A big group of buyers sometimes called “sharks.”‘purWe chased an enormous quantity of 65,000 BTC in only a week. Bitcoin costs had been recovered to $115,000 in two weeks.

Usually, shark wallets maintain between 100 and 1,000 BTC. The group had beforehand attracted consideration for giant purchases when Bitcoin was consolidating the $112,000 stage.

Sharks accumulate 65,000 BTC in per week

In line with crypto analyst Xwin Analysis Japan, the actions of Bitcoin short-term merchants now present clear indicators of divergence.

Up to now week alone, the shark pockets has added 65,000 BTC, pushing its complete inventory to an all-time excessive of three.65 million BTC. Analysts mentioned the market is risky and swings up and down, however Bitcoin provide crunch is entrenched on the similar time.

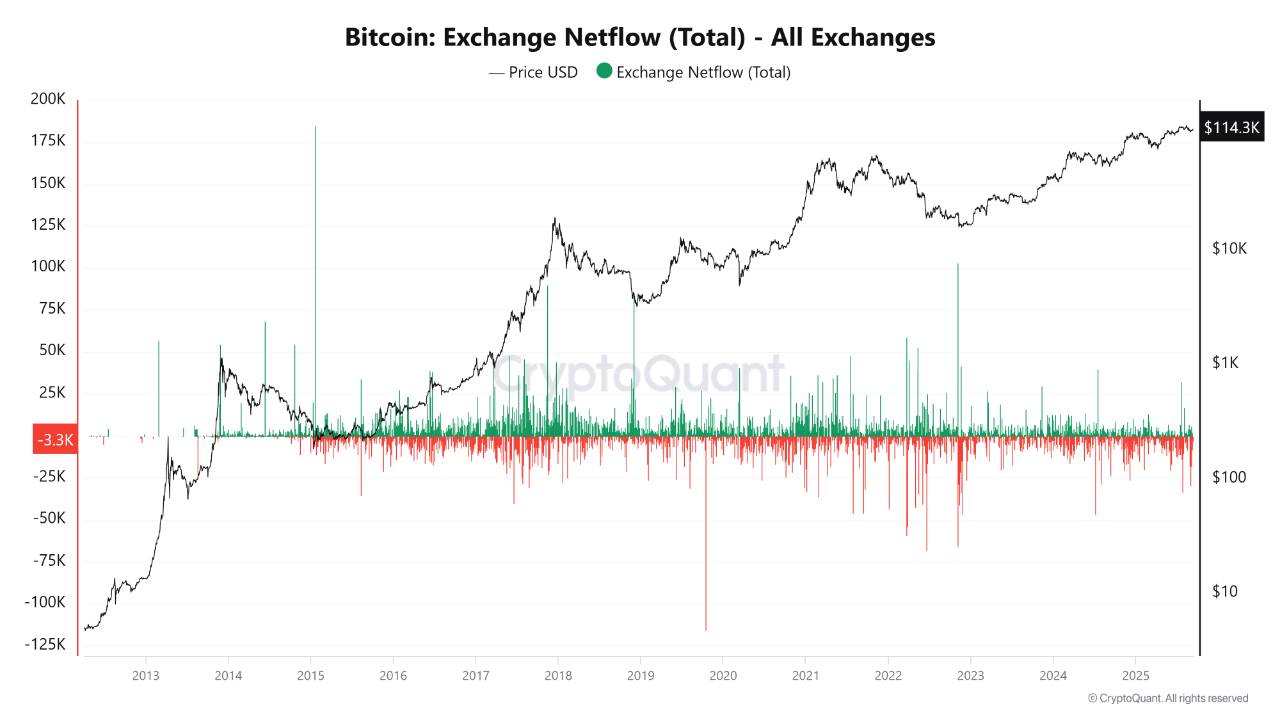

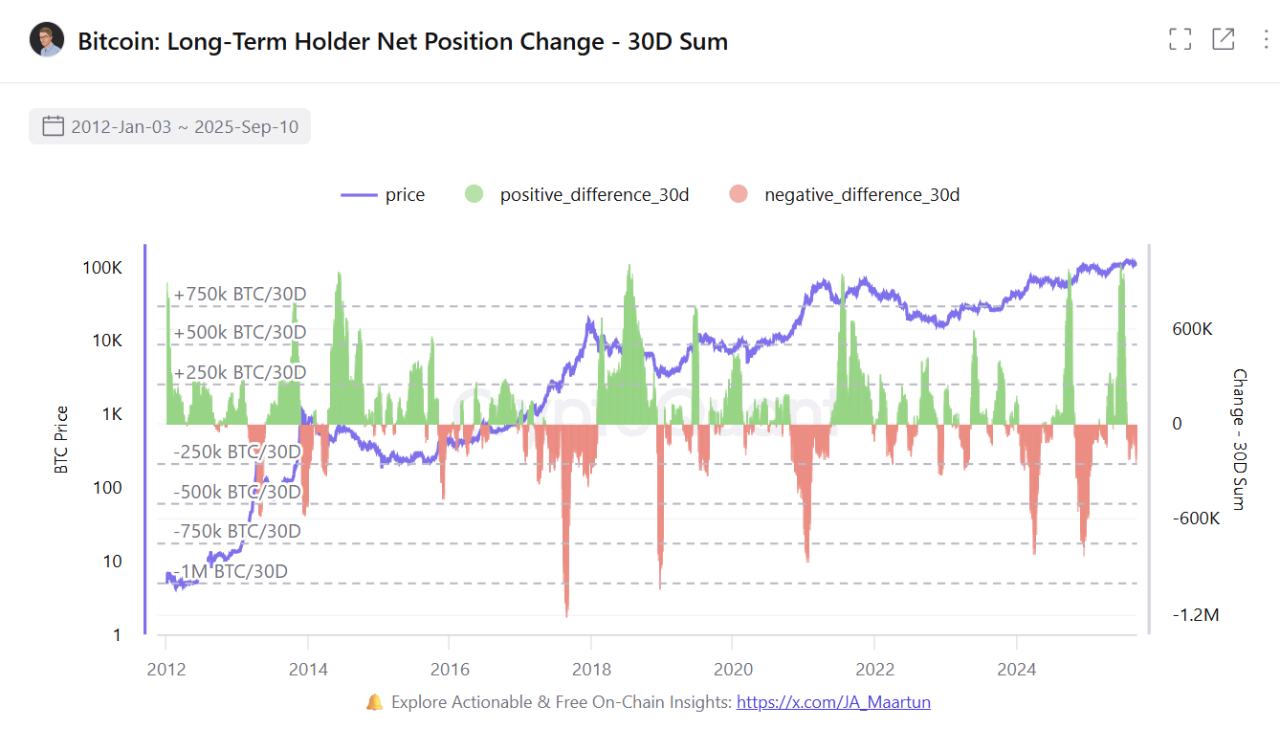

Two essential on-chain datasets affirm this pattern. Lengthy-term Holder (LTH) Netflow alternate with altering and changing web place.

Bitcoin: Trade Netflow. Supply: Cryptoquant

Provide is squeezed underneath volatility

XWIN Analysis Japan defined that long-term holders are additionally accumulating cash. That is the sign forward of the traditionally highly effective bull run. The 30-day change within the web place of Lengthy-Time period Holders (LTH), a metric that tracks these actions, has now modified to optimistic.

Bitcoin: Modifications to long-term holder web place. Supply: Cryptoquant

Analysts mentioned the latest tendencies in steady web spills from exchanges assist this concept. He urged that buyers had been withdrawing BTC from the alternate and transferring it to chilly storage.

Xwin Analysis Japan suggested that short-term fixes are nonetheless potential if by-product leverage is overheated. Nevertheless, he concluded that the inspiration for Bitcoin’s subsequent main gathering is underneath floor volatility.

This publish pushed “Shark” over $115,000 in two weeks to Bitcoin? It first appeared in Beincrypto.