Lower than three months after it was acquired by Robinhood, Crypto Alternate Bitstamp had surpassed the father or mother platform’s crypto buying and selling quantity, marking a 21% enhance in August to $14.4 billion.

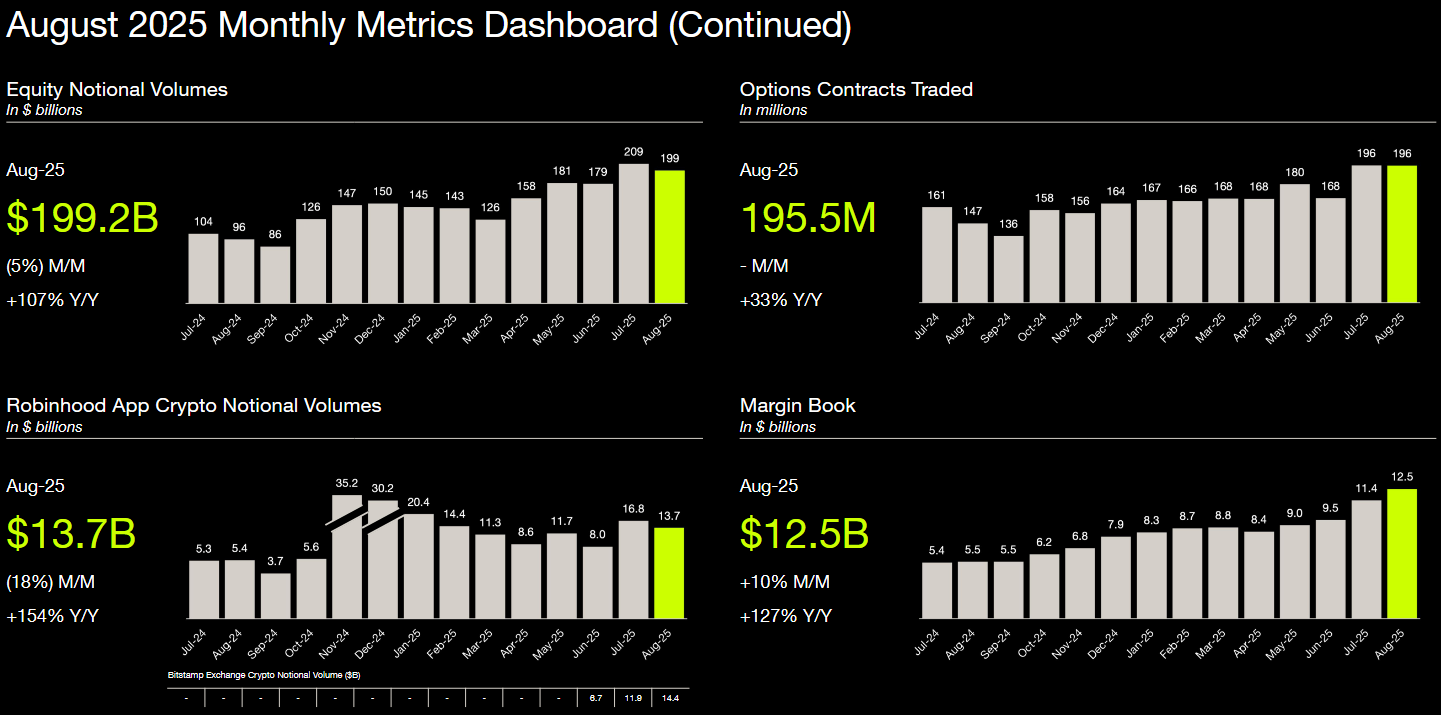

Robinhood’s firm report on Thursday confirmed that Robinhood’s nominal product of Crypto fell 18% in August in comparison with July to simply $13.7 billion.

Knowledge exhibits that November 2024 registered a report quarter, however it was flowing for Robin Hood earlier than it had slumped in August in July.

Robinhood’s main buying and selling quantity figures over the previous 12 months. sauce: Robin Hood

Robinhood accomplished its $200 million acquisition of Bitstamp on June 2nd, including greater than 5,000 institutional prospects and 50,000 retail prospects to Robinhood’s complete base.

Crypto exchanges are set to play a pivotal position within the firm’s ambitions in the true world asset tokenization market.

Bitstamp, now generally known as Bitstamp by Robinhood, is related to Robinhood Legend and its good change routing providing, making buying and selling simpler between the 2 platforms.

Bitstamp and Robinhood’s complete crypto buying and selling quantity fell 2.1% in comparison with the earlier month, however Robinhood’s complete belongings rose 2% in a month to $340 billion, with crypto at about $41 million.

The crypto market closed flat in August

The broader crypto market ended the month when costs virtually started, with solely a slight enhance in buying and selling quantity in August.

Ryan McMillin, CEO of Australia’s crypto fund administration firm Merkle Tree Capital, identified the seasonality when requested why Crypto Buying and selling at Robinhood was stagnant.

Wanting extra broadly, McMillin mentioned Crypto Market sentiment has been “comparatively quiet” just lately because it has been ready for essential macro indicators.

“Trump has been asking for a decrease payment whereas Jerome Powell delves into his heels. It seems prefer it’s modified now.”

Ck Zheng, founder and chief funding officer of ZX Squared Capital, is certain that total buying and selling quantity is rising quickly as Crypto is predicted to hit a brand new excessive by the top of the 12 months.

Zheng can be not satisfied that within the fourth quarter, it can mark the height of the present market cycle based mostly on a four-year crypto cycle paper. This factors to strengthening institutional adoption between funds traded on cryptocurrency exchanges and cryptocurrency corporations.

Robin Hood at the moment on the S&P 500

In the meantime, Robinhood debuted this week with Commonplace & Poor’s 500, bringing one other crypto-active firm to America’s most tracked inventory index.

Associated: Ark Make investments Buys Buys Dip: $21 million bullish, $16 million Robin Hood inventory

“The transfer will broaden the index’s publicity and connectivity to the digital asset financial system,” Edwin Mata, CEO of tokenization platform Brickken, mentioned in a remark to Cointelegraph on Tuesday as Hood’s shares exceeded 16%.

Robin Hood’s inclusion got here when Michael Saylor’s technique was snubled.

Robinhood has launched its personal Layer 2

Across the starting of July, Robinhood launched a Layer 2 blockchain, centered on tokenization of its European Union buyer base, offering entry to US shares.

It additionally launched everlasting futures within the EU, offering eligible merchants with entry to derivatives with as much as thrice the leverage. Transactions can be routed by way of BitStamp, a crypto change that was just lately acquired for $200 million.

journal: Can a tokenized stock of Robinhood or Kraken actually be decentralized?