Bitcoin is situated close to $113,000 as of September 23, 2025, and has recovered from the month-to-month medium-term revision. The broader narrative of US coverage has modified dramatically this 12 months after President Trump’s government order created a strategic Bitcoin sanctuary in March.

The reserve already has round 198,000 BTC on the property which have been confiscated, but when Congress passes the regulation to codify and develop it, a essential second will come.

We used OTC knowledge on superior chain prompts, market context, BTC provide, and CHATGPT to foretell Bitcoin’s worth response to varied legislative outcomes. The evaluation exhibits what arithmetic is telling us, and which markets ought to merchants watch.

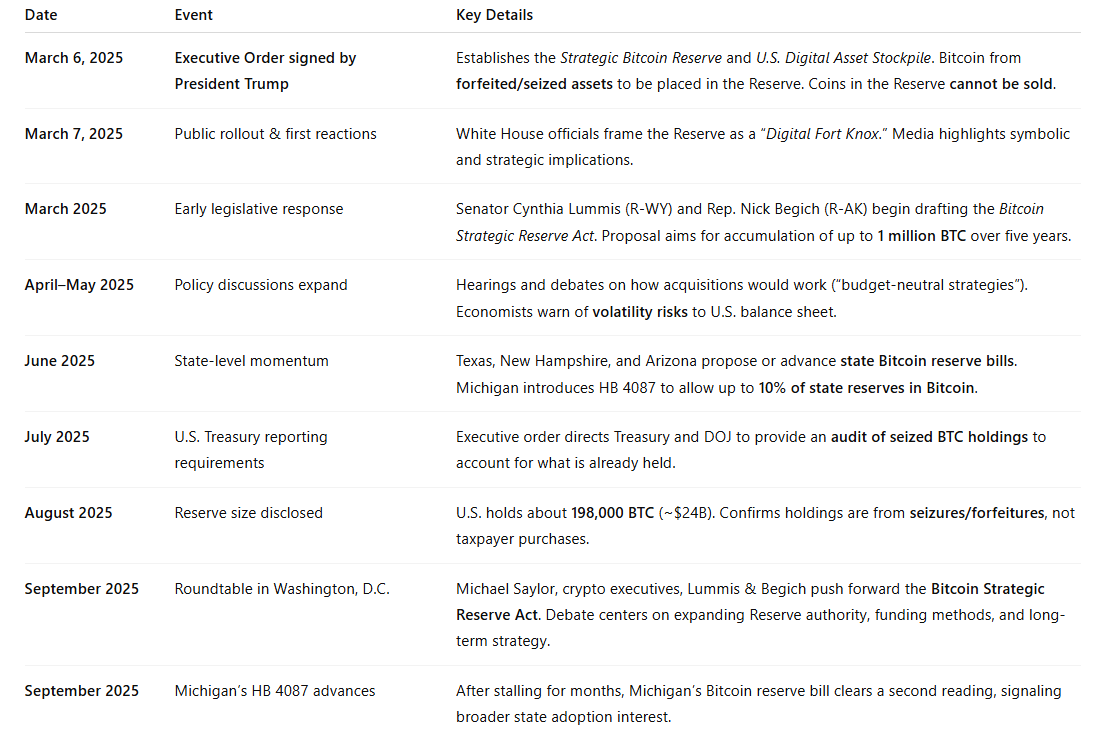

US Bitcoin Reserve Timeline

What Congress is discussing

- Govt Order (March 2025): It established a strategic Bitcoin reserve and a US digital asset stockpile, inserting seized Bitcoin in everlasting federal custody and banning gross sales.

- Pending Invoices: Senators Cynthia Ramis and Nick Begich launched it Bitcoin Technique Preparation Methodologysome drafts recommend accumulation 1 million BTC over 5 years.

- Essential variations: Govt orders are reversible by future presidents. The regulation might doubtlessly be locked up in reserves, outline reporting guidelines and require new purchases.

Why Necessary Bitcoin Purchases Change Every thing

New Bitcoin problem after harving 164,250 BTC (~450/day) per 12 months. Parliamentary duties to buy 200,000 BTC per 12 months (~550/day)

Authorities requests should deduct cash from the alternate stability with OTC until the long-term holder or miner is actively bought.

- OTC Provide: It was estimated to be near 155,000 BTC in August 2025, and it has dropped sharply since 2021.

- Change Stability: It hoveres and drops round 2.9 million btc.

- outcome: Massive authorities applications will strengthen liquidity and implement increased liquidation costs.

