In response to Mert Mumtaz, CEO of Distant Process Name (RPC) Node Supplier Helius, Crypto is known as “Net 3.0.”

Mumtaz stated Crypto is supercharged to perform correctly, together with free info in a decentralized method, unchanging property rights, incentive alignment, transparency, and “friction-free” capital flows. Mumtaz added:

“The endgame of Crypto is about radically evolving essentially the most impactful human innovations of all time. Capitalism. I stated Crypto is Net 3.0, however that undermines it – it is truly Capitalism 2.0.”

sauce: As a result of it is mumta

In September, two US monetary regulatory our bodies, the U.S. Securities and Alternate Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC), issued a joint assertion tearing the potential of the home 24/7 capital markets.

If brokers achieve establishing a ever-present capital market, this transfer marks a big and earthquake deviation from the legacy monetary system that travels gradual and closes on nights, weekends and most holidays.

Associated: Tokenization may unleash development in Latin American capital markets

US regulators present that 24/7 monetary markets are coming

The SEC and CFTC outlined a number of factors that might modernize the prevailing monetary system, together with always-on markets, regulatory frameworks for everlasting futures contracts (futures contracts with no expiration dates), and occasion forecast market regulation.

“Sure markets, together with foreign exchange, gold and crypto belongings, are already buying and selling constantly. If expanded additional, the US market might match into the evolving actuality of the worldwide and continuously occurring economic system,” learn a press release from the joint SEC and CFTC.

These proposals additional intertwin the digital belongings with conventional monetary methods, shifting legacy monetary methods into the Web capital markets by way of digital rails, together with tokenizing real-world monetary belongings on the blockchain.

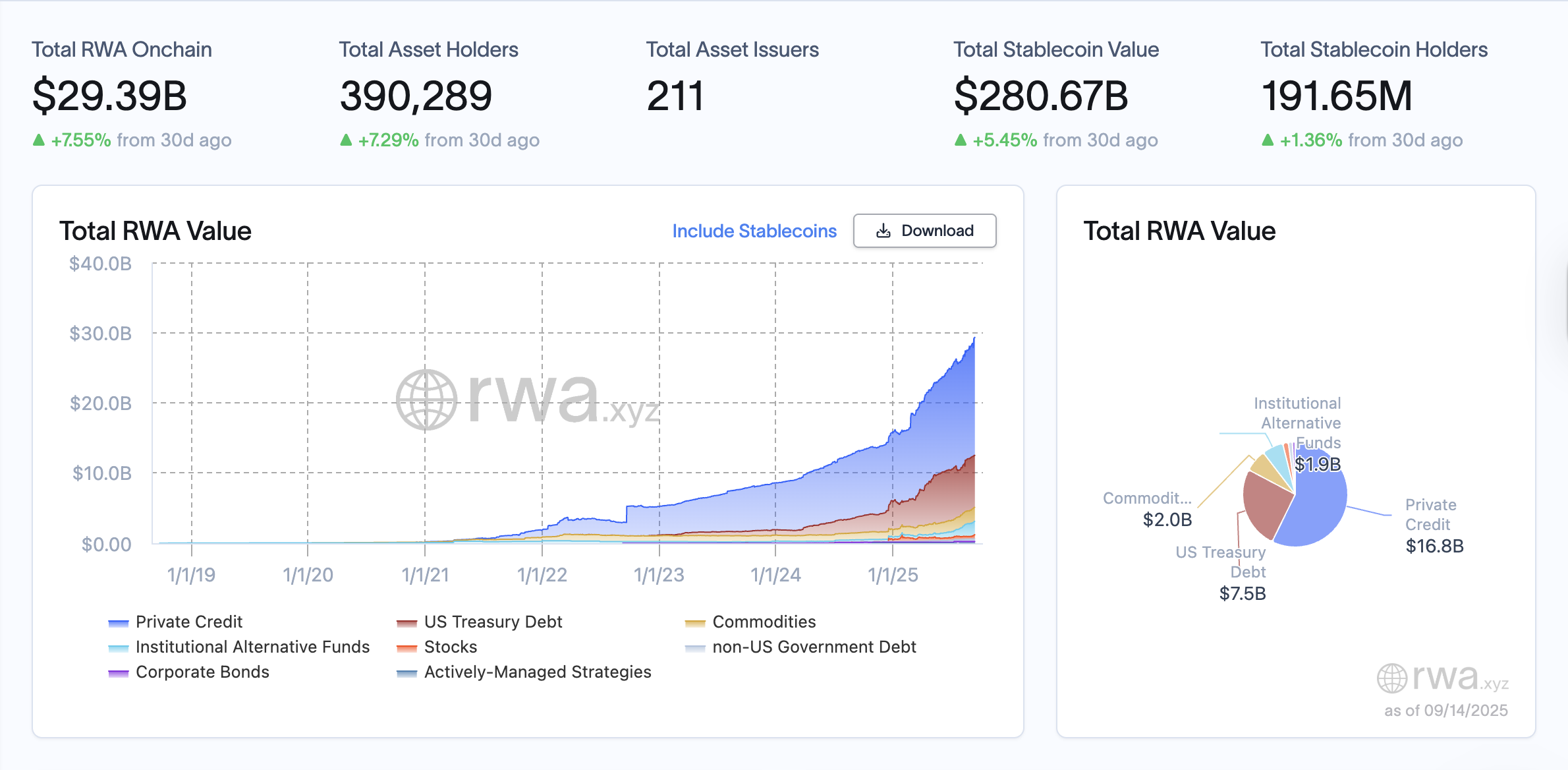

An outline of the real-world tokenized asset market, together with Stablecoins. sauce: rwa.xyz

Tokenized belongings embody shares, silly credit score, bonds, artwork, collectibles, and even shares within the type of actual property, in addition to Fiat foreign money.

In July, the Solana Basis, the group that oversees the event of the Solana blockchain community, revealed its roadmap for creating the Web capital market till 2027.

The roadmap emerged amongst conventional monetary corporations, the place a number of blockchain corporations and conventional monetary corporations unveiled tokenized merchandise, together with blended securities platforms that launched tokenized inventory buying and selling for European customers in July.

journal: Can a tokenized stock of Robinhood or Kraken actually be decentralized?