Somewhat than greedy the threats Stablecoins brings to revenue, US banks ought to give higher rewards to draw and retain prospects, says Bitwise funding chief Matt Hougan.

“If native banks are frightened about competitors with Stubcoin, they need to pay extra curiosity on their deposits,” Hougan wrote to X on Tuesday.

He added that banks are frightened as a result of “they’ve abused depositors as free sources of capital for many years.”

Hougan’s feedback final month, Citi argued that yield-backing stubcoins might set off a wave of financial institution withdrawals, lobbying US banks to Congress to strengthen US stubcoin legal guidelines on yields in an effort to keep in Lobbbbbbbbbb.

Hougan slams “first ideas”

“The horror article about stubcoins destroying the native lending market is ridiculous,” Hogan mentioned.

In contrast to massive banks with entry to small markets, smaller communities and native banks face new competitors threats from Secure Coin as they depend on buyer deposits in lending.

The report compares the yield-producing stubcoins within the Nineteen Seventies with the arrival of economic markets, offering a high-yield various to conventional financial savings accounts and swiftly withdrawn funds from banks.

Hougan added that hypothesis that credit will “dry” if Stablecoins are allowed to compete with banks is “basic major pondering.”

Hougan mentioned that if the financial institution has fewer deposits, the financial institution might supply much less credit score, however that folks with Stablecoins would supply credit score on to debtors by way of decentralized finance purposes.

“The loser right here is the financial institution’s revenue margin. The winner right here is the person saver. The economic system goes properly.”

Stablecoin generates complementary financial savings accounts

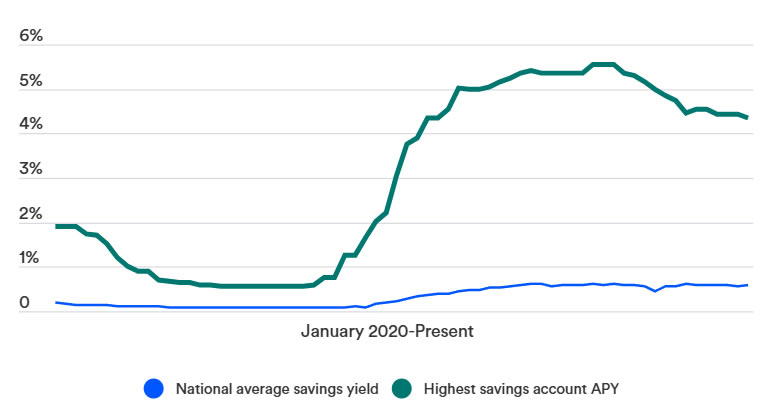

Some Stablecoins supply as much as 5% on deposits on sure crypto platforms, with the US nationwide common financial savings charge at a way more enticing charge than simply 0.6%, surpassing the very best excessive revenue margin, in accordance with financial institution charge knowledge.

Associated: After the Genius Act, a speedy enhance in secure coin provide that helps yield

When inflation and financial institution prices are taken under consideration, shoppers typically lose cash by sitting money within the financial institution with out yield.

The very best US financial institution accounts supply decrease rates of interest in comparison with most stubcoins. sauce: Financial institution Price

Stablecoin supporters say that tokens supply different advantages over banks and supply sooner buying and selling speeds at decrease prices, though there is no such thing as a holding price.

Banks lobbyed towards Stablecoin yields

Final month, the banking business lobbyed to stop Stablecoin issuers from providing yields.

The crypto business opposed financial institution issues and warned that laws revisions would profit conventional banks whereas suppressing innovation and shopper decisions.

journal: Bitcoin can sink to “Below $50K” with Justin San’s WLFI Saga: Hodler’s Digest