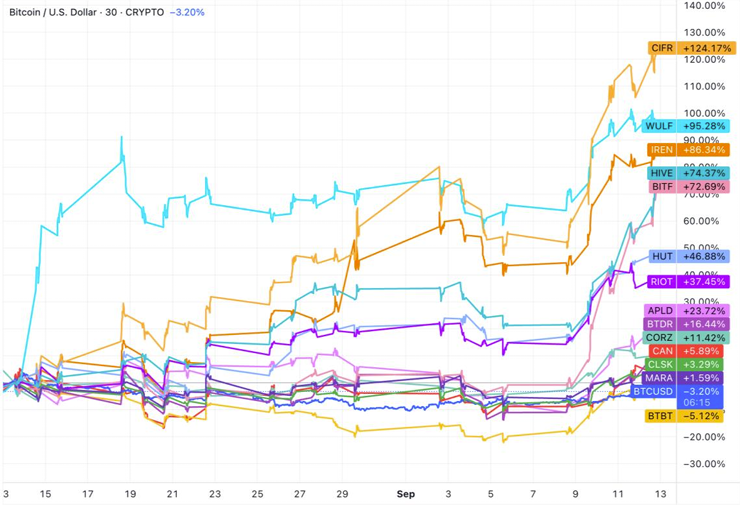

Bitcoin mining shares prolonged their restoration in September, surpassing Bitcoin and growing {hardware} payout interval regardless of the pressures of trade economics.

Shares in Cipher Mining (CIFR), Terawulf (Wulf), Iris Power (Iren), Hive Digital Applied sciences (Hive) and BitFarms (BITF) have skyrocketed from 73% to 124% over the previous month, in response to Miner Magazine’s newest trade replace. In distinction, Bitcoin (BTC) slid over 3% over the identical interval.

Some Bitcoin mining shares commerce yearly or at their highest ever highs. Supply: Minor journal

Mining inventory gatherings happen regardless of steady strain on trade fundamentals. The subsequent problem adjustment for the Bitcoin Community is projected to rise by a further 4.1%. This “marks the primary epoch with a mean hashrate on high of the Zetahashmark,” Miner Magazine reported.

One Zetahash milestone first reached in September, primarily based on Bitcoin’s 14-day transferring common hash fee. However the outcomes did little to ease the profitability pressure.

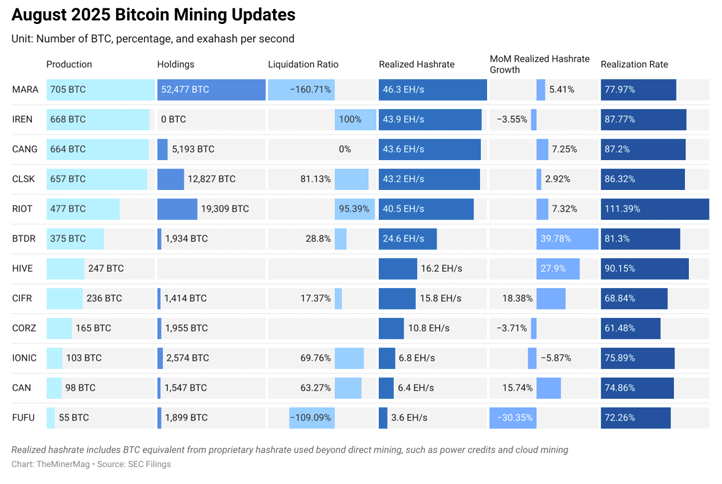

Hashpris remained beneath the Petahash, which was pressured by rising community exercise, of lower than $55 per second, however its buying and selling charges slid at lower than 0.8% of its month-to-month charge.

Bitcoin mining replace for August 2025. Supply: Minor Mug

Nonetheless, traders will reward miners who pursue GPUs and AI pivots, Miner Magazine stated. Hive Digital accelerates its transition to AI knowledge middle infrastructure, Iris Power is rising with Blackwell GPUs, and Terawulf has drawn momentum from its high-performance computing partnership with Google.

Associated: Bitcoin Community Mining Difficulties Rises to the Highest of All Time

Bitcoin miners proceed to build up

Within the face of more durable revenue margins, rising prices and growing competitors, Bitcoin miners are more and more counting on diversifying methods.

Past the pivot of assets to AI and high-performance computing, many miners embrace monetary methods and retain extra mined Bitcoin in anticipation of future worth surges.

Cointelegraph reported on this pattern in January, highlighting a major change in miner accumulation as firms maintain a bigger share of manufacturing till 2024.

“In 2024, there was a major change amongst Bitcoin miners, and we selected to retain the vast majority of the mined Bitcoin or chorus from promoting it completely,” Digital Mining Options and BitcoinminingStock.io wrote in a January report.

Miners seem to double the technique in September, with GlassNode knowledge exhibiting pockets steadiness rising for 3 consecutive weeks. On September ninth, internet influx peaked at 573 BTC. That is the most important every day improve since October 2023.

https://www.youtube.com/watch?v=3_b-7ctsvhy

journal: Bitcoin’s long-term safety price range points: an imminent disaster or FUD?