4 Bitcoin Reserve Eventualities to Contemplate

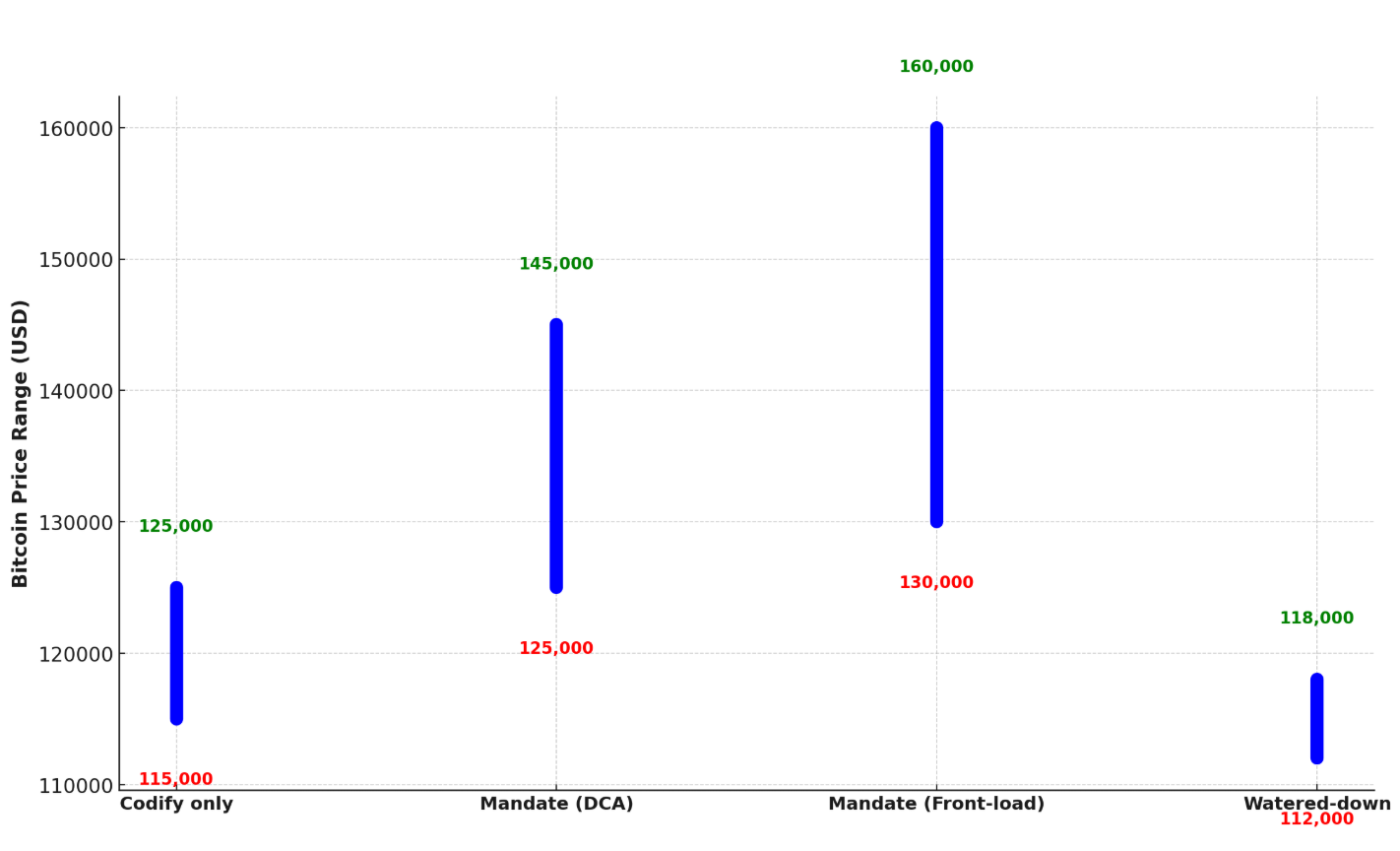

A. Solely system

If Congress merely turns government orders into regulation with out a buy obligation, then the reserves will likely be troublesome to rewind politically. that is:

- Lowers the US regulatory threat premium.

- It helps secure inflows to Spot ETFs and the Ministry of Company Finance.

- It will probably trigger extra modest grinding, however not a structural provide shock.

B. DCA gradual order

If the regulation requires ~200k BTC/12 months a 12 months and the Ministry of Finance is progressively carried out by way of OTC and ETF, Bitcoin could have larger demand every day demand than new issuance. Anticipated:

- Everlasting upward drift separated by sharp conferences on the run.

- Thinning of the OTC stock, forces the circulate to progressively transfer to alternate.

- As structural demand continues, pullbacks turn out to be a purchase order alternative.

C. Delegation by buying entrance street

The front-loaded accumulation plan shortly emits OTC shares and drives the Treasury into the direct alternate market. that is:

- Volatility spikes and broad sliding set off sharp re-ricks increased.

- It might entice imitation bids from companies, pensions and sovereignty.

- The dangers and subsequent integration of making unsustainable short-term spikes.

D. Boning Compromise

If the regulation is symbolic, however you keep away from shopping for funding or targets, the primary headline could cause a brief pop. however:

- Merchants will probably debilitate their actions.

- Market impacts are just like “promoting information” behaviour.

Essential buying and selling alerts to watch

- Bill textual content: Search for specific buy targets within the remaining model.

- Monetary Steering: Begin date and rhythm of the acquisition program.

- ETF Creations: A sustained internet influx of over $300 million per day confirms structural demand.

- OTC Chat: Spreading and delays in procurement refers to supplying stress.

- Alternative depth: Decreasing the depth sign for orders by 1% will increase the danger of slipping.

BTC worth degree to observe

- help: $110,000 (post-liquefied foundation), $100,000 (psychological anchor).

- resistance: $116,000 (September Excessive), $125,000 (Breakout Stage), and $150,000 (Psychological Magnets if Mandate Passes).

Potential Bitcoin Value Vary US Reserve Legislative Eventualities (2025)

Macro Overlay

Federal Reserve coverage, US greenback energy, and gold correlations stay essential. Dubu feeding and weaker {dollars} amplify the other way up from the reserve regulation, however the hawk shock can blunt its effectiveness.

If Congress passes Bitcoin ought to profit from decrease coverage threat and powerful ETF flows, and will keep an upward grind.

If the lawmaker passes Necessary accumulation programcirculate arithmetic is evident. As authorities demand outweighs new provide and OTC reserves already skinny, Bitcoin liquidation costs should rise to withdraw sellers.

The ultimate textual content of the regulation is topic to modest coverage tailwind and full provide shock.

Merchants have to be ready for each outcomes. Nevertheless, in both case, US regulation relating to strategic Bitcoin reserves will show a historic change in Bitcoin’s world function as a sovereign protected asset.

PostAI forecasts BTC costs if the US Congress passes the Bitcoin Reserve Act.