The Federal Reserve’s 25 foundation level (BP) fee lower has sparked a important transfer throughout the most important whales within the crypto market.

From massive Ethereum (ETH) purchases to facility solana (SOL) withdrawals and shifts within the dynamics of XRP provide, this response displays how macropolicies form the cryptographic move.

Eth Whale deploys $112 million post-feeding cuts

Hours after the Fed introduced its quarter level lower, on-chain trackers flagged the unbelievable Ethereum buy.

In keeping with lookonchain, the whale’s deal with 0xd8d0 spent $112.34 million to get 25,000 ETH for $4,493.

After FRB is decreased by 25bps, OTC whale 0xd8d0 spends 112.34m $usdc to purchase 25,000 $eth at 4,493.https://t.co/7euzqpgfro pic.twitter.com/vf55m9te9e

– lookonchain (@lookonchain) September 18, 2025

Aggressive accumulation displays new confidence that borrowing prices and delicate {dollars} can lead liquidity to dangerous property.

Already decreasing demand and hoping for upgrades to scale, Ethereum noticed a direct enhance in whale exercise. This implies that the company is on the forefront of wider gatherings.

One other whale, deal with 0x96F4, individually withdrawn 15,200 ETH, price about $70.44 million from the Binance alternate inside two hours. This provides to hypothesis that the buildup is intensifying amongst deep gamers.

The establishment continues to stack Solana

Solana will not be that lively. Company dealer Falconx has withdrawn 118,190 Sol, price $28.39 million from Binance, marking yet one more indication of institutional belief.

LookOnChain information exhibits that six strategic reserve entities every have over 1 million SOLs.

The ahead trade is taking the lead, incomes a large 682 million Sol portfolio price $1.58 billion with a median value of $232.

At present there are six strategic $SOL reserve entities every holding over $1 million.

Amongst them, the ahead trade has a large $6,822,000 Sol ($158 million), with a median buy value of $232. pic.twitter.com/yxs6azmfdr

– lookonchain (@lookonchain) September 16, 2025

The quantity of Solana Futures has reached $22.3 billion in current weeks, and it seems that SOL at the moment has a stronger demand from each establishments and whales amongst property coated by the ETF record based mostly on the SEC’s new generic normal.

XRP Whale strikes $50 million to Coinbase

XRP actions took a distinct type. The Whale has shifted its $16.4 million XRP to Coinbse Trade, which is greater than $50 million.

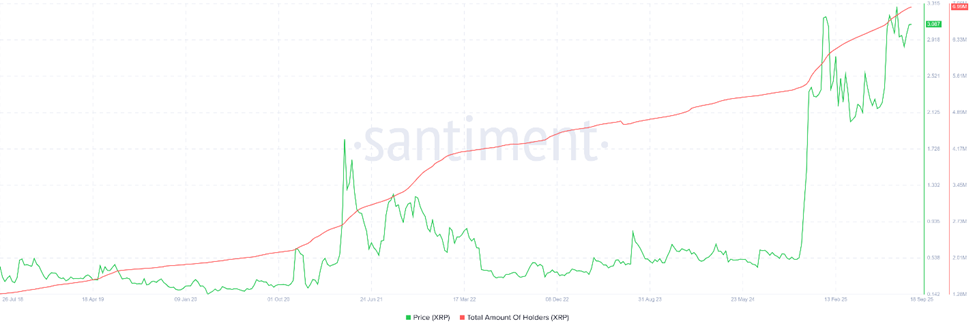

The transfer coincided with one other XRP milestone. The XRP reached 6.99 million holder bases in September 2025, making it the brand new ATH (ATH).

