Regardless of rising expectations for US rate of interest cuts, Bitcoin has not achieved a significant worth rise. As an alternative, the quantity of futures buying and selling in Binance futures has dropped considerably, and analysts see it as a possible “crimson flag.”

In a report launched Monday, Cryptoquant Analyst Mignolet argued {that a} important drop in futures volumes was an indication of concern..

Modifications in market conduct

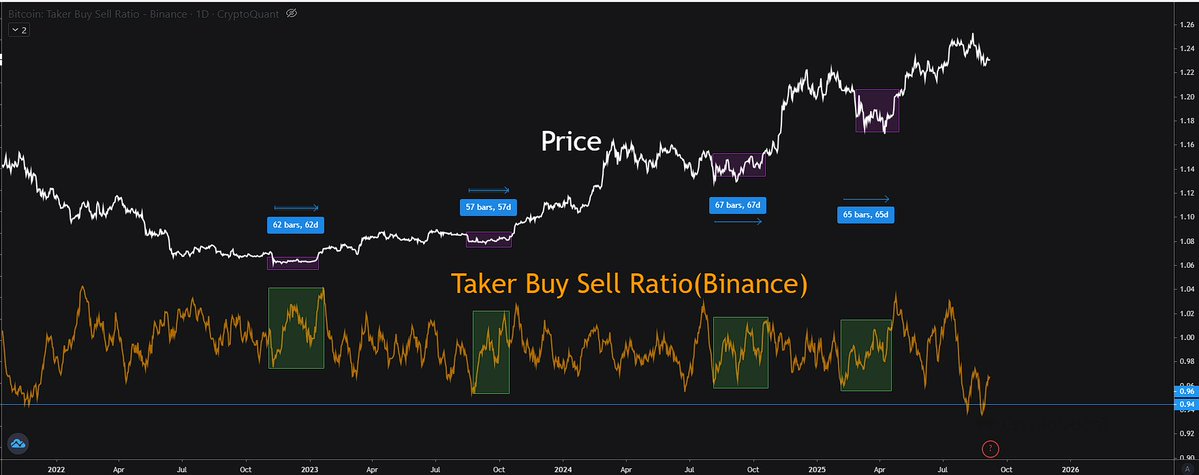

He defined that by means of the present Bull Run, bullish divergence within the purchase/promote ratio within the futures market usually signifies that costs are bottom-out or built-in.

Taker shopping for and promoting ratio (Binance). Supply: Cryptoquant

A lot of market purchases within the futures market implies that many buyers and plenty of capital are betting on worth will increase. He famous that historic tendencies within the vinance futures market normally level to an upward trajectory.

Nevertheless, my temper has modified just lately. Mignolett believes the present state of affairs is much like when the market peaked in 2021. He means that merchants ought to deal with precise buying and selling volumes past a easy bull/bearish ratio, as costs have risen considerably.

Binance futures quantity must be restored

Analyzing the charts, the rise in Bitcoin costs since 2020 is roughly according to a rise within the quantity of purchases of vinance futures. Nevertheless, this time the state of affairs is totally different. Bitcoin costs are at their highest ever excessive, however futures purchases haven’t saved tempo. Mignolet identified that this divergence is similar to the highest of the market in 2021.

Taker buy quantity (Binance). Supply: Cryptoquant

He argued that the futures market continues to be targeting binance whereas ETFs and MicroStrategy (MSTR) promote liquidity within the spot market. In line with Mignolet, Bitcoin’s robust upward motion is tough with out rebounding within the futures market.

Mignolet has stopped declaring the top of the present Bull Run. “The issue is that liquidity is total declining,” he says, “If buying and selling volumes get well, we are able to assume that the market just isn’t completed but.”

Put up-Binance Futures Quantity Drop: Bitcoin Purple Flag? It first appeared in Beincrypto.