A brand new proposal to overtake Polygon’s tokenomics is gaining momentum on the undertaking’s governance boards and social media as traders categorical frustration with POL’s sharp decline in efficiency in comparison with the broader crypto market.

The proposal, authored by activist token investor Enterprise Founder, requires important revisions to Poirigon’s (POL) provide mannequin, together with the elimination of the two% annual inflation price and the introduction of a Treasury-funded buyback or burn program to alleviate ongoing promoting strain.

“These modifications are aimed toward aligning POL’s provide dynamics with present technical and strategic realities, strengthening investor confidence, and stopping additional token worth declines and community stagnation,” Venturefounder wrote in a discussion board submit.

Underneath the present mannequin, Polygon’s 2% annual inflation provides roughly 200 million new POL tokens to the market annually. The writer argues that that is what’s creating sustained downward strain on costs. The proposal proposes both transferring to a 0% inflation goal to determine mounted provide or adopting a tapering schedule that lowers inflation by 0.5% every quarter till it reaches zero.

The authors cite BNB (BNB), Avalanche (AVAX), and Ether (ETH) as examples of tokens which have benefited from deflationary and stuck provide fashions, and argue {that a} related method might strengthen POL’s worth proposition.

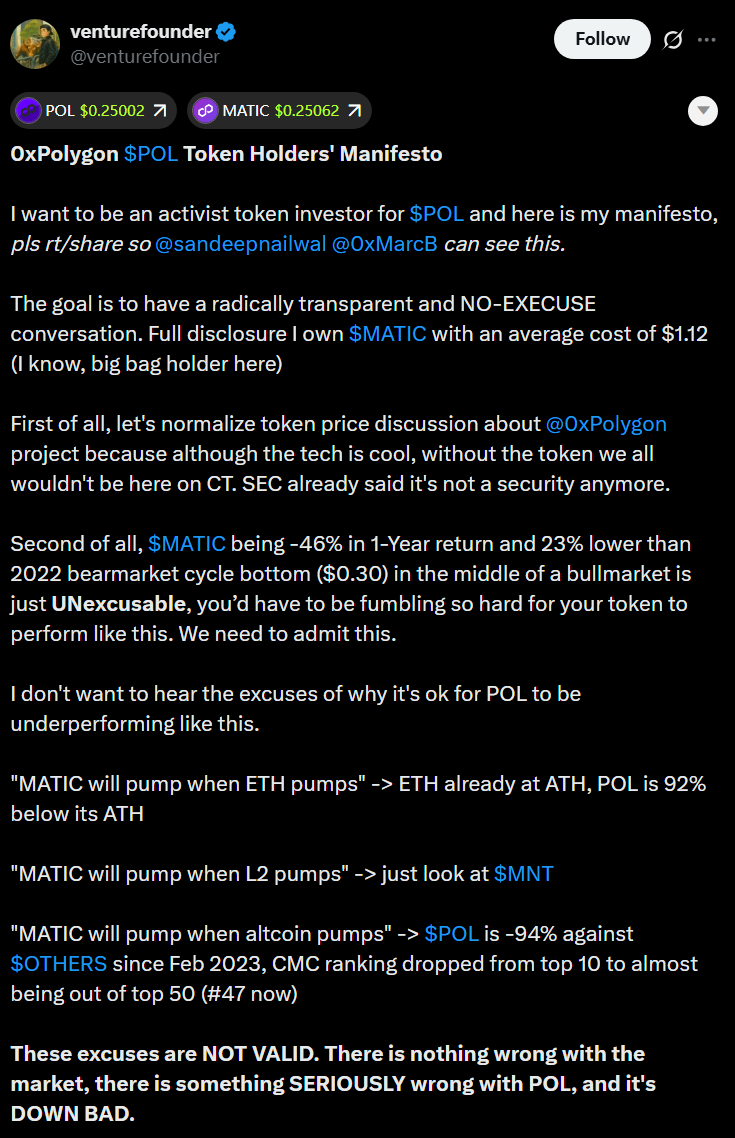

The proposal relies on a broadly distributed manifesto posted on X by Venturefounder that garnered greater than 25,000 views. Within the submit, the investor referred to as POL’s 46% decline over the previous 12 months and present buying and selling ranges beneath the 2022 bear market lows “inexcusable” in what many imagine is a crypto bull market led by Bitcoin (BTC) and Ether.

sauce: enterprise founder

“These excuses are invalid,” the enterprise founder wrote. “There’s nothing fallacious with the market. There is a major problem with POL, and it is a very dangerous scenario.”

Along with the inflation concern, the manifesto criticized a collection of strategic failures by the Polygon staff past 2022, and referred to as for extra clear communication and quicker supply of key infrastructure akin to Agglayer.

This proposal elicited lively engagement from inside the Polygon ecosystem. Polygon co-founder Brendan Farmer responded to the dialogue, and Polygon Labs CEO Marc Boiron acknowledged the proposal on social media.

Disastrous value efficiency of POL. sauce: cointelegraph

A discussion board thread has been left open with group members discussing the feasibility of funding validator rewards with out inflation, the sustainability of buybacks, and the general influence on community safety.

Polygon faces reliability challenges as competitors will increase

As soon as some of the extremely regarded Ethereum scaling options, Polygon constructed its fame on highly effective improvements, from the rollout of zkEVM to the formidable AggLayer framework designed to combine a number of chains. Nevertheless, regardless of these advances, investor confidence is waning and competitors from new layer 2 ecosystems akin to Arbitrum, Optimism, and Base is growing.

In 2024, Polygon started transitioning its native token from MATIC to POL as a part of a broader governance and tokenomics evaluation aimed toward strengthening group participation and securing the community. This transition launched a 2% annual emissions schedule to fund verifier compensation and ecosystem incentives.

Regardless of current struggles, Polygon maintains a powerful developer group, particularly amongst builders searching for technological maturity and enterprise-grade infrastructure.

As Cointelegraph just lately reported citing surveys from Mexico, Brazil, Peru, and Bolivia, builders in Latin America proceed to favor Polygon and Ethereum to new protocols for deploying decentralized purposes.

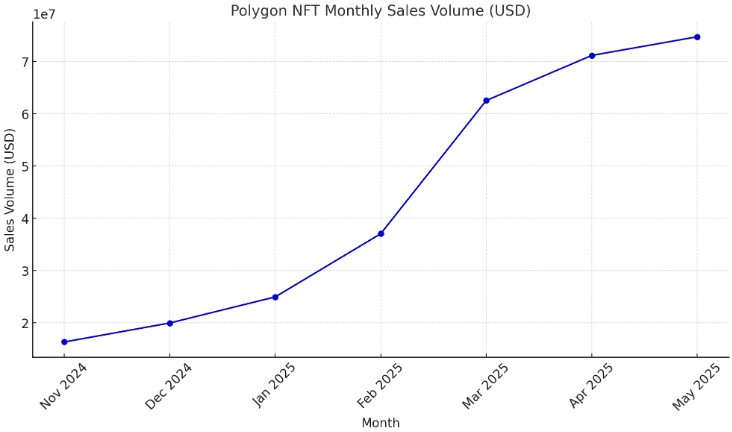

Polygon can also be targeted on tokenizing real-world property (RWA). In a current instance, tokenization infrastructure supplier AlloyX launched a tokenized cash market fund on Polygon. This progress in RWA exercise has helped drive broader on-chain engagement, together with a milestone of over $2 billion in NFT gross sales for Polygon.

Polygon NFT gross sales. Supply: Cointelegraph