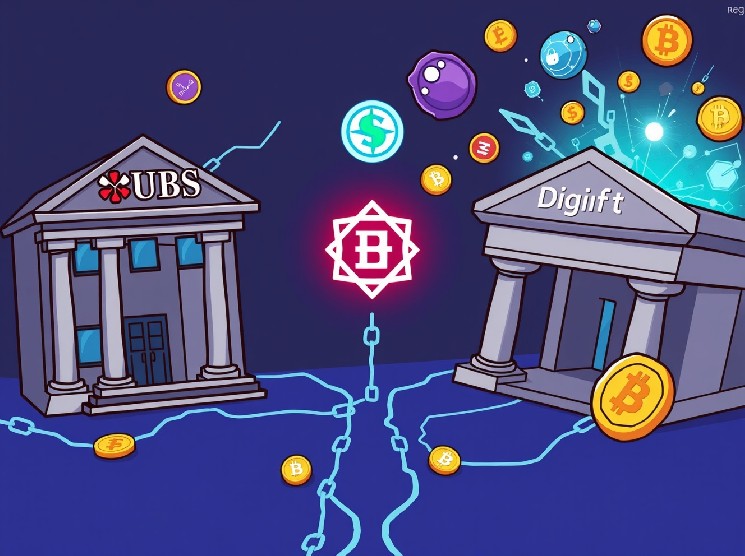

Prepare for a recreation changer within the monetary world! Groundbreaking collaborations are set to vary how institutional funding works. ChainLink has labored collectively to automate the tokenized belongings of UBS and establishments, the main US brokerage firm, Change Digift. ChainLink tokenized funds On-chain. This is a crucial step in direction of combining conventional finance with blockchain, opening new potentialities for buyers and wider markets.

What are ChainLink tokenized funds? Why is it essential?

At its core, tokenization includes changing real-world belongings resembling shares and bonds into digital tokens on the blockchain. These tokens characterize possession of the underlying asset. ChainLink tokenized funds Leverage ChainLink’s industry-standard, distributed Oracle networks to allow these digital belongings to be safe, dependable and seamlessly work together with actual information and programs.

It presents the earlier degree:

- effectivity: Normally, gradual streamlines the guide course of.

- Transparency: Supplies a transparent and unchanging report of transactions.

- Accessibility: It could possibly probably decrease the limitations to buyers collaborating in facility-grade merchandise.

This initiative marks a pivotal second, displaying how you can modernize and improve the standard monetary surroundings by means of blockchain know-how, notably chain hyperlinks.

How does this revolutionary collaboration work?

This partnership brings collectively key gamers and creates a strong ecosystem for chain investments. A worldwide monetary powerhouse, UBS presents tokenized merchandise. Basically, it’s the provision of institutional investments transformed into digital tokens. A regulated institutional tokenized asset alternate, Digift serves as a market the place these tokenized merchandise will be traded.

Innovation resides in ChainLink’s Digital Switch Agent (DTA) good contracts, automates these total lifecycles ChainLink tokenized funds. Handles essential features resembling:

- Issuing tokens.

- Redemption course of.

- Administration of company habits.

- Guarantee compliance with regulatory necessities.

Basically, buyers can commerce UBS tokenized merchandise by means of good contracts which can be each regulatory approval and drive by ChainLink’s safe infrastructure. This ensures that each step, from transaction to settlement, is automated and dependable.

The highly effective advantages of automated on-chain tokenized funds

Automation ChainLink tokenized funds It presents many advantages that might probably reform your funds. Shifting the method to the blockchain will enhance it.

- Decreasing operational prices: Automation minimizes guide intervention and reduces monetary establishment overhead.

- Quicker cost instances: Conventional asset transfers can take a number of days. On-chain transactions can settle in minutes or hours.

- Enhanced world accessibility: Tokenized funds can commerce throughout borders 24/7, 12 months a yr, growing market entry for buyers all over the world.

- Improved fluidity: By making belongings simpler to switch, tokenization can improve market liquidity.

- Improved transparency and auditability: All transactions are recorded in immutable ledgers, offering a transparent audit path and lowering the danger of fraud.

This streamlined strategy makes institutional investments extra agile and meet market calls for, benefiting each institutional and particular person buyers.

Navigating the longer term: Challenges and alternatives for chain-link tokenized funding

Chance of ChainLink tokenized funds The challenges stay extremely essential. The evolving regulatory framework and interoperability between blockchain and conventional programs require steady improvement. Clear tips are important for widespread adoption.

However alternatives far outweigh the hurdles. This collaboration reveals the rising acceptance of blockchain know-how inside mainstream finance. It paves the best way for a future the place extra complicated monetary merchandise will be tokenized, creating new funding automobiles, and democratizing entry to a couple beforehand chosen belongings. This pioneering effort by ChainLink, UBS and Digift units new requirements for the way monetary belongings are managed and traded within the digital age.

In abstract, this partnership is a monumental leap in institutional funds. By automating on-chain ChainLink tokenized fundsit will increase effectivity and transparency, filling conventional funds with decentralized innovation. This initiative guarantees a extra accessible, fluid and secure future for investments.

Ceaselessly requested questions (FAQ)

1. What are tokenized funds?

A tokenized fund is a standard funding fund wherein a inventory or unit is transformed right into a digital token on the blockchain. These tokens characterize possession and will be traded digitally, offering larger effectivity and transparency.

2. What’s ChainLink’s function on this collaboration?

ChainLink presents Digital Switch Agent (DTA) good contracts that automate all the lifecycle of tokenized funds, together with issuance, redemption, and compliance. It acts as a secure and dependable spine for chain operation.

3. Who’re UBS and Digift on this partnership?

UBS is a number one world US brokerage offering institutional tokenized merchandise. Digift is a regulated institutional tokenized asset alternate that enables buyers to commerce these merchandise.

4. What are the principle advantages for buyers from this initiative?

Buyers can anticipate advantages resembling pace of settlement instances, elevated transparency, elevated liquidity, and entry to facility-grade merchandise by means of regulatory automated good contract programs.

5. Is that this new system for tokenized funding regulated?

Sure, the collaboration highlights that buyers can commerce UBS tokenized merchandise by means of regulatory authorized good contracts operated by Digift, making certain compliance and safety inside current frameworks.

When you discover this text insightful, take into account sharing it together with your community! Assist unfold the phrase about thrilling developments ChainLink tokenized funds And the way forward for funds. Your shares will assist others uncover these essential developments.

For extra info on the most recent crypto market developments, try our article on the main developments that form the institutional adoption of Ethereum.

Disclaimer: The knowledge supplied will not be buying and selling recommendation, bitcoinworld.co.in will not be liable for any investments made primarily based on the knowledge supplied on this web page. We strongly advocate impartial analysis and session with certified consultants earlier than investing resolution.