London-based fintech firm LMAX Group has entered the utilised crypto derivatives market and revealed everlasting Bitcoin and ether-related futures contracts focusing on institutional purchasers.

In line with a report from Bloomberg on Wednesday, the alternate was pushed by consumer demand for extremely leveraged entry to the Crypto market, exceeding the each day spot quantity averaged over $40 billion throughout Foreign exchange and digital property.

“For the previous three or 4 years, the everlasting future has dominated the crypto market,” stated David Mercer, CEO of LMAX. “Purchasers from our establishments, together with prime proprietary buying and selling corporations and brokers, are on the lookout for such publicity,” Mercer added.

Everlasting is a form of monetary spinoff that features like conventional futures contracts, however has no expiration date. With the supply of LMAX, you possibly can leverage as much as 100 occasions extra. LMAX operates international alternate brokers within the UK, Europe, New Zealand and Mauritius, following their web site.

Cointelegraph contacted the LMAX group for remark however was not responded by publishing.

Associated: Excessive threat and excessive reward: The lasting way forward for codes will achieve momentum for us

Perps dominates crypto buying and selling quantity

In line with Kaiko, everlasting futures dominate crypto buying and selling exercise, accounting for 68% of all Bitcoin (BTC) quantity in 2025, ranging from 66% final 12 months.

Main exchanges corresponding to Binance, Bybit and OKX account for nearly 70% of open curiosity in these merchandise, with each day PARP volumes starting from $10 to $30 billion, with Binance alone reaching $80 billion per silkworm.

Everlasting controls buying and selling at a quantity of $1.39 trillion within the final 24 hours, far surpassing conventional futures contracts, exceeding simply $670.61 million, based on Coinmarketcap knowledge.

Without end managed crypto derivatives buying and selling. Supply: CoinMarketCap

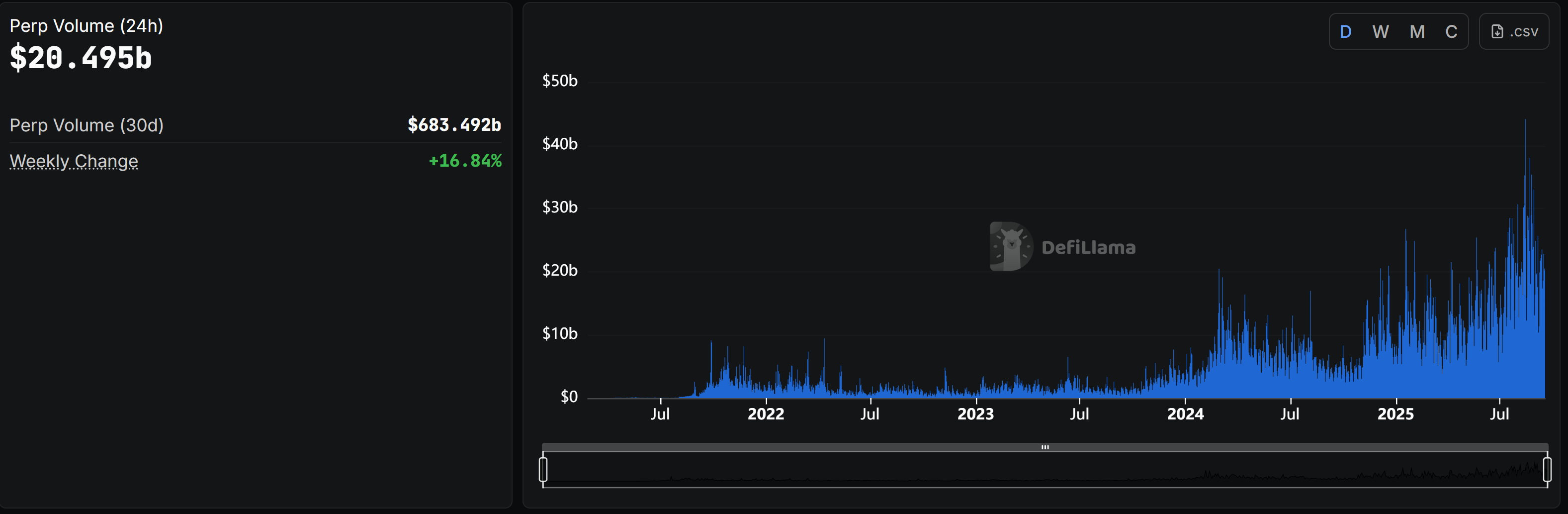

In the meantime, per Defilama’s knowledge, the decentralized, persistent platform collectively processes $20.5 billion on a 24-hour quantity, with a 30-day complete of over $683.5 billion, reflecting a weekly surge of 16.84%. Excessive lipids alone contributed over $65 billion over the course of seven days.

The decentralized, persistent platform collectively processed $20.5 billion on a 24-hour quantity. Supply: Defilama

Associated: “Crypto Forcures Futures will probably be coming quickly,” stated Mersinger of CTTC.

perps arrives within the US

LMAX Group’s push to the Crypto Derivatives market strikes main US venues to supply retail entry to an enduring future. Coinbase will start providing Perps to US prospects in July, and Cboe will launch its model in November.

In April, one European deal launched a everlasting MiFID II compliant, however the providing is proscribed to institutional purchasers. The platform plans to increase its merchandise to eligible retail purchasers.

journal: Can a tokenized stock of Robinhood or Kraken actually be decentralized?