The primary Spot XRP Alternate-Traded Fund (ETF) within the US has been launched in just below two weeks and has proven modest weak point since its debut.

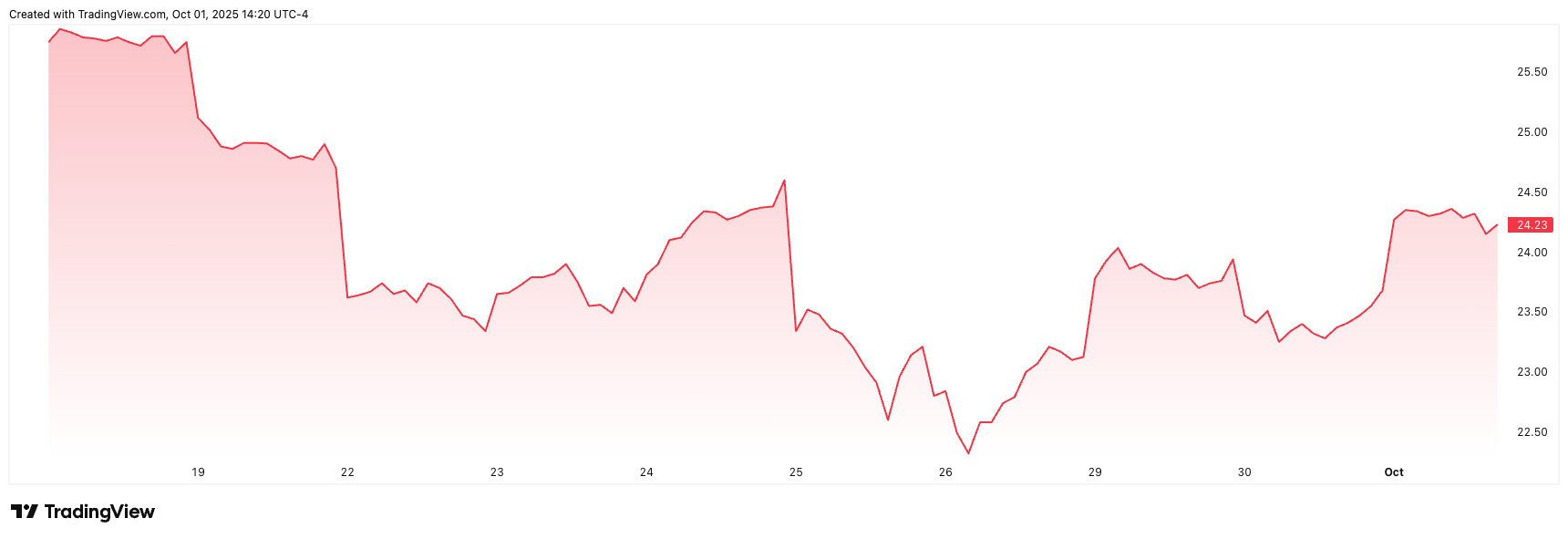

Particularly, the Rex-Soprey XRP ETF (XRPR) was launched on September 18th for $25.83. By press time it was buying and selling at $24.15. This has been a lower of roughly 6.5% since its launch.

This pullback displays the frequent tendencies seen in newly listed cryptographic ETFs. There, early liquidity, market institution actions, and early buying and selling flows usually generate short-term volatility.

Specifically, the Rex-Soprey XRP ETF obtained fast approval attributable to its distinctive regulatory construction. Not like conventional spot Crypto ETFs, which may take as much as 240 days to SEC opinions beneath the Securities Act of 1933, Rex-Soprey was made up of beneath the Funding Firms Act of 1940, shortening the evaluation to roughly 75 days.

The current adoption of the final itemizing requirements for goods-based ETFs in main exchanges corresponding to NASDAQ, CBOE BZX, and NYSE ARCA has eradicated the necessity for particular person purposes beneath part 19(b) of the Inventory Alternate Act of 1934.

Regardless of the gradual begin, XRPR’s checklist marks a milestone within the US market and supplies mainstream entry to XRP by conventional securities accounts.

Earlier than the US launch, each Brazil and Canada had already launched Spot XRP ETFs in 2025. Brazil’s Hashdex Nasdaq XRP Fund started buying and selling on B3 Alternate in April, turning into the world’s first regulated spot XRP ETF.

In June, Canadian issuers corresponding to Goal Funding and Evolve gave earlier traders earlier publicity by regulated merchandise following their lawsuits following their launch on the Toronto Inventory Alternate.

Spot XRP ETF pending

The Rex-Sosprey Fund isn’t just XRP ETFs. A number of key asset managers have pending purposes with the Securities and Alternate Fee (SEC), and choices are anticipated within the coming weeks.

The broader approval may considerably enhance institutional entry to XRP, reflecting the effectiveness seen when Spot Bitcoin and Ethereum ETFs acquire regulatory clearance.

If extra US SPOT XRP ETFs are permitted, analysts count on a stronger inflow that may help long-term worth development, together with potential derivatives corresponding to CME futures and choices.

Nevertheless, short-term efficiency could stay risky, as proven by the preliminary 6.5% discount in XRPR.

On the press convention, XRP is buying and selling at $2.93, up about 3.5% over the previous 24 hours, however down 0.68% over the week.