Bitcoin Miners amenities elevated throughout H1 2025 as Iren, CIFR, CORZ, APLD and MARA lead the variety of holders and capital flows.

Bitcoin mining inventory and investor sentiment

The following visitor put up comes from bitcoinminingstock.io, One-stop hub for all the things Bitcoin mining shares, academic instruments, and business insights. Initially revealed on September 11, 2025, it was written by the creator of bitcoinminingstock.io Cindy Fen.

Our workforce is engaged on the next necessary options, however we needed to share a quick replace on institutional actions within the Bitcoin mining sector. I have been watching for the reason that finish of final yr.

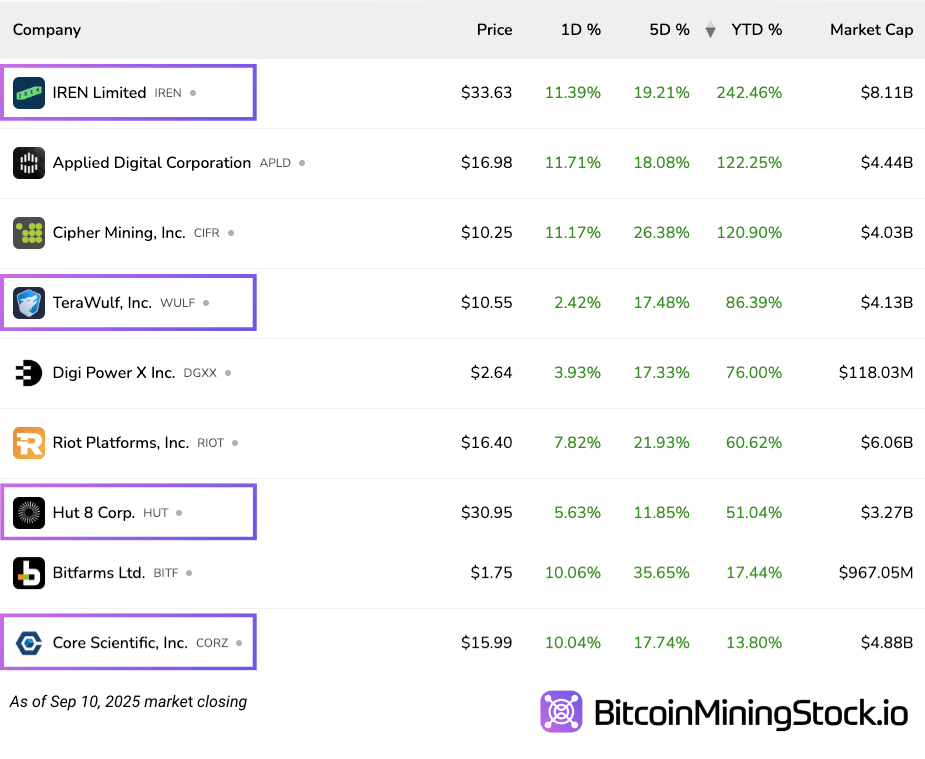

In January, we made it public 2024 Bitcoin Mining Evaluate It was co-authored with from. Digital Mining Options. In that report, It was talked about The company had “huge bets” on the Colts, Wolf, Aylen and Hutt. Thus far, these names are generally discovered Outperform Vast mining sector YTD.

Prime YTD Beneficial properties within the Bitcoin Mining Sector

The report additionally flagged three institutional tendencies.

- Institutional curiosity in Bitcoin miners was on the rise.

- The AI/HPC story was attracting consideration.

- Giant miners remained the default selection for facility capital.

It has a contemporary spherical of 13F filings, so it is a good time to see what’s modified and what nonetheless applies. And most significantly, the establishments are making new bets.

