Ethereum costs It slid below the $4,200 help zone and triggered a pointy repair that rattled the broader Altcoin market. ETF flows weaken, macro uncertainty will increase, and technical breakdowns seem on each day charts, traders ask the identical questions. ETH costs are geared toward deeper corrections Or a brief shakeout?

Ethereum Information: Why did Ethereum Value fall under $4,200?

The most recent DIP was triggered when Ethereum misplaced $4,200 in help. This breakdown coincides with the liquidation of greater than $1.7 billion in cascades throughout Altcoins, of which $222.9 million got here from ETH alone. Such compelled gross sales promote momentum, speed up to the downsides, and sometimes overshoot fundamental worth.

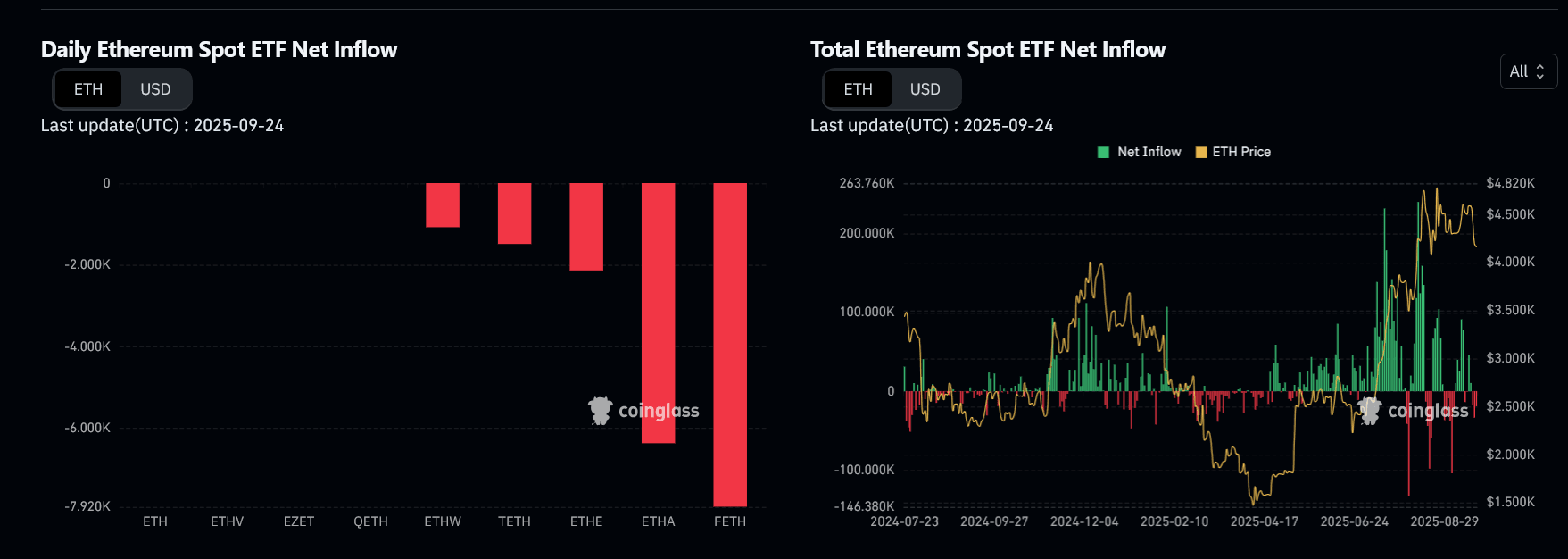

Picture Supply: Overview of Coinglass ETH ETF

Ethereum ETF knowledge is about the actual story right here. There was solely $110 million in ETH ETF inflows in September, a big drop in comparison with $3.8 billion in August. Worse, the newest knowledge exhibits constant leaks throughout a number of Ethereum ETF merchandise, with Feth and Etha exhibiting the heaviest redemptions. It is a clear indication that institutional urge for food is being cooled, eliminating key drivers for summer season gatherings.

The change in momentum is evident on the cumulative ETF web influx chart. After peaking with giant spikes on the inexperienced bar in mid-2025, the influx flattened and adverse slips. It undermines the story of ETFs as a sustainable bull driver.

Ethereum Information: Fed charge discount loses punch

The Fed reduce 25 foundation factors in September, however Chairman Jerome Powell’s assertion issued an announcement that he “just isn’t in a rush” to scale back the belief of the market that has been additional broken. The dearth of flashy follow-through signifies that crypto merchants are not betting on fast liquidity injections. This impartial to barely hawk stance reduces the attraction of speculative threat belongings comparable to ETH, particularly after such giant gatherings.

