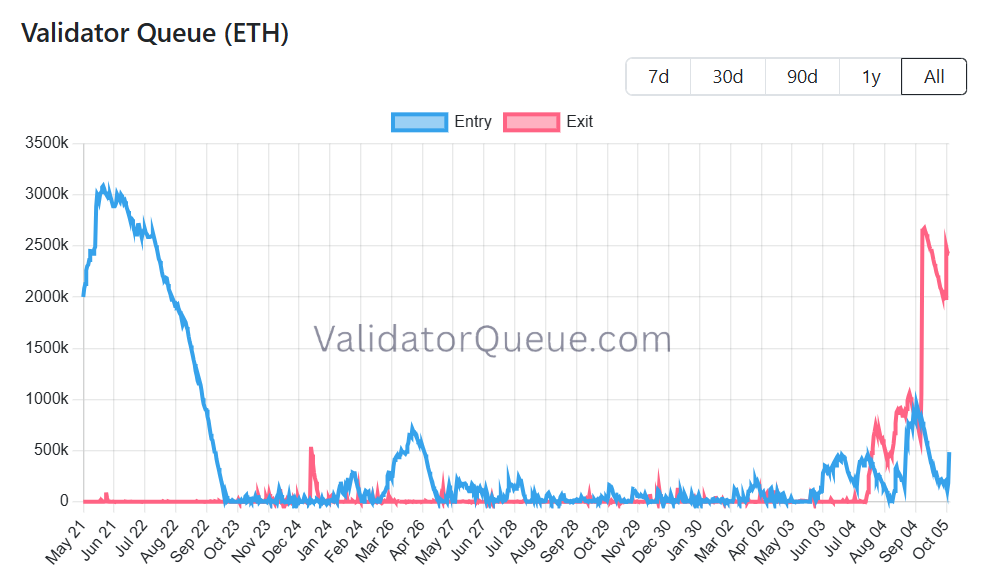

Ethereum recorded its largest validator exit in historical past this week, with greater than 2.4 million ether value greater than $10 billion ready to be withdrawn from the proof-of-stake community, whereas institutional traders are lining up billions of {dollars} for validator entries.

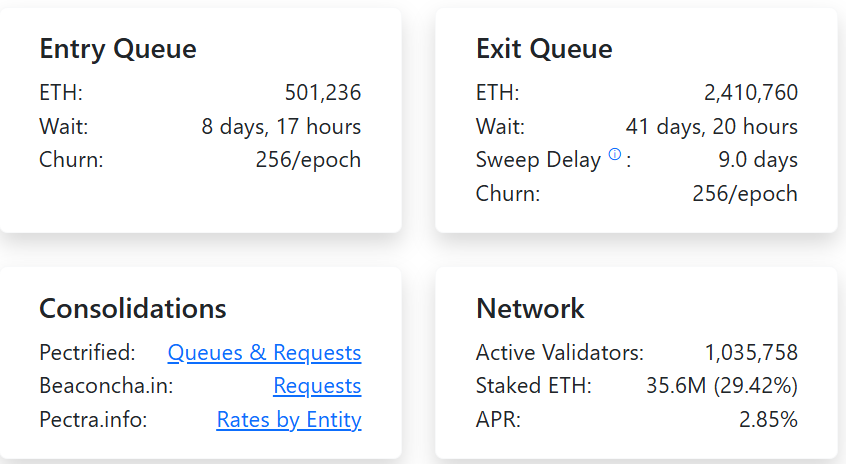

Ethereum’s exit queue exceeded 2.4 million ether (ETH) value greater than $10 billion on Wednesday. In response to blockchain knowledge from ValidatorQueue.com, the surge in exits will lengthen validator queue occasions to greater than 41 days and 21 hours.

Validators are liable for including new blocks and validating transactions on the Ethereum community, and play a key position in its operation.

Ether validator queue. Supply: validatorqueue.com

Associated: Older, Rich Buyers May Drive Cryptocurrency Adoption Till 2100

$10B Ethereum exit queue raises considerations about promoting strain

The surge in pending withdrawals has raised recent considerations about potential promoting strain on Ether holders.

This doesn’t imply that each one validators need to revenue, however on condition that the value of Ether has elevated by 83% previously 12 months, in accordance with Cointelegraph’s worth index, a big quantity of the $10 billion could possibly be bought.

ETH/USD, 1 12 months chart. Supply: Cointelegraph

Including to considerations about promoting strain, the validator exit queue is roughly 5 occasions bigger than Ethereum’s entry queue, at the moment holding over 490,000 Ether scheduled to be staked, with a wait time of 8 days and 12 hours.

Ethereum entry and exit queues. sauce: validatorqueue.com

Though considerations about short-term promoting strain stay, the $10 billion withdrawals don’t threaten the soundness of the Ethereum community, which nonetheless boasts over 1 million lively validators staking 35.6 million Ether (29.4% of complete provide).

Associated: Stimulus meets authorities shutdown: What tariff-funded checks imply for cryptocurrencies

The event comes a day after Grayscale staked $150 million in Ether on Tuesday. This follows the crypto-focused asset administration agency’s introduction of staking in its Ether-listed merchandise, making it the primary US-based cryptocurrency fund issuer to supply staking-based passive earnings to its funds.

On Wednesday, Grayscale deposited an extra 272,000 ether value $1.21 billion into its staking queue. This implies the corporate accounts for “nearly all of cash at the moment awaiting staking activation,” in accordance with on-chain analyst EmberCN.

sauce: Ember CN

Regardless of a swell of validator exits, Ether’s momentum continues to be pushed by institutional inflows by means of exchange-traded funds (ETFs) and company treasuries, Ilya Karchev, dispatch analyst at digital asset platform Nexo, informed Cointelegraph.

“Institutional traders and company treasuries at the moment maintain over 10% of the overall ETH provide, with ETF inflows already exceeding $620 million in October.”

He added: “The info displays the evolution of Ethereum right into a high-yielding, institutionally acknowledged asset that can be utilized for each infrastructure and collateral functions.”

journal: How Ethereum Finance Corporations Can Spark “DeFi Summer time 2.0”