The engine continues to be spinning

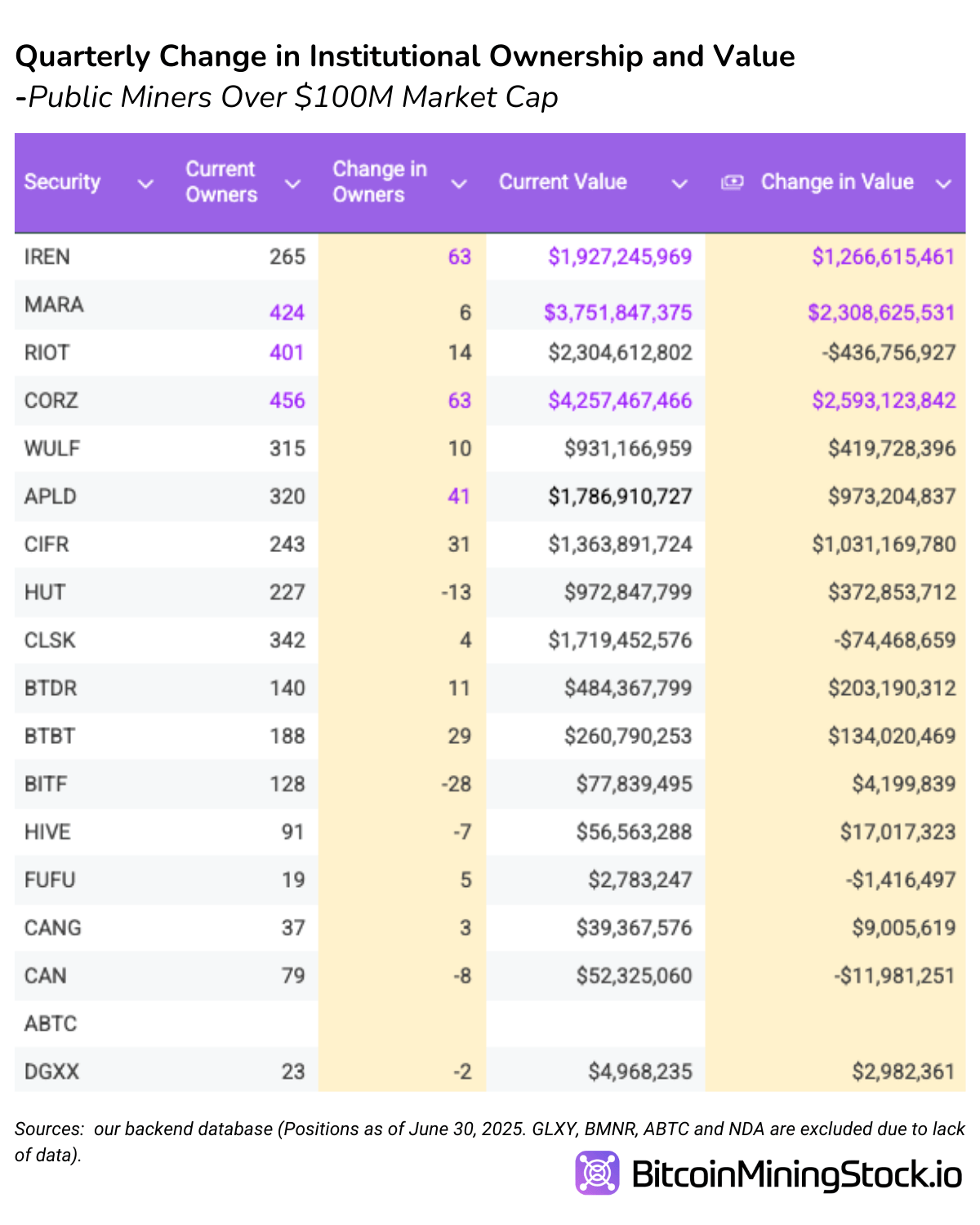

Miners with market capitalizations of over $100 million, most noticed each a rise in institutional possession and a rise in complete capital invested. this Examine the primary pattern: Total, institutional curiosity on this sector remained robust all through H1 2025.

However what’s extra clear is the place The capital is flowing. Iren, Corz and APLD led the fees, every including greater than 40 new institutional holders. What have they got in widespread? All three are uncovered on to AI/HPC.

- Colts and APLD We signed a multi-billion greenback colocation take care of CoreWeave.

- ironhas but to announce any main HPC transactions, however it’s persistently updating the progress of GPU deployment and the AI-Reaid infrastructure market.

