Ethereum is extremely correlated with small-cap shares, that are very delicate to rates of interest, and analysts say each may rise if there are additional charge cuts.

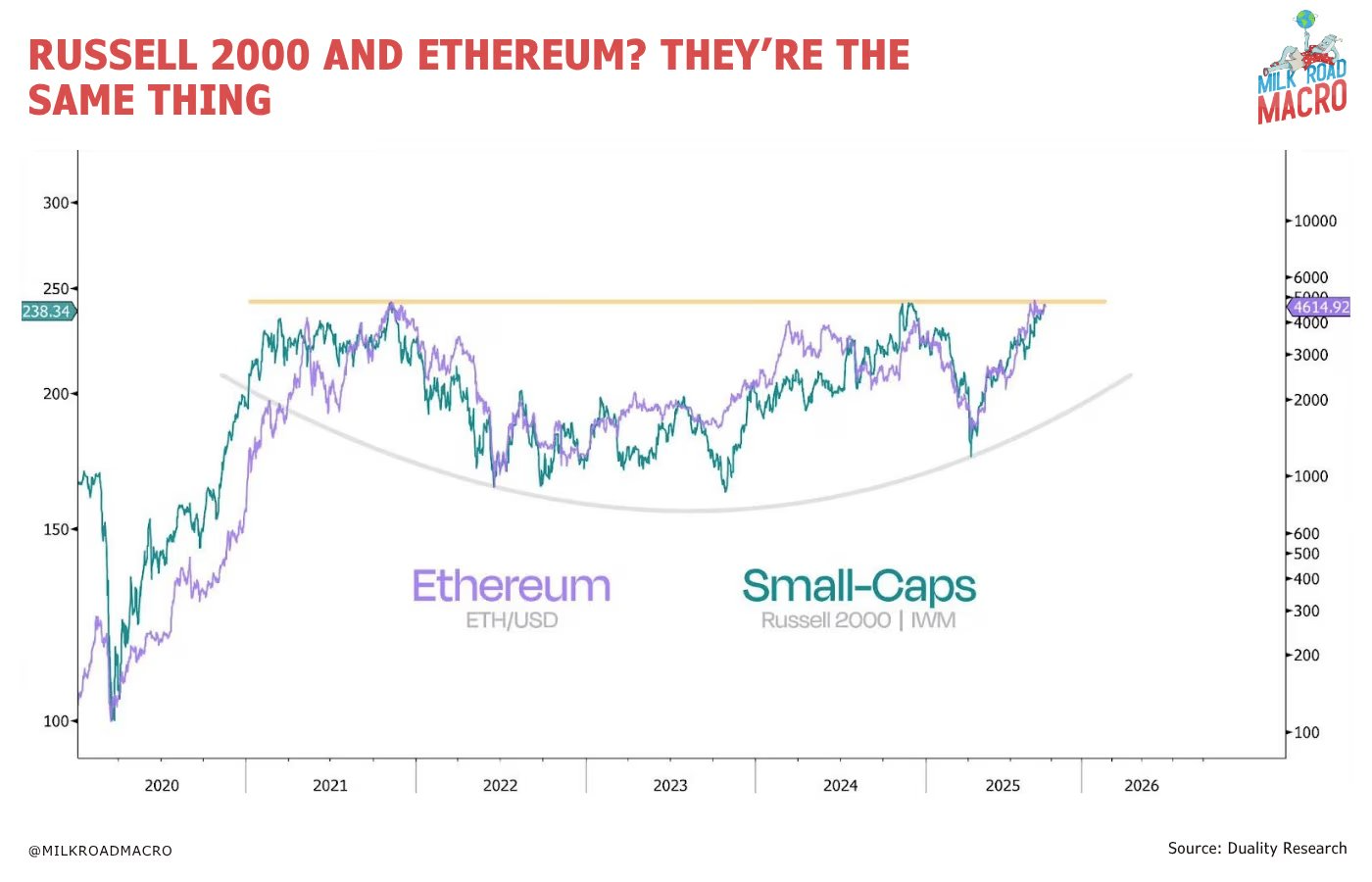

Analysts at macro investor outlet Milkroad stated Tuesday there may be an “nearly eerie” correlation between Ether (ETH) and the Russell 2000 index of small-cap shares.

Each are extremely delicate to rates of interest, with the opportunity of as much as 4 consecutive cuts, and analysts stated they “anticipate them to rise in tandem.”

The Russell 2000 Index tracks the two,000 largest publicly traded U.S. corporations by market capitalization and is extensively used to measure the efficiency of the U.S. economic system.

The CME futures market presently initiatives a 95.7% probability that the US Federal Reserve will lower rates of interest by one other 0.25% at its October twenty ninth assembly, and an 82.2% probability that it’ll lower charges in December.

“In contrast to Bitcoin, Ether generates yield, which is extraordinarily vital in a world the place rate of interest cuts usually are not solely priced in, however just about assured,” Justin Danesan, head of partnerships at crypto personal markets agency Arctic Digital, instructed Cointelegraph.

sauce: milk highway macro

ETH and the Russell 2000 additionally seem like exhibiting a cup-and-handle sample, a bullish continuation sample that signifies a interval of consolidation following a decline.

Rotation to threat property

MN Fund founder Michael van de Poppe stated on Wednesday that there are two the explanation why ETH will quickly attain new all-time highs.

First, the ETH/BTC buying and selling pair “seems to have bottomed out” and is poised for a brand new rally after a comparatively regular correction.

Second, gold has gone “very parabolic” after peaking above $4,000 per ounce, which means it ought to fall sooner or later and “set off an enormous risk-on change.”

Associated: Ethereum bulls tout supercycle, however Wall Avenue is skeptical

“Globally, as central banks transfer into easing mode, capital is prone to rotate into riskier property with upside potential, and ETH matches that profile,” Danesan added.

New ether peak is close to

“ETH has lastly discovered stability above $4,350 and appears poised to interrupt into all-time excessive territory,” chart analyst Matt Hughes commented on Wednesday.

“So long as that zone continues to carry as help, ATH is just not distant.”

Hughes targets $5,200 as the following bull marketplace for Ether, whereas analyst Poseidon stated the cycle excessive could be $8,500.

Ether was correcting on the time of writing, dropping 6% on the day to commerce at $4,430 and approaching a key help zone round $4,400.

journal: Hong Kong is just not the loophole Chinese language crypto corporations suppose it’s