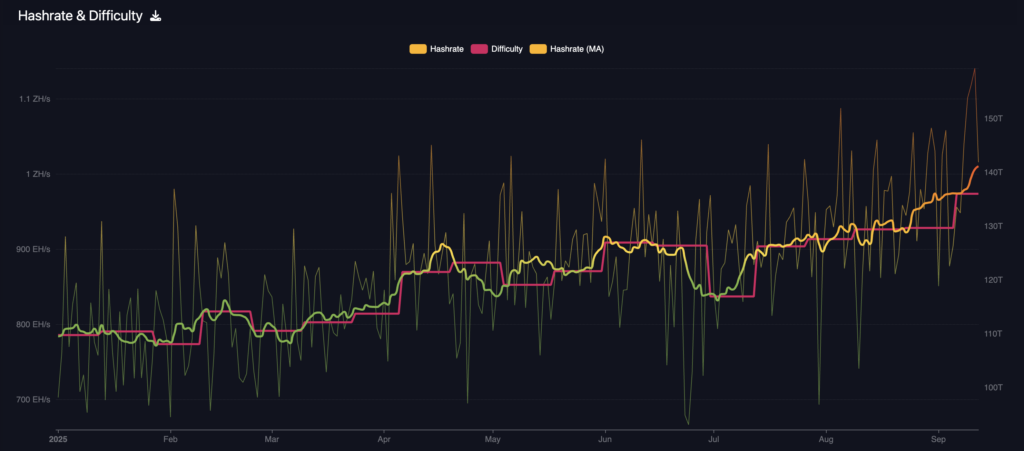

The Bitcoin Community’s issue reached 136.04 trillion on September 4th, however this week it slid to round $52 per day. For every hashrate index, the ultimate adjustment set a brand new excessive for issue, incomes a median hashprice worth of practically $49.17 per day for the following six months.

Squeeze determines whether or not miners promote stock, combine operations, or pursue high-performance computing revenues associated to synthetic intelligence.

The background behind the manufacturing is strong. The seven-day common hash charge is close to one Zettahash per second, however buying and selling charges have lately averaged simply over 1% of block rewards.

The combo concurrently compresses the entire margins with developments in retail electrical energy costs and rental developments in wholesale information facilities. International colocation costs averaged $217.30 per kilowatt per 30 days within the first quarter, with provide tightening to main hubs per pattern 2025 in CBRE’s world information facilities.

As computing calls for relocate the ability stack, strategic choices are increasing.

CoreWeave agreed to acquire Core Scientific earlier this yr. This suggests a inventory worth of roughly $9 billion. The acquisition will permit for extra growth potential by consolidating roughly 1.3 gigawatts of put in capability.

In its transaction materials, consumers outlined the synergy between bettering lease effectivity and working by 2027, however this transaction is a part of a broader AI buildout competing for grid entry throughout North America. The course of the journey is evident. AI workloads have change into a central various to electrical energy and land that beforehand had been skewed in the direction of proof of labor.

Public market signaling has additionally shifted with the debut of American Bitcoin Corp. After finishing its merger with Griffon Digital Mining, the corporate started buying and selling as ABTC on NASDAQ. Company submitting particulars the construction managed after the mixture, with former US Bitcoin holders proudly owning about 98% of the totally diluted firm.

This mannequin highlights accumulation together with self-mining and creates one other lever of a monetary technique that will attenuate or amplify market gross sales, relying on the unfold between mining prices, spot costs, and funding phrases.

Energy constraints and insurance policies proceed to set short-term provide behaviors.

In Texas, miners usually lower down throughout 4 unintended peak seasons to handle prices and earn credit score. The discount may briefly carry hashprice and shift the timing of income, but it surely additionally exhibits why ahead hedging has change into the norm. Luxor’s market exhibits aggressively traded curves with mid-market quotes printed with hashrate ahead curves.

In opposition to this background, the arithmetic which are being destroyed is straightforward however unforgiving. Utilizing typical effectivity bands and present economics, the next ranges present approximate break-even energy costs, expressed in cents per kilowatt per hour, with hashpool charges of $53 per day and nominal pool charges.

Enter references reveal the specs for the Antminer S21 and WhatsMiner M60, together with the acquisition of incremental firmware, confirmed by Luxos testing.

These thresholds imply that the fleet pays on When Hashprice tracks the ahead common, a single digit energy charge feels stress. It will push finance in the direction of hedging the hashrate curves, deeper reductions throughout costly occasions, and non-mining revenues.

The ultimate class contains AI colocation and managed GPU providers. The contracted lease is quoted per megawatt per yr, and in lots of circumstances the load continues with the calculation.

Current contracts tackle adjustments to income steps.

Terawulf disclosed forecast host revenues of greater than $3.7 billion below the contract over just a few years, and the general public report estimated an annual acquisition charge of practically $1.85 million per megawatt in its first tranches.

The comparability beneath makes use of these public figures and CBRE lease benchmarks to indicate the magnitude hole between mature AI colocations and present mining money era per energy provide unit.

Delta doesn’t mechanically imply that each one miners have to pivot.

Renovations require CAPEX, liquid cooling, and excessive density racks that may saturate present transformers, and contractual take-out obligations could restrict short-term flexibility.

Nonetheless, the mixture of shut colocation provides and introduced integrations, corresponding to CoreWeave’s deal, may preserve AI rents all year long, requiring the Treasury’s alternative at any time when Bitcoin’s price share stays low.

Miner Moneyize demand-ready packages such because the ERCOT 4CP framework and modify fleets with effectivity firmware You’ll be able to broaden your break-even band with out promoting cash.

The case research present the choice set. IRIS Power continues to broaden its GPU capability and cloud income Self-mining utilizing twin tracks that stabilize money move towards hashpris volatility.

American Bitcoin presents a financially pushed method that mixes stability sheet accumulation and mining and management particulars with shared counting With SEC submitting. These paths sit alongside pure playhosting that captures AI demand and infrastructure premiums.

The short-term market query is whether or not the stability sheet will change into a supply of provide by the tip of the yr. If Hashprice follows the ahead curve and the charges stay close to the present print, miners who exceed the single-digit value band usually tend to increase money by promoting cash or locking them up with pre-sale gross sales of hashrates.

If AI colocation will increase in beforehand introduced agreements, among the gross sales may offset among the gross sales by being already tiered on the Summer season Premium.

The stability of those forces determines whether or not miners provide will attain the trade within the fourth quarter.