TL;DR

- JPMorgan expects internet inflows to stay at $1.5 billion Solana ETF has a decrease stage in comparison with BTC and ETH within the first 12 months.

- A low prediction is The ratio with Ethereum is 1:7 And the notion that Solana is weaker good contract ecosystem.

- Nonetheless, the financial institution views the approval of the Solana ETF as follows: “Extremely probably” As a result of CME has futures contracts.

consultants in JP MorganThe monetary big predicts that whereas the spot Solana ETF will certainly be authorized, the quantity of inflows can be considerably decrease than these for Bitcoin and Ethereum.

JP Morgan is Solana ETF. Analysts on the financial institution, led by Nikolaos Panigirtzoglou, imagine U.S. Securities and Trade Fee approval of the Spot Solana ETF is imminent given the existence of CME futures contracts, however demand forecasts are fairly modest.

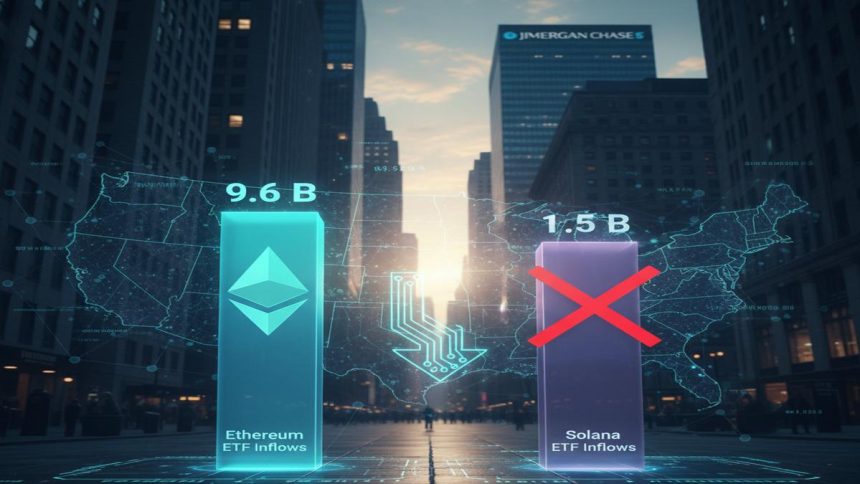

The JP Morgan report predicts: Solana ETF inflows anticipated to succeed in $1.5 billion internet Within the first 12 months of buying and selling. This quantity is simply one-seventh of the inflows the Ethereum ETF recorded in its first 12 months ($9.6 billion), and considerably decrease than the Bitcoin fund’s preliminary projections.

Why can we must be cautious when predicting influx?

JPMorgan’s justification for its conservative forecast relies on a wide range of components, however the impending ETF approval is already mirrored in a reduction discount for Grayscale Solana Belief (GSOL).

- Exercise comparability: The analyst group in contrast Solana’s exercise to Ethereum and made an estimate primarily based on the outcomes. In different phrases, 1.5 billion {dollars} Estimates are primarily based on Solana percentages On-chain exercise and Complete worth lock (TVL) In comparison with Ethereum, 1 to 7 ratio has been noticed.

- Investor fatigue and competitors: They level out the potential for “Investor fatigue” Given the launch of a number of spot ETFs and elevated competitors from diversified index funds.

- Community consciousness: The JP Morgan report highlights the next factors: Poor community consciousness Within the case of Solana, energetic addresses will lower after the second half of 2024; meme coin buying and selling This will likely discourage extra severe institutional traders.

As well as, on this prediction, Solana ETF inflows anticipated to succeed in $1.5 billion This contrasts with earlier estimates from one other JPMorgan group, which had predicted flows for a similar interval to be between $2.7 billion and $5.2 billion. The brand new numbers spotlight a downward revision in Wall Avenue’s expectations for the product’s early adoption.