The Bitcoin (BTC) Treasury is going through a fairly necessary scenario because it erodes the market premium of underlying BTC holdings amid a decline in volatility and a pointy slowdown in new purchases.

Particularly, month-to-month BTC purchases by these firms have crashed 97% since November 2024, reflecting a really cautious market method in latest months. Nonetheless, latest knowledge from Cryptoquant suggests the necessity for speedy adjustments in methods.

A decline in Bitcoin volatility threatens the market worth of Bitcoin’s Ministry of Finance

Usually, Bitcoin Treasury is traded at premium. That’s, the market worth exceeds the precise worth of BTC as traders consider these firms can develop their holdings, monetize volatility and act as a safe publicity to one of the best cryptocurrency. Subsequently, the market internet asset worth (MNAV) that compares the inventory worth of those firms with the NAVs owned by Bitcoin is all the time above 1.

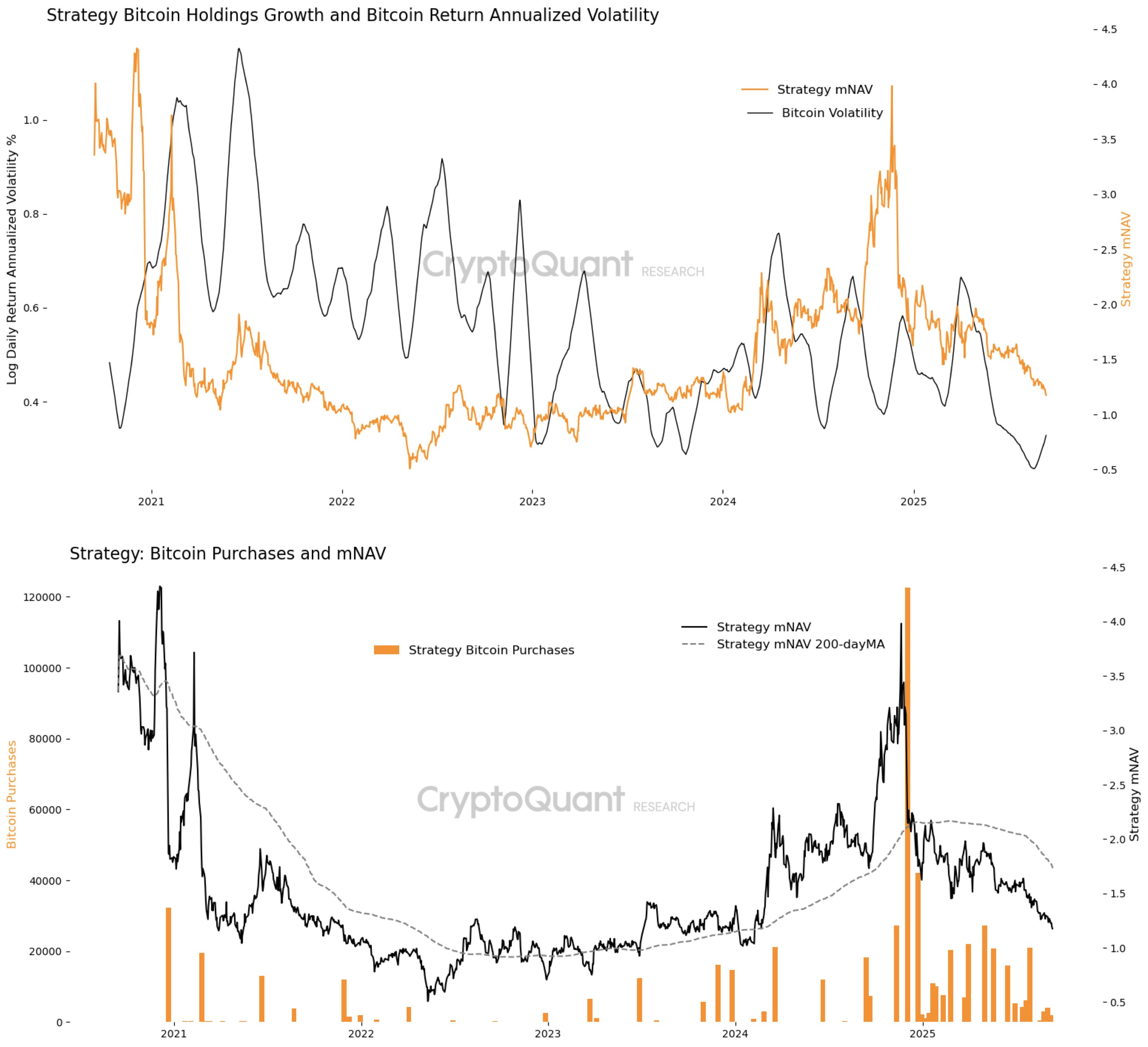

Nonetheless, Julio Moreno, head of Cryptoquant Analysis, shares that annual Bitcoin volatility has dropped to a multi-year low, eradicating its premium key drivers, and there may be much less alternative for the Treasury to benefit from worth fluctuations and justify valuations past underlying BTC shares.

When analyzing market knowledge for Methods, the most important firm BTC holder, we are able to observe that sure risky surges rose above 2.0, particularly in early 2021 and mid-2024. Throughout these home windows, the finance firm was capable of monetize volatility, enhance equity or legal responsibility with premiums, and deploy these revenues to speedy BTC purchases.

Nonetheless, volatility is now effectively under the annual return of 0.4 logs per 12 months, reaching its lowest stage since 2020. The planarization volatility curve coincided with a gentle lower in MNAV, returning to 1.25. This slender premium means that traders not see treasury firms as offering significant leverage in instantly holding Bitcoin.

Weakening the Ministry of Finance’s issues with demand compounds

With out the “gas” of worth fluctuations, Bitcoin finance firms are struggling to broaden their holdings in a approach that justifies their premium valuation. There was an remoted burst of purchases between late 2024 and early 2025, however total exercise stays stifled.

In response, regardless of BTC itself buying and selling at a comparatively excessive worth vary in comparison with latest years, the technique’s MNAV has been on a downward pattern because the flip of 2025. The info means that when the Treasury purchases aggressively, investor enthusiasm will push MNAV excessive and strengthen the cycle of premium issuance and BTC accumulation.

Julio Moreno explains that for MNAV Premium to final, new demand from BTC volatility rebound and large-scale purchases will quickly be wanted. Till then, it might develop into more and more troublesome for treasury firms to justify valuations past Bitcoin’s internet asset worth, forcing traders to think about direct publicity to Bitcoin for returns fairly than company methods.

On the press convention, Bitcoin traded at $115,810, reflecting a 4.72% enhance final week.

Pexels featured photos, TradingView charts