This reinforces the concept that The AI/HPC story stays probably the most highly effective institutional pull The complete public mining sector. Establishments are clearly rewarded with corporations that may monetize their knowledge middle infrastructure past Bitcoin.

Greenback Circulation talks the identical factor. Corz, Mara, and Iren Main on rising worth institutional funding, adopted by CIFR and APLD. Mara Though it stands out as the one top-gainer with out legitimate AI/HPC publicity, it stays the most important public miner in each hashrate and Bitcoin Treasury sizes. That is in all probability why it continued to obtain main capital inflows. The company needed pure Bitcoin beta publicity on a big scale. For a very long time, Mara held the highest spot in market capitalization, however till just lately BMNR and Aylen had been overtaken.

Not everyone seems to be gaining love

On the identical time, not all miners continued strolling. You’ll be able to lose BITF, HUT and institutional possession, however you have got seen internet reductions within the worth of Riot, CLSK and institutional holdings.

In some instances, that is in line with a decline in inventory efficiency. For instance, the can is -65.60% ytd. CLSK and BITF confirmed marginal development in YTD (+4.99% and +6.17%, respectively) and lagged behind their friends on the same operational scale.

The shed is an fascinating case. Regardless of shedding 13 institutional house owners, there’s nonetheless a powerful YTD return. It could mirror a turnover, a rise in retail exercise, or a rebalance because of funds, but it surely doesn’t look like a basic difficulty of belief. By the way, Hut has actively positioned its place as an power infrastructure platform as an alternative of Bitcoin miners. They packaged all the computing phase as an unbiased firm, American Bitcoin.

Riot, CLSK and BITF have additionally introduced their HPC exploration, however nobody has ever reported any energyized capability or signature transactions.

The possession share reveals deeper positioning

institutional possession as a share of excellent shares, a number of patterns emerge.

- Colts (78.44%); CIFR (76.06%) and APLD (71.36%) have the very best institutional penetration.

- In a small cap, BTBT It’s excellent with 65.52% institutional possession.

- in distinction, BTDRregardless of its market capitalization exceeding $1 billion, it solely has 22.18% institutional possession.

On the whole, companies with bigger market caps see stronger institutional participation. Nevertheless, exceptions similar to BTBT and BTDR present how necessary the story and imaginative and prescient are.

particularly, CIFR, BTBTand iron Additionally, the utmost was proven The proportion will increase Possession for the second quarter of 2025. All three are leaning closely in the direction of selling HPC/AI ambitions, and the company responds clearly.

So what has modified and what hasn’t occurred?

The latest knowledge confirms what we proposed in our annual report: the company has Publicity continued Their capital will not be evenly distributed within the Bitcoin mining sector. Larger Miner (Market Cap) Persevering with to draw a big portion of the inflow inside that group; Precedence is concentrated in corporations with signed AI/HPC Contract or seen GPU deployment. That explains why Aylen, Colts, CIFR and APLD led the sphere With each new institutional house owners and contemporary capital allocations.

Mara stands out as an exception. However, with out the HPC technique, it holds its place as the highest non-HPC guess pushed by the most important hash charge and sectoral Bitcoin Treasury. In distinction, smaller cap names, folks with out AI publicity, or corporations headquartered outdoors the US proceed to battle to achieve the identical degree of institutional belief.

Wanting forwardthe main focus shifts from positioning to supply. For miners uncovered to HPC, the query is whether or not they can hit contract milestones shortly sufficient to activate capabilities, develop revenues and keep institutional convictions. For Latecomers, the problem is to carve out a transparent story and again it up with exhausting numbers.

Additionally it is value noting that corporations with already excessive institutional possession might start to face restrictions just because lots of their floats are already institutionally held. In the meantime, miners with low facility possession however dependable infrastructure and energy capabilities can be found for reevaluation if the best catalysts emerge. In different phrases, the establishments present the place their beliefs are; The market stays liquid. Finally, the run separates the chief from the laguard of the earlier quarter.

Methodology and limitations

This replace relies on the most recent 13F submitting backend aggregation as of June 30, 2025. The figures mirror the lengthy honest place reported by US institutional filers, excluding derivatives, swaps, and most non-US filers. 13FS seems backward, so the place displayed might differ considerably from the place the establishment is standing on the time of writing.