Ethereum has rebounded barely after a big drop that noticed its value drop beneath $4,000. The general market stays cautious as merchants reassess their positions following latest volatility, which might result in a reversal of the bullish pattern.

technical evaluation

Written by Shayan

day by day chart

On the day by day timeframe, ETH lately fell beneath the 100-day transferring common, the midline of the ascending channel, and touched the 0.5 Fibonacci retracement degree round $3,400-$3,500. This zone coincides with earlier structural help and triggers a rebound in direction of $3,800.

Nevertheless, the RSI continues to be beneath 40 and momentum is weak. A day by day shut above $4,000 might sign a short-term restoration, but when the channel can’t be regained, ETH will possible fall beneath the $3,000 vary, which might spell the tip of the bull market.

4 hour chart

The 4-hour chart reveals that Ethereum discovered momentary help inside the $3,400 demand zone after plummeting. The RSI has additionally fallen into oversold territory and is presently close to 24, indicating a doable short-term reversal.

Nonetheless, the $3,800 resistance stays important. A rejection there might result in a retest of $3,400, however a clear breakout might open the best way to $4,200 once more.

On-chain evaluation

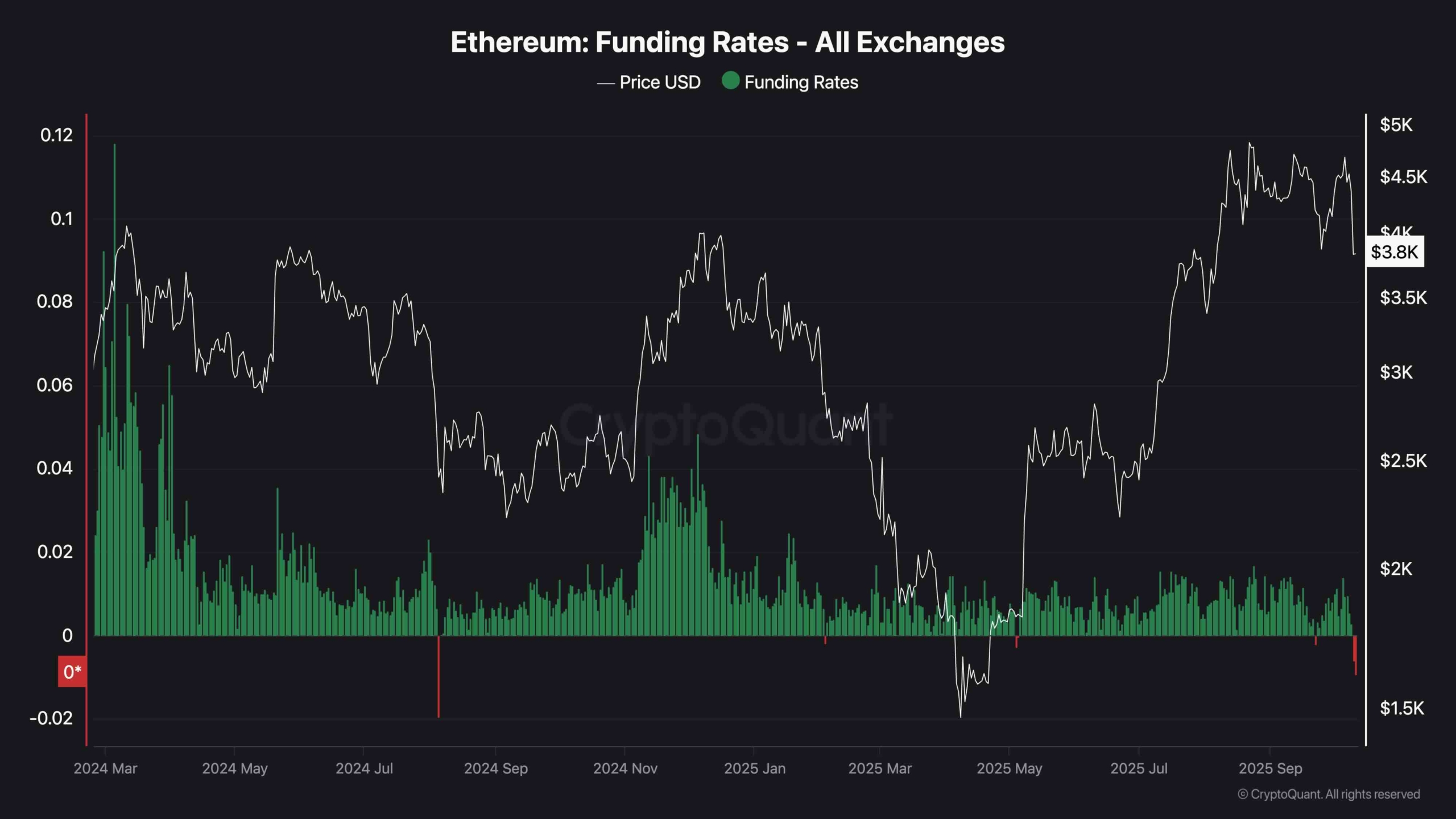

funding charge

As merchants rushed to unwind their lengthy positions, funding charges at exchanges fell into detrimental territory, hitting their lowest degree for the reason that finish of 2024. This reset is indicative of worry and liquidation strain, however might additionally sign a possible backside if bearish sentiment persists earlier than costs stabilize. Traditionally, detrimental funding charges throughout giant pullbacks have preceded short-term recoveries as promoting momentum wanes.

So, whereas the market could also be within the early phases of a bearish reversal, there may be nonetheless hope that this transfer is only a flashout to chill down the futures market and will pave the best way for a sustainable spot-led rally.