Modifications in international demographics and elevated wealth might strengthen cryptocurrency adoption and demand for property within the subsequent century.

Demand for international property, together with cryptocurrencies, is anticipated to be pushed by international getting older and elevated productiveness worldwide, leading to older folks with extra capital investing.

The dynamics will drive asset demand via 2100, in line with the US Federal Reserve Financial institution of Kansas Metropolis. “When it comes to asset demand, inhabitants getting older signifies that the upward development in current a long time continues,” the survey report, launched on August twenty fifth, acknowledged.

“If we develop our historic evaluation utilizing demographic forecasts, we count on getting older to extend 200% of GDP by an extra 200% between 2024 and 2100.”

The report added that the dynamic might “imply a steady decline in actual rates of interest,” and will improve the demand for different investments reminiscent of Bitcoin (BTC).

Supply: kansascityfed.org

Associated: Crypto Dealer turns $3K to $2 million to $200 after CZ Publish sends Memecoin Hovering

Traders will cherish Bitcoin like gold over the subsequent 75 years

Cryptocurrency continues to be thought-about a harmful asset, however growing readability of laws might worth gold as a lot because the getting older inhabitants (BTC) over the subsequent 75 years, in line with Gracy Chen, CEO of Cryptocurrency Alternate Bitget.

In accordance with a report by the Crypto Fee Firm Triple-A, a couple of third of worldwide cryptocurrency house owners, or 34%, had been between 24 and 35 years outdated as of December 2024.

Whereas Crypto stays a risky asset class, elevated regulatory readability and institutional merchandise like ETFs might make Bitcoin extra enticing to older buyers, he advised Cointelegraph.

“The maturity of crypto laws we’re engaged on for the time being can play a great function in driving future demand for asset lessons.”

“The expansion of Crypto’s “authorities help” and its function as a priceless reservoir will evolve to cherish Bitcoin as a lot because the aged inhabitants will worth it inside the 75-year hole.”

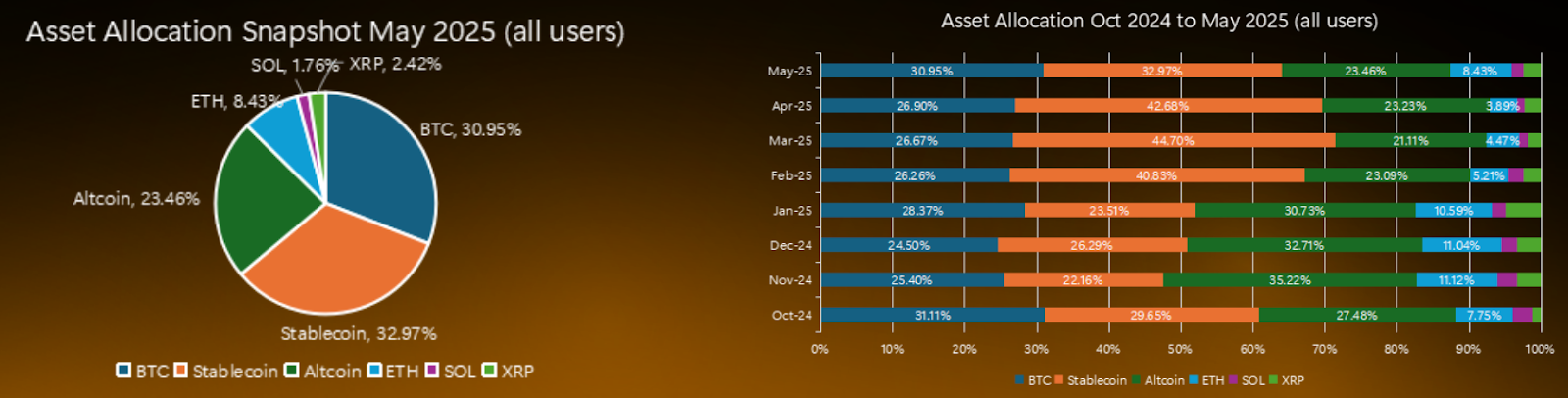

Asset allocation for crypto buyers. Supply: Bybit Analysis

Bitcoin accounted for a 3rd (30.95%) of the entire property of the investor portfolio as of Might, from 25.4% in November 2024.

Associated: Bitcoin ETFS Kickstart ‘Uptober’ is recorded at $3.2 billion within the second finest week

Rising wealth drives diversification of crypto

Analysts at Cryptocurrency Alternate Bitfinex mentioned growing international wealth is prone to result in danger urge for food and diversification to rising asset lessons reminiscent of Crypto.

“A rise in particular person wealth will increase diversification into new property as the danger attraction develops,” an analyst advised Cointelegraph. “We see that larger ranges of wealth are dedicated to growing crypto demand, however buyers with an extended funding perspective usually tend to be open to investing in Bitcoin.”

They added that youthful, extra tech-savvy buyers would “appear extra optimistic about Altcoins and the brand new Crypto mission by gaining a deeper understanding of know-how and danger tolerance.”

journal: Bitcoin is “humorous web cash” throughout the disaster: Tezos co-founder