XRP holders will skyrocket to ATH. Supply: Santiment

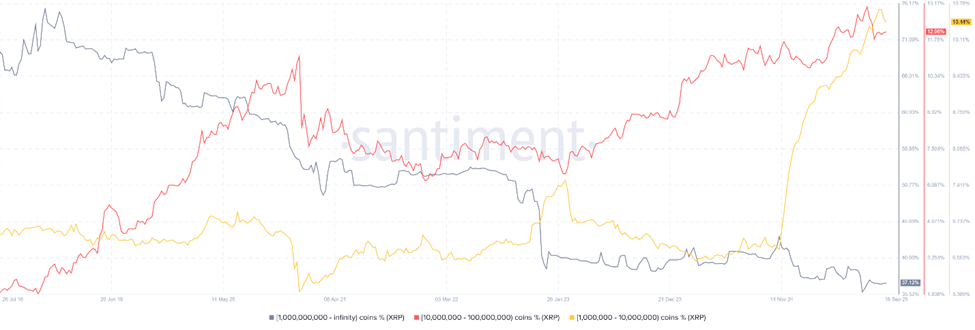

Nonetheless, underneath the floor the distribution is altering. The availability share of wallets with XRP exceeding 10 billion has declined, however the variety of mid-sized holders of XRP to 1 billion has skyrocketed.

XRP holder distribution. Supply: Santiment

This means a structural shift from enriched whale holdings to wider retail participation.

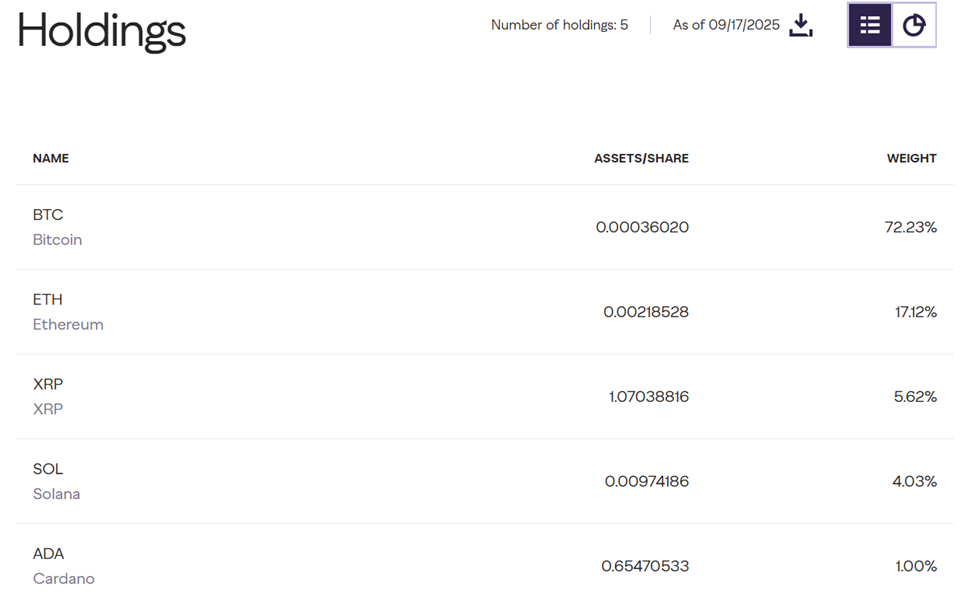

XRP’s Increasing Establishment Profile

However, XRP continues to punch past the power’s market weight. It at the moment holds the third largest allocation in Grayscale’s Digital Giant Cap Fund, which was lately permitted by the SEC generic ETF record normal.

GDLC Holdings from Grayscale. Supply: Grayscale Investments

“The Grayscale Digital Giant Cap Fund $GDLC has been permitted for buying and selling together with generic record requirements. The Grayscale crew is working shortly to ship the primary multicrypt property ETP to the market together with Bitcoin, Ethereum, XRP, Solana and Cardano.”

On the similar time, CME is planning to launch futures on XRP, with the choice debuting on October thirteenth with regulatory approval.

Falconx and DRW are one of many firms supporting launches, permitting them to unlock new demand from deeper hedging instruments and establishments. Already, XRP futures have reached $1 billion of public income, highlighting robust liquidity.

Accessing whale rearrangement convergence, shifting provide distributions, and prolonged derivatives paint bullish mid-term work.

Whereas XRP’s short-term costs stay low, the market construction means that the inspiration is laid for wider adoption and investor belief.

What ETH, SOL and XRP whales did is what they did after the Fed’s 0.25% rate of interest lower first appeared in Beincrypto.