Sam “SBF” Bankman-Fried, founder and former CEO of the bankrupt cryptocurrency Alternate FTX, mentioned his “bigest mistake” amid the $8 billion collapse is handy over the corporate’s administration to new administration groups.

Bankmanfried, a former chief of the $32 billion FTX trade, served a 25-year jail sentence on seven felony fees associated to the collapse of the FTX and Alameda analysis in November 2022, leading to a lack of $8.9 billion for the investor fund.

Trying again on the collapse of FTX, Bankman-Fried’s “huge mistake” was handy over the corporate’s management to present CEO John J. Ray III on November 11, 2022.

“The one greatest mistake I’ve ever made was handing over the corporate,” SBF informed information outlet Mom Jones in an interview printed Friday.

A couple of minutes after signing Crypto Alternate, Bankman-Fried obtained a name a few potential exterior funding that would have saved the corporate from chapter, however it was too late to revoke his signature, he claimed.

After being appointed as new CEO, Ray filed for Chapter 11 chapter on November 11, 2022, hiring regulation agency Sullivan & Cromwell (S&C) for authorized help within the case.

Bankman Fried was arrested within the Bahamas on December 12, 2022 after US prosecutors filed prison fees in opposition to him. He was handed over to the US in January 2023.

FTX collapsed attributable to fraudulent diversion of person funds, leading to billions of {dollars} value of buying and selling losses from its sister firm Alameda Analysis. The quantitative buying and selling firm used FTX buyer funds transferred by the financial institution with out agreeing to Alameda’s transaction losses, now referred to as the Alameda Hole.

Associated: Wall Avenue’s subsequent crypto play might be an IPO-enabled crypto firm, not Altcoins

Sullivan & Cromwell advisable Ray as SBF’s new FTX CEO

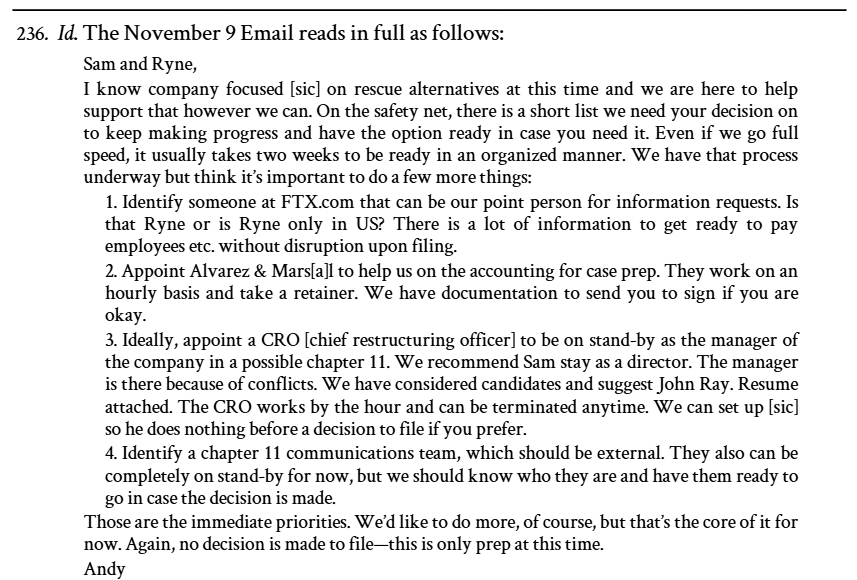

Two days earlier than FTX’s chapter submitting on November ninth, S&C lawyer Andrew Mietderich emailed bankers a plan to suggest to rent Ray as chief restructuring supervisor “in Chapter 11 attainable.”

Supply: documentcloud.org

On February 16, 2024, a gaggle of FTX collectors sued the regulation agency, claiming that they performed a task in FTX’s multi-billion greenback fraud, which helped the corporate profit financially. The lawsuit looking for to help fraud, promote fraud and damages for breach of fiduciary obligation was voluntarily dismissed in October 2024.

In response to a authorized submitting reviewed by Reuters, S&C had acquired greater than $171.8 million in authorized charges from the FTX chapter by June 27, 2024.

Associated: Melania Trump plugs in memo cash in $10 million promoting a $10 million workforce

FTX customers are nonetheless ready for greater than $4.2 billion in repayments

Virtually three years after the trade collapse, FTX collectors are ready for full reimbursement.

FTX Property started paying off collectors with a $1.2 billion fee in February, and $5 billion distribution was made in Could. With funds in September, the trade reimbursed collectors a complete of $7.8 billion.

FTX is estimated to have recovered property value as much as $16.5 billion out there to repay collectors. Meaning collectors are anticipated to obtain an extra $8.7 billion.

As of November 2022, Alternate plans to repay at the very least 98% of its clients 118% of its account worth.

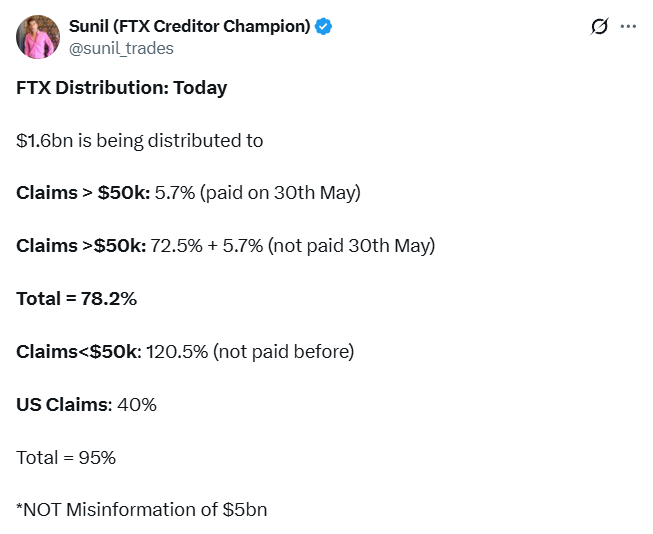

sauce: Sunil

FTX distributed a 3rd set of repayments value $1.6 billion to customers on September 30, in line with Sunil, a creditor and buyer advert hoc committee member.

The collapse of FTX has sparked a wave of chapter all through the crypto business, resulting in one of many longest bear markets within the sector’s historical past. Bitcoin (BTC) has dropped to $16,000 after fallout.

Journal: $2,500 DOCO on FTX collapse on Amazon Prime… With assist from Mother