and Solana within the cost area of interest. If Tempo efficiently captures liquidity and vendor recruitment, the Stablecoin circulation could possibly be considerably redirected.

Stripe and Paradigm have launched Tempo, a “payment-first” blockchain designed to optimize Stablecoin transactions. This sparked intense debate over the affect on Ethereum, Solana and different current payment-focused chains.

Whereas many consultants see this as a possibility to increase person adoption and improve cross-chain infrastructure, others are skeptical of its alleged “neutrality” and the true motivations of Stripe. Whereas Tempo could possibly be a key catalyst for the Stablecoin market, it additionally runs the danger of reshaping the aggressive panorama of cryptos.

The tempo of Libra V2?

Stripe and Paradigm attracted market consideration by unveiling the idea of payment-first blockchain known as Tempo. The announcement promptly sparked debate on the “payment-first” mannequin. This can be a design that prioritizes secure switch and cost expertise relatively than specializing in multipurpose sensible contracts like Ethereum.

On the macro stage, payment-first blockchain offers new customers (retailers and Stripe buyer base) with a direct path to entry range coin and chain funds with out going via a number of bridges or advanced Layer 2 (L2) options. This explains why the Fintech large prefers Layer-1 (L1) over L2.

Apparently, many individuals have in contrast the tempo with Libra. Tempo is an unlucky undertaking that was as soon as led by Meta (previously Fb). Nevertheless, Crypto presently enjoys higher political and institutional help, so the tempo could have higher odds.

“The striped tempo chain is the Libra V2, but it surely has a political local weather that does not choke it down in a crib,” mentioned Ryan Adams of Bankless.

That mentioned, Tempo’s true worth is dependent upon whether or not it attracts significant cost volumes or whether or not it may change into a “one other chain” of the ecosystem.

Many questions

Tempo is labelled “Libra V2,” however some argue that its technical basis could not match the present state of the market, provided that different platforms supply excess of what Tempo is proposing.

“There could also be enterprise causes for the Stripe L1, however in 2025, the technical motivation cited is a bit SUS,” commented Mysten Labs CEO/CTO.

Different consultants have expressed concern concerning the undertaking’s claims of “neutrality” concerning stubcoins and fuel tokens inside tempo ecosystems. Regulatory threat stays as Stablecoin issuers could face conflicts of curiosity or lack confidence within the chain’s framework.

“There is a motive why a profitable L1 solely accepts their very own native token for fuel. The counterparty threat of doing it in different methods is excessive and solely grows if the chain is profitable…”

The affect of tempo on the crypto market

Some views spotlight that “chain fragmentation” may gain advantage cross-chain interoperability protocols as demand for bridges and oracles will increase. Because of this, infrastructure gamers corresponding to bridges, Oracle suppliers corresponding to chain hyperlinks (hyperlinks), and on-chain cost service suppliers can take advantage of income as companies change into important for worth switch throughout the ecosystem.

Nevertheless, whereas stubcoin’s progress is mostly a optimistic sign for crypto, and new stripe customers can nonetheless make the most of Ethereum debt, analyst Ignus warned that it could be tough to interpret this as a bullish sign for ETH.

Most Stablecoin transactions happen in Tron, Solana, Polygon, and L2 networks. Tempo entries can compete straight with these ecosystems. Nonetheless, consultants predict that Ethereum can be an enormous winner within the new stubcoin economic system.

Stablecoin transactions through blockchain. Supply: Ignas of x

Sharing this view, Blockworks CEO Jason Yanowitz argued that Tempo may change into a critical competitor to Tether, Circle, Ethereum and Solana within the cost area of interest. If Tempo efficiently captures liquidity and vendor recruitment, the Stablecoin circulation could possibly be considerably redirected.