Merchants use leverage to elevate bitcoin BTC$115,283.91 Going again to the document, we create a high-risk atmosphere the place derivatives could possibly be rewind to the draw back if costs begin to change in reverse.

Market analyst Skew warned one of many merchants’ intentions to open up an extended nine-figure place, “might wait to attend for a purchase order to hold in order that no poisonous circulate happens.”

$ BTC

A random variety of 9 is a whale that sings lengthy and relatedPossibly they’re going to look forward to the spot to hold purchases, and do not create a poisonous stream pic.twitter.com/goi1gzazl0

-September 12, 2025

The Bears are additionally including leverage, decreasing BTC to $234 million after which shortening BTC with an entry of $111,386, adopted by unbiased merchants presently coping with unrealized losses of $7.5 million. The dealer has maintained his place by including $10 million price of stubcoins, and is presently liquidated at $121,510.

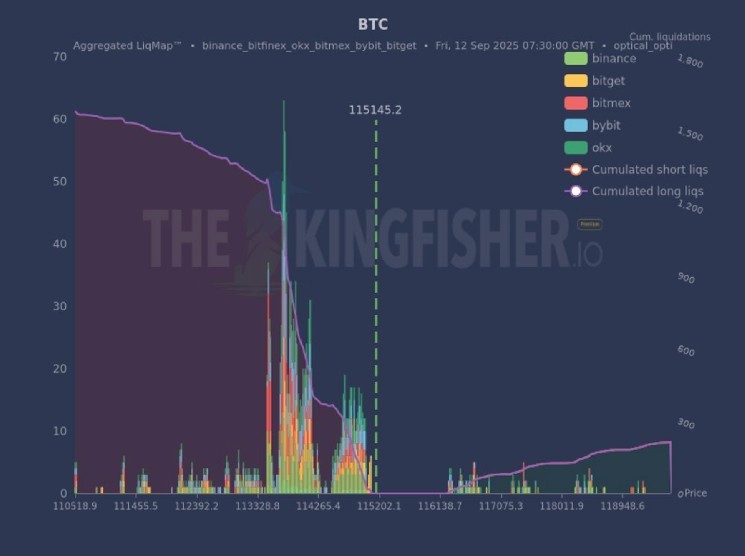

Nevertheless, the primary liquidation dangers lie on the draw back, with Kingfisher’s information exhibiting a big pocket of derivatives being liquidated between $113,300 and $114,500, and the liquidation cascade might return to help on the $110,000 degree.

“This chart reveals the place merchants are over-leveraged,” Kingfisher wrote. “It is a ache map. Costs are likely to get sucked into these zones and eliminate their location. We’ll use this information to keep away from being on the unsuitable aspect of an enormous motion.”

Bitcoin is presently quietly coming into a interval of volatility of round $115,000 and has not fallen out of its present vary for over two months.