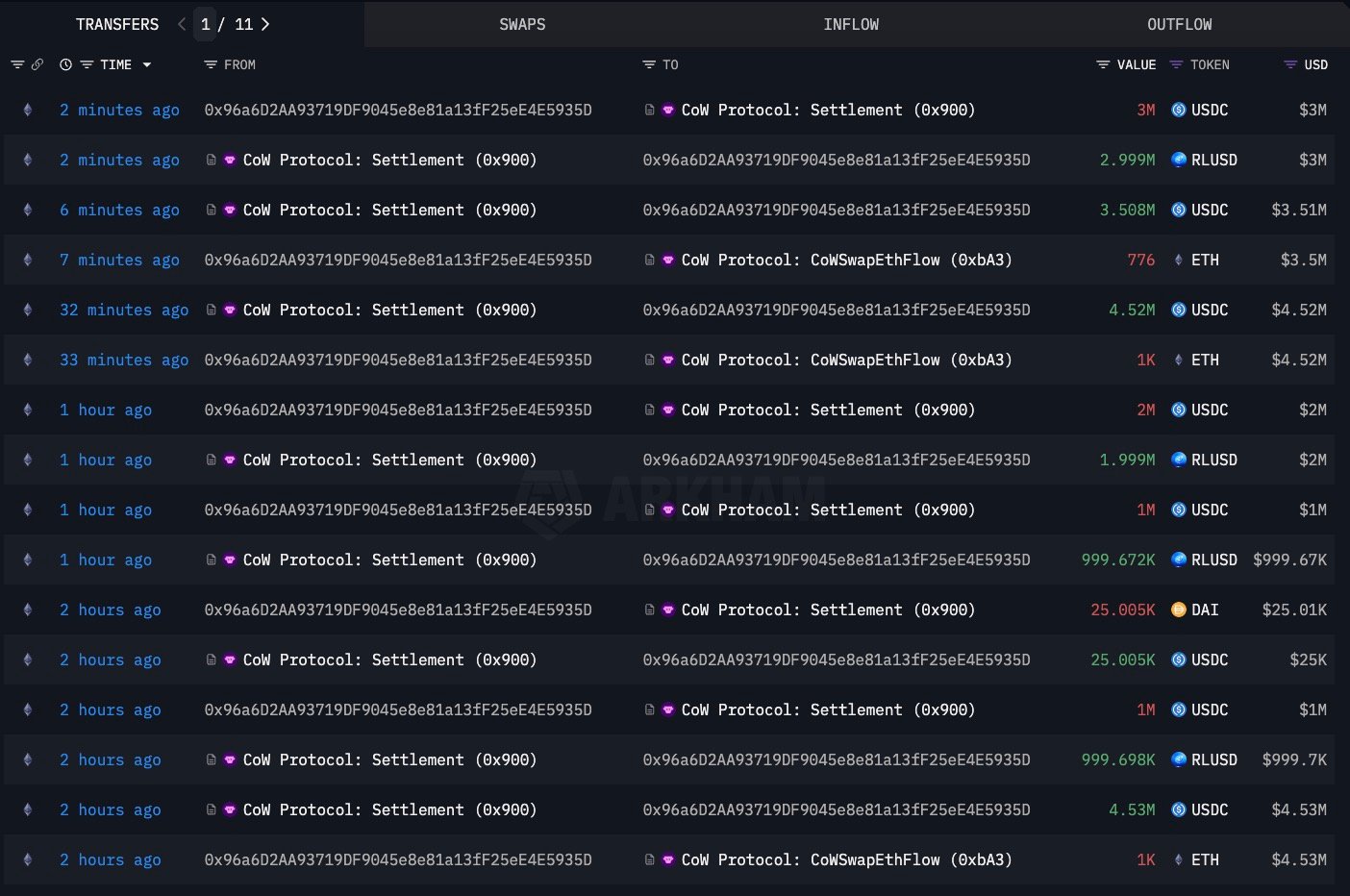

The previous Ethereum pockets, which hasn’t moved cash for 3 years, all of the sudden decides that now is an effective time to behave, sending 2,086 ETH to stablecoins value $9.48 million, spreading it to stablecoins like DAI, USDC, RLUSD, and gross sales are carried out by way of cow protocols.

The fascinating half is that this wasn’t a whole exit as Ethereum OG nonetheless holds 2,779 ETH and is valued at round $12.6 million.

This transfer appears like somebody is leaving ETH, however somebody who believes the $4,544 degree is robust sufficient to justify the lock on earnings, however maintains loads of publicity in case the rally has extra room for driving.

When the 2017 tied up Ethereum deal with made headlines for transferring 8,310 ETH value $41.4 million into trade, that is a special story.

Ethereum (ETH) worth alternatives

Ethereum’s worth motion explains a part of the logic, indicating that Altcoin is reluctant to interrupt $4,600-$4,700 across the $4,500 zone, with its weekly charts reluctant to interrupt $4,600-$4,700, making it a pure space for long-term holders to scale back threat.

From their perspective, after embracing this yr’s battle, the struggle for laws, and the best ever new top, the choice to promote right here is to not timing the precise high, however to maintain sufficient cash to affix in when the story is rising, whereas nonetheless being in regards to the crystallization of earnings that almost all merchants can dream of.