Avax Value reached $30 on Binance. That is the very best stage since February. This efficiency has reworked buyers’ sentiment right into a extra optimistic outlook for the remainder of the 12 months.

Presently, Avax sees it as a robust candidate for portfolio allocation. What fueled this gathering? The next particulars clarify the motive force:

Avalanche (Avax) will develop institutional publicity in September

The Monetary Occasions reported that the Avalanche Basis is negotiating the creation of two US-based Crypto monetary automobiles, focusing on $1 billion.

The preliminary contract, led by Hivemind Capital, goals to boost as much as $500 million by an organization registered with NASDAQ, and is anticipated to be accomplished by late September.

The second deal contains SPACs backed by Dragonfly Capital.

Funds from each transactions have been used to buy hundreds of thousands of avax from the muse’s reserves, leveraging the utmost whole provide of 720 million tokens, of which 420 million are already in circulation.

Efficiency at avax costs. Supply: Beincrypto

In response to Beincrypto information, the information doubtless pushed Avax to $30 on September eleventh.

At this time’s exchanges have Avax buying and selling volumes above $1.8 billion, which can also be the very best quantity of the day since February. This exhibits that this Altcoin has as soon as once more attracted merchants’ consideration.

Actual World Belongings (RWA) Progress Strengthen Avax’s Outlook

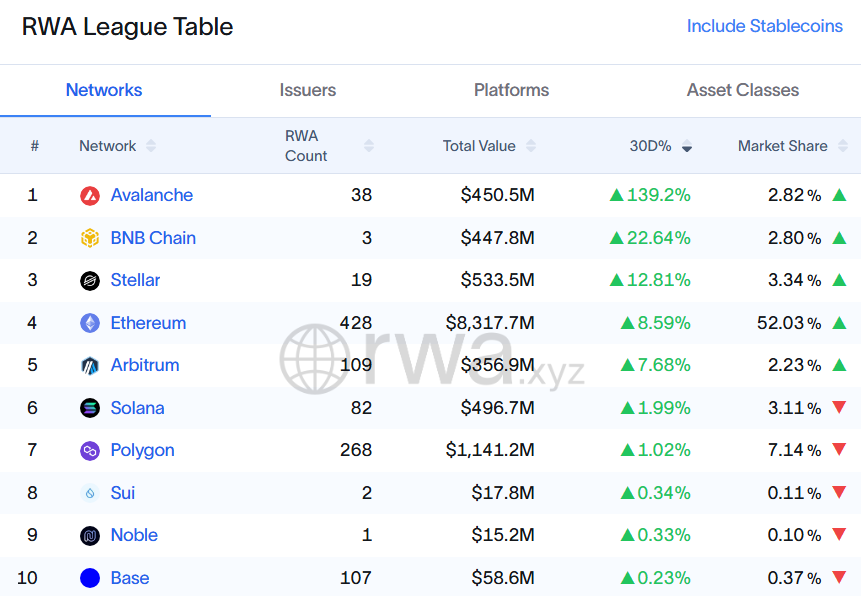

One other main spotlight of Avax is its main place in real-world belongings development over the previous 30 days. In response to information from RWA.xyz, Avalanche has recorded development of over 139% of whole RWA, exceeding $450 million.

The avalanche has surpassed the RWA sector in 30 days of development. Supply: rwa.xyz

A lot of this development comes from the tokenization of belongings by Janus Henderson, a worldwide funding firm with over $379 billion. Particularly, the Janus Henderson Anemoy AAA CLO Fund (JAAA) was printed totally in chains by way of an avalanche centrifugation protocol.

Since early September, the overall quantity of avalanche JAAA has exceeded $250 million. Nevertheless, the info exhibits that Avax’s RWA market share remains to be very low at simply 2.82%, reflecting right this moment’s fierce competitors within the RWA sector.

Elevated institutional involvement throughout September eased feelings and supported Avax’s gatherings. Based mostly on this momentum, technical analysts see the potential for larger objectives, with some anticipating returns of over $40 by the top of the 12 months.

The Avax Publish broke $30 because it first appeared on Beincrypto as RWA recruitment and Treasury plans had been promoted.