Ethereum worth forecast: Failure sign is dangerous first

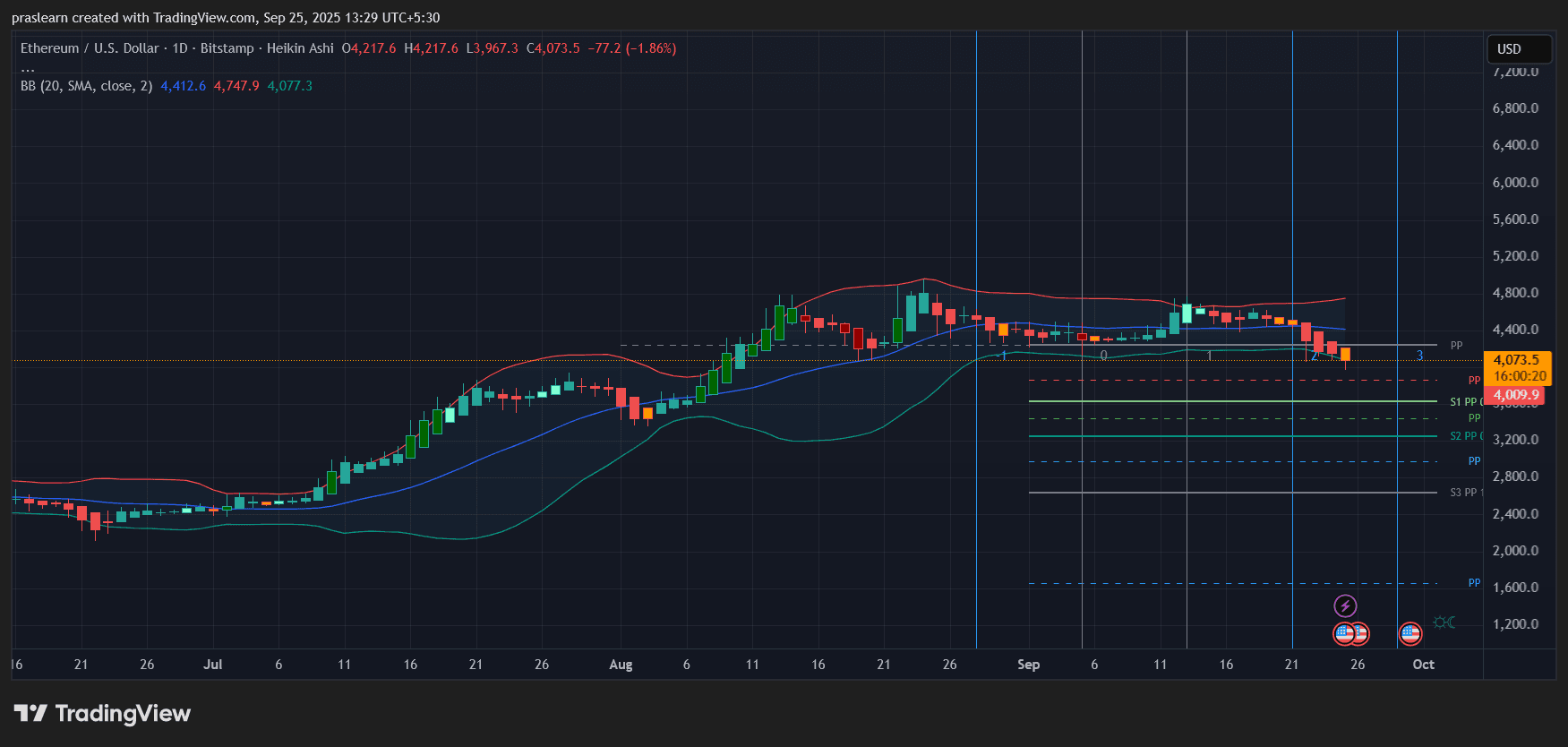

eth/usd each day charts – TradingView

At TradingView Each day Chart, ETH costs are buying and selling almost $4,073, down under the Bollinger Bands midline and heading for almost $4,000 band help. The hikin ash candle turns pink in a number of consecutive periods, exhibiting clear gross sales momentum.

There are at present main help ranges:

- $4,000 psychological barrier

- $3,750 Pivot Help

- Deepered Flaws $3,200 (S2 Pivot)

The benefit is that resistance is $4,400 and $4,750, each of which have to be shortly recall to reset bullish momentum.

The pivot chart exhibits that Ethereum costs are being destroyed below the central pivot, suggesting that sellers are in management for now. If the worth is decisively under $4,000, the subsequent leg can simply take a look at it at $3,750 or $3,200.

Quick-term Ethereum Value Prediction: Can ETH Costs Maintain $4,000?

The mix of ETF spills, failed macrocatalysts, and technical breakdowns makes $4,000 a key battlefield. The bounce from right here requires a brand new inflow of ETFs or a robust spot buy, so feelings have to be reversed. With out that, ETH may consolidate between $3,750 and $4,200 for weeks, irritated the bull who hoped to interrupt out at $5,000.

If the ETF stream stays adverse, then $ETH dangers slipping to $3,200 within the fourth quarter. In the meantime, as US macro knowledge softens and Powell alerts extra cuts, the ETF inflow will revive, giving ETH pushbacks above $4,500.

Ethereum fixes are extra than simply chart-driven occasions. It’s strengthened by weakening ETF flows and fewer supportive Feds. Merchants have to carefully monitor $4,000. In the event you do not hold it, you possibly can open the door to a a lot deeper correction, however fast recall of $4,400 will restore confidence. For now, you might want to watch out, and adverse aspect safety appears to be like clever till the stream assessments constructive once more.