Bitcoin costs are nearing their all-time excessive, backed by elevated open earnings. With value motion above the primary ranges, the market construction stays firmly bullish.

abstract

- Bitcoin is testing a $123,348 resistance. That is the final essential barrier, the best new barrier ever.

- The channel construction stays bullish, with steady highs and better lows.

- Open earnings are rising, confirming demand and supporting $131,000 for bullish continuation.

Bitcoin (BTC) momentum continues to be constructed as costs method the higher restrict of long-term buying and selling channels. After defending the channel low on the confluence with the purpose of management, the BTC started a rally to the $123,348 high-time body resistance zone. The area now stands as the last word barrier earlier than establishing a brand new all-time excessive.

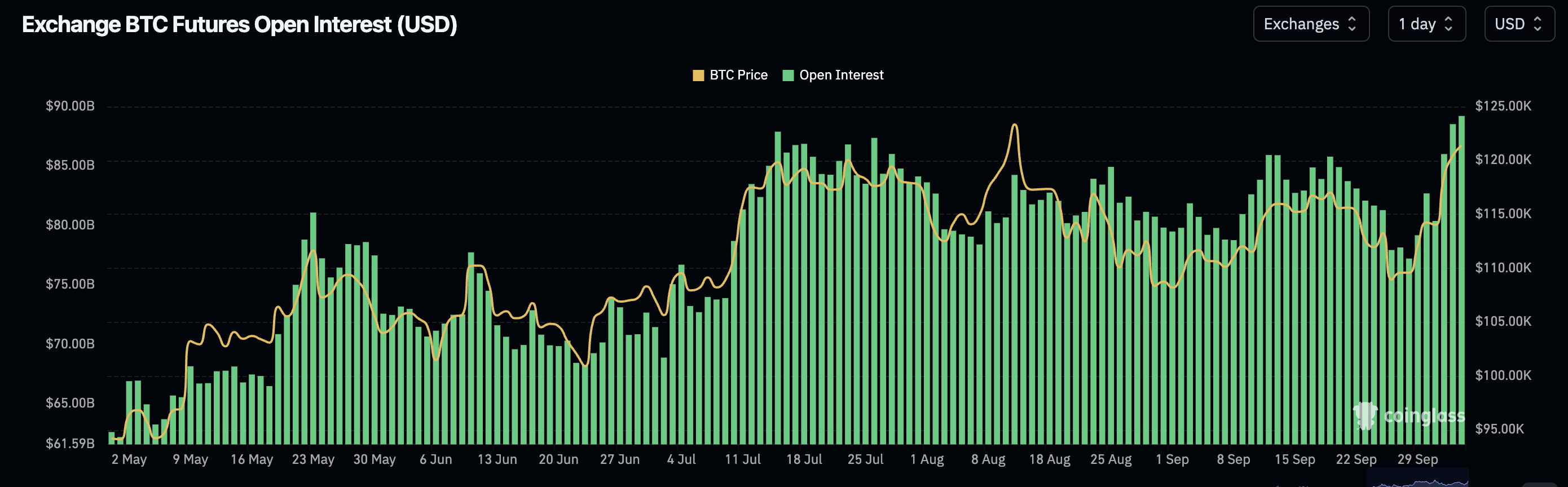

With parallel open curiosity rising together with costs, this transfer is supported by wholesome demand and elevated market participation. Along with this energy, the technique’s Bitcoin Holding rose to $77.4 billion as BTC regained a degree of $120,000 and highlighted belief from gamers at key establishments.

Essential technical factors of Bitcoin value

- Bitcoin is testing a high-time body resistance of $123,348. That is the best last barrier of recent historical past.

- The channel construction stays intact at steady highs and better lows.

- The rising open curiosity confirms robust demand and helps the present bullish growth.

You may prefer it too: Inventory Market Information: S&P 500 expands rally in response to shutdown delayed job studies

BTCUSDT (1D) chart, supply: TradingView

Bitcoin’s value construction continues to respect established buying and selling channels. Every pivot, represented by the primary greenback degree on the chart, maintains a bullish construction. Latest respect arises with channel lows which can be according to the factors of management, making a launchpad good for bullish gatherings. This response pushed Bitcoin to a $123,348 resistance. This can be a zone that’s essential for the market to look at to arrange for potential breakouts.

You may prefer it too: If the SEC approves the Doge ETF this month, will Dogecoin Worth attain $1?

If this resistance is recaptured decisively, the market opens the door to “blue sky breakout” and value discovery brings Bitcoin to unknown territory. Traditionally, this state leads to a state of low fluidity above its highest top ever. The following logical goal throughout the channel is the $131,000 area, alongside the channel’s prime resistance.

The market construction continues to assist this bullish state of affairs. The excessive and better and decrease sequences stay intact, highlighting the energy of the uptrend. Every growth is adopted by a wholesome revision to make the pattern sustainable. This managed development provides credibility to the concept Bitcoin is just not solely ralliing, but in addition constructing a structurally sound basis for continuity.

BTC Open Curiosity, Supply: Coinglass

A rise in open curiosity is one other confirmatory issue. As costs rise, so does the variety of energetic positions out there. This consistency between value rises and open revenue progress exhibits that actions are supported not solely by short-term hypothesis but in addition by genuine demand.

In earlier cycles, the rising open curiosity together with bullish constructions has premonitored a powerful, persevering with gathering. Reflecting this optimistic optimism, Wall Avenue’s main banks are even predicting that Bitcoin can rise as a lot as 231K.

What to anticipate from future value motion

Bitcoin stays bullish in all technical views: value construction, market construction and open curiosity. A breakout above $123,348 might drive momentum to $131,000, the place channel resistance is current. Merchants ought to predict elevated volatility in blue sky areas, however with rising open curiosity, the setup will improve continuity.

learn extra: PI community costs keep low yearly because the market enters its promoting state, however is it attainable to